Peru is the fourth-most populous country in South America, with half its population less than 30 and 79 percent of its 33 million residents living in major urban areas as of 2023. The U.S. International Trade Administration reports that Peru's agricultural sector is expanding, supported by direct investments from the Peruvian government. However, this sector has encountered numerous challenges due to extreme weather events, earthquakes, landslides, El Niño rains, and other natural disasters. These difficulties have prompted Peru to increase its imports of foreign commodities.

The Central Intelligence Agency World Factbook classifies Peru as an upper-middle-income economy. The country has experienced rapid economic growth in recent years, although this has slowed due to the COVID-19 pandemic, political instability, and social unrest. Nevertheless, the World Bank indicates that Peru is on the path to recovery from the economic impacts of the pandemic, projecting a real gross domestic product (GDP) growth rate of 3 percent in 2024, along with a decrease in inflation to 2 percent. Additionally, the number of middle-income households rose by 26 percent between 2019 and 2023.

Consumption Trends and Market Drivers

Peru's increasing urbanization, the rise in single-person households, and a younger demographic drive a higher demand for convenient food. S&P Global anticipates that Peru's online food delivery market will expand by 19 percent from 2020, reaching $835 million by 2024.

The growth in food delivery services is leading to new supermarkets opening in both urban and suburban regions. The U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS) Lima predicts a 5-percent increase in the food retail sector by 2024. While traditional outlets like wet markets and bodegas continue to thrive, major supermarket chains such as Cencosud (Wong and Metro), Saga Falabella (Tottus), and Supermercados Peruanos (Vivanda, Plaza Vea, Makro, and Mass) are adopting innovative strategies to attract consumers, including private labeling to reduce prices on items like dairy and grains.

These marketing initiatives, aimed at lowering costs, mainly target Peru's growing youth demographic. With fewer individuals getting married and the economy recovering from the COVID-19 pandemic, food prices have become a significant concern for many young Peruvians. As convenience becomes a priority, along with the demand for more affordable and healthier options, U.S. exporters have a valuable opportunity to cater to this changing market landscape.

Prospects for U.S. Agricultural Exports

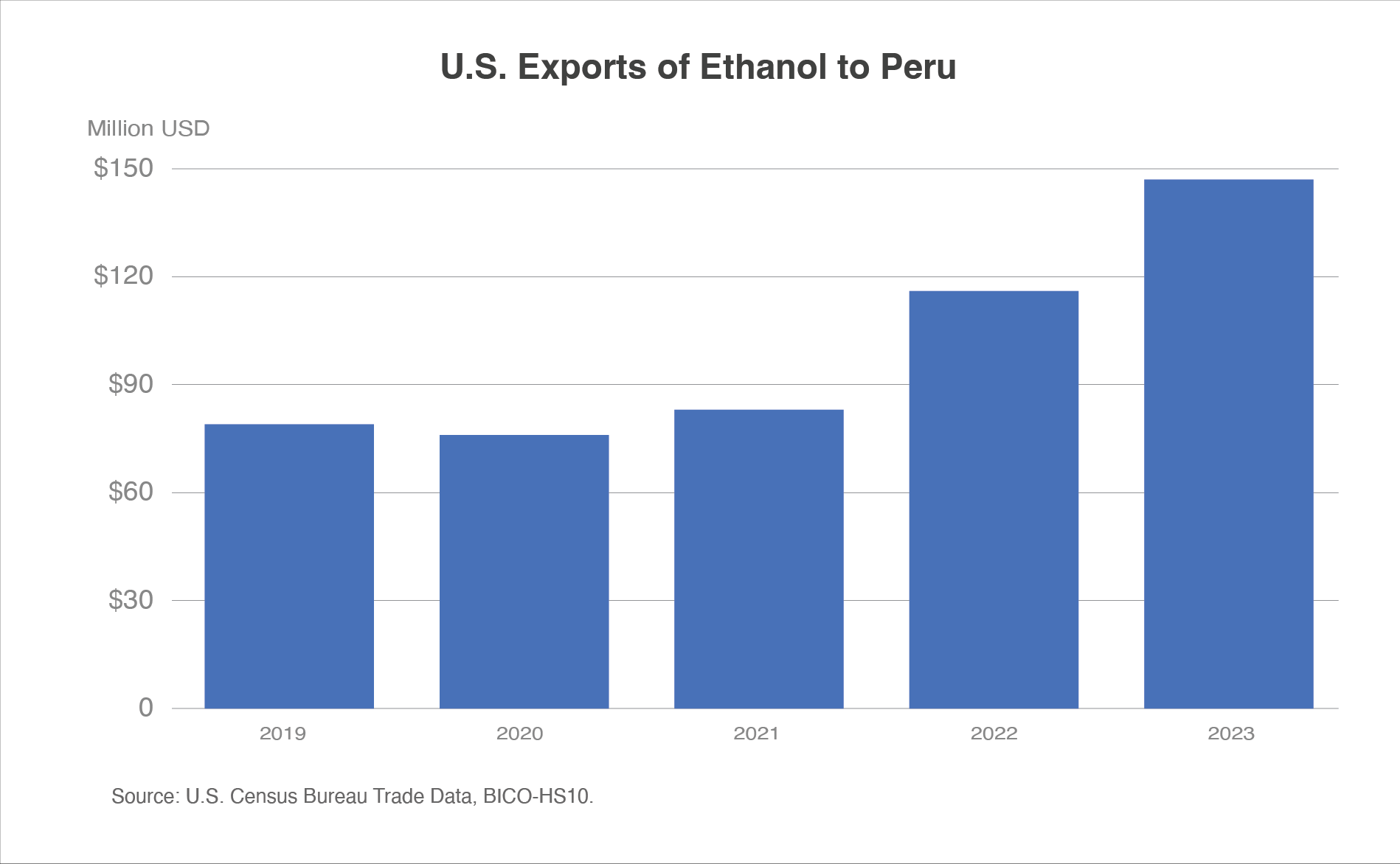

Ethanol

The United States is the leading ethanol supplier to Peru, capturing a 90-percent market share in 2023 and experiencing an 85-percent growth rate during the last 5 years. Ethanol is the largest agricultural export from the U.S. to Peru, with the value of these exports reaching $146 million in 2023.

To meet its domestic ethanol needs, Peru relies on imports while exporting its locally produced ethanol to Europe. It is more cost-effective for Peru to sell its ethanol at a premium to the European Union (EU), thanks to a free trade agreement (FTA), while importing less expensive ethanol from the United States. A decree from 2005 requires that gasoline contains at least 7.8 percent ethanol, which supports ongoing imports, especially considering Peru's commitment at the 2015 United Nations Paris Climate Change Conference to cut carbon emissions by 30 percent by 2030.

As consumers look for more affordable fuel options, Repsol and Petro Peru, the leading gasoline suppliers in the Peruvian market, support increasing the ethanol blend rate, believing it will lead to cost savings. Currently, gasoline makes up 22 percent of the total fuel consumption in Peru, and liquefied petroleum gas accounts for 23 percent of total fuel consumption. Since 2018, U.S. ethanol has enjoyed duty-free access to the market.

Dairy Products

In 2023, U.S. dairy exports to Peru reached $118 million, making it the second-largest agricultural export from the United States to Peru, following ethanol. Since the enaction of the PTPA in 2009, dairy exports have surged fifteenfold. Euromonitor International projects that Peru's retail dairy sales will grow by 4 percent in 2024, amounting to 9.4 billion Peruvian Sol (approximately $2.5 billion), with an expected annual growth of an additional 24 percent through 2029.

As inflation subsides and dairy prices stabilize, there is optimism that demand for dairy products will rise. Trade Data Monitor notes that while Peru has seen a decline in imports of dry skim milk and cheeses, the market is evolving with increased exports of condensed and evaporated milk, whey, coffee creamers, and ice cream. The food processing sector in Peru, which accounts for 27 percent of the country's industrial GDP, frequently sources dairy products from U.S. suppliers.

To approve dairy exports, they must receive clearance from Peru's Ministry of Health and possess a zoo-sanitary certificate from the USDA's Agricultural Marketing Service. In April 2022, Peru updated its regulations with Supreme Decree 004-2022-MIDAGRI, which prohibits the production of evaporated milk using powdered milk.

Meat Products

In 2023, U.S. exports of meat products to Peru reached $82 million. The leading suppliers of meat products to Peru include Brazil, the United States, Chile, and Argentina, with the United States accounting for 28 percent of the market share. The leading meat product that the United States exports to Peru is poultry, especially frozen chicken leg quarters. Meat products feature prominently in traditional dishes, such as anticuchos (skewers of grilled, marinated, and sliced beef hearts). However, Peru uses a significant portion of meat products in food processing and the hotel, restaurant, and institutional (HRI) sectors. According to FAS Lima, the growing demand for affordable meat cuts in the HRI sector has spurred the local production of packaged processed meats, particularly sausages for fast food restaurants, as well as hot dogs and burgers, increasing the need for mixed meat inputs, including beef, pork, and poultry. For additional information, please refer to USDA’s The Overlooked Consumer of Affordable Meat Products, Global Agricultural Information Network report.

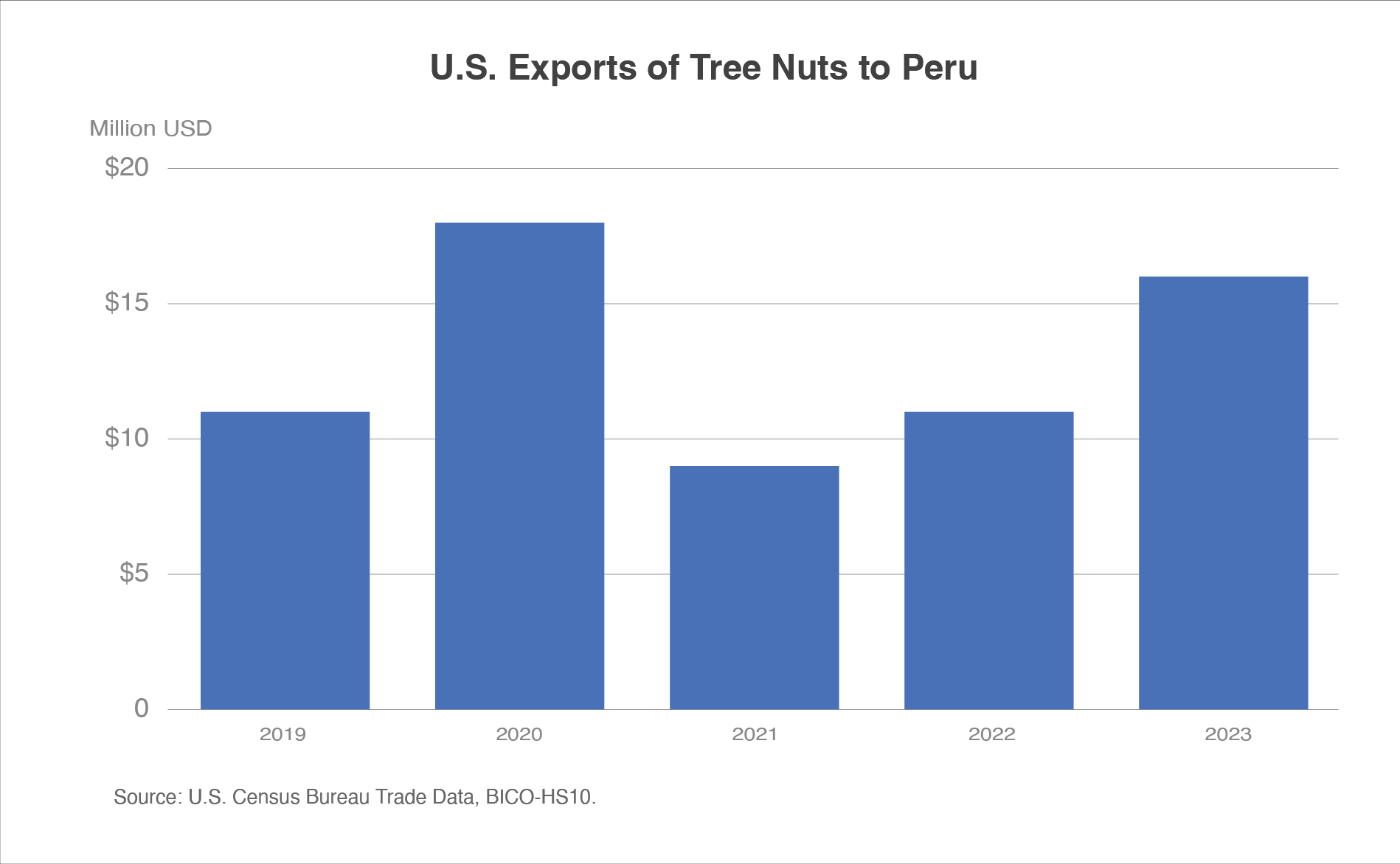

Tree Nuts

Peru has seen a rise in tree nut imports during the past 5 years, particularly in almonds and pistachios. In 2023, the country imported $41 million worth of tree nuts, with nearly $16 million coming from the United States, which accounts for 39 percent of the market share. The leading suppliers include the United States, Argentina, Brazil, and Chile. Like meat products, tree nuts play a role in Peru's food processing sector. They are incorporated into various confectionery items, including bread and cakes. According to Euromonitor International, there is a growing health consciousness among Peruvians, reflected in the rising demand for bread that includes seeds and nuts. Importers favor U.S. tree nuts due to their quality and competitive pricing, often repackaging them for retail sale. Additionally, the World Bank notes that there are no tariff rates on U.S. tree nut exports, making them more accessible.

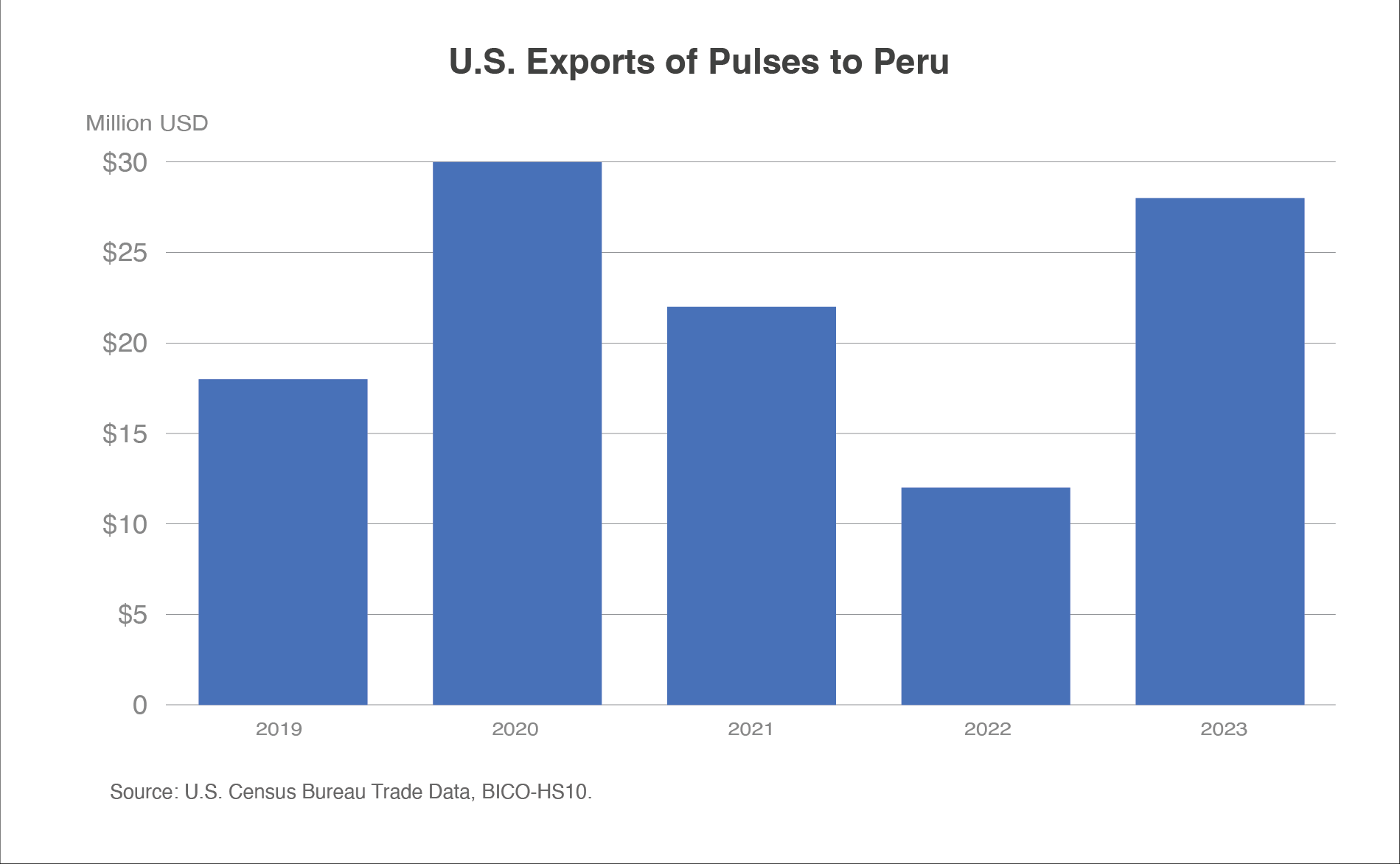

Pulses

In 2023, U.S. exports of pulses reached $28 million, marking a 53-percent increase since 2019. The leading suppliers include Canada, the United States, Mexico, and Bolivia. Initially, the COVID-19 pandemic led to a 9-percent decline in U.S. pulse exports in 2021. However, trade is now rebounding to pre-pandemic levels, driven by a growing demand for legumes in Peru as part of a healthy diet. The Peruvian government actively encourages pulse consumption as a dependable protein source, resulting in a notable rise in consumption during the last 2 years. Health-conscious consumers and the growing popularity of packaged pulses fuel this increase.

Beverages

In 2023, U.S. beverage exports to Peru amounted to $18 million, reflecting a 7-percent increase since 2016. Mexico is the primary supplier of beverage exports to Peru, followed by the United States. The United States mainly exports carbonated drinks, tea, and coffee in the non-alcoholic beverages category, with sales rising by 4 percent since 2016. Sales of reduced-sugar carbonated drinks saw a 7-percent increase in 2023. While soft drinks remain popular, the growing demand for products with lower added sugars presents new opportunities for U.S. exports of sugar-free alternatives.

.png)

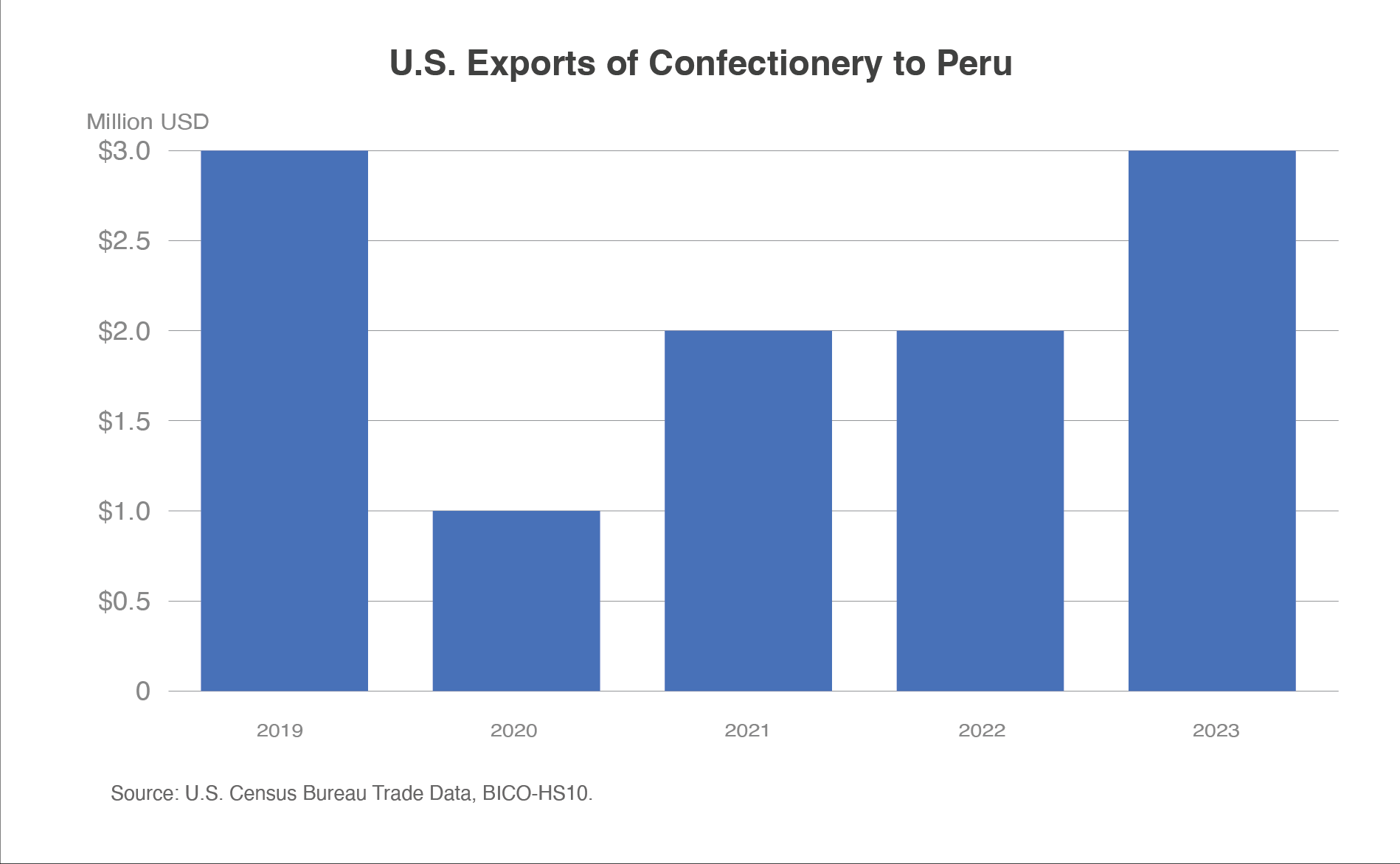

Confectionery

U.S. exports of confectionery products to Peru have surged by 200 percent since 2020. In 2023, U.S. exports of confectionery to Peru were $3 million. However, the United States is not a top supplier; Colombia, Mexico, China, Brazil, and Guatemala lead the market, with the United States holding only 2 percent of Peru's candy and chewing gum market. Despite this, the confectionery market is growing. According to Euromonitor, retail sales of sweet confectionery increased by 6 percent in 2024, reaching 900 million Peruvian soles (about $237 million), with a projected annual growth of 36 percent through 2029. Peru implemented front-of-pack nutrition labeling in 2019, and mandates processed foods with total sugar, saturated fat, or sodium content exceeding set thresholds must carry black octagon "stop sign" warning labels for each nutrient more than the threshold. This poses a challenge to U.S. exports.

Trade Policy

The PTPA has created new avenues for U.S. exporters. Effective February 1, 2009, the PTPA has facilitated trade between the two countries. By 2024, 90 percent of U.S. agricultural exports will be duty-free, with the elimination of all tariffs by 2026.

As reported by the U.S. International Trade Administration, Peru has established 16 FTAs with various countries, including the EU, the European Free Trade Association, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. Additionally, Peru has an FTA with the South American Common Market trade bloc (MERCOSUR) as part of the Andean Community-MERCOSUR Framework Agreement.

Conclusion

Peru is recovering from COVID-19, El Niño, political instability, and social unrest. The country is emerging as a significant market in South America for U.S. agricultural exports. The Peruvian consumer base is becoming younger, more financially secure, and health-conscious, driving an increased demand for high-quality and diverse agricultural products. With the PTPA fully implemented in 2026, the United States can solidify its position as a key supplier. U.S. companies should focus on providing healthy, affordable, and convenient food options to capitalize on this opportunity.

Source : usda.gov