The National Chapter 12 bankruptcy rate is an important indicator of the overall health of the U.S. agricultural economy, but it can mask geographic variation. The mix of commodities produced as well as weather and pest pressures vary across States. Local factors can influence off-farm employment opportunities and land prices. Comparing bankruptcy rates by State shows differences in farm financial stress across the Nation and provides a richer understanding of the factors that drive bankruptcies. Researchers from USDA, Economic Research Service (ERS) recently created a new measure of bankruptcy rates that allows for a more accurate comparison of bankruptcy rates across States and over time. Their study found that bankruptcy rates in 2019 in most of the main agricultural States were the highest in at least 15 years.

Chapter 12 Bankruptcy Rates Reflect Downturn in Agricultural Economy

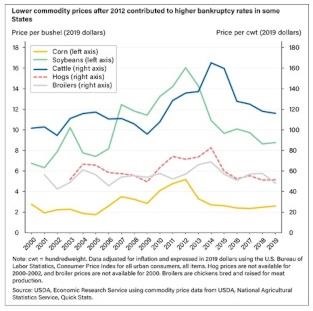

Commodity and farmland prices fell from 2014 to 2019, putting pressure on income and assets farmers use for living expenses and production investments. Farmers have several options for dealing with financial challenges. They might draw down their working capital, postpone capital investments, reduce input expenditures, or seek off-farm employment. Filing for bankruptcy is typically one of the last steps farmers take before selling their farm business.

Most farmers who file for bankruptcy do so under Chapter 12 because it provides a relatively quick and predictable way to reorganize debts and avoid asset liquidation or foreclosure. Under Chapter 12, debtors propose a repayment plan to the court to make installments to creditors over 3 to 5 years. Farmers can submit plans that reduce the amount owed, extend their payment period, and lower their existing loan interest rates to current market levels.

Trends in the national Chapter 12 bankruptcy rates reflect a recent rise in farm financial stress. As measured by quarterly bankruptcy reports from the U.S. Courts, the number of farms filing under Chapter 12 increased 46 percent from 2014 to 2019. However, the bankruptcy rate remains lower than the rates observed throughout the 1980s and 1990s.

Bankruptcy Rates Are Above 10-Year Averages in Most States

To analyze Chapter 12 bankruptcy rates across States, ERS researchers compared the number of bankruptcies relative to the number of farms that could qualify for bankruptcy. To qualify for Chapter 12, family farmers must meet several eligibility requirements. For example, more than half the gross income for the preceding tax year (or for each of the second and third prior tax years) must have come from farming. This requirement substantially limits the number of farms that qualify for Chapter 12 protection. It also means that those that qualify tend to be larger-scale operations because their households typically earn most of their income from on-farm activities. Hence, the standard bankruptcy rate measure (expressed as a share of all farms) tends to indicate higher bankruptcy rates in States with more large farms, even when economic conditions across States are similar. By comparison, the bankruptcy rate as a share of eligible farms is less influenced by the size distribution of farms, so it should more accurately reflect economic conditions in each State.

To estimate the number of farms eligible for Chapter 12 protection, ERS researchers used annual data from the Agricultural Resource Management Survey (ARMS), which is jointly produced by ERS and USDA, National Agricultural Statistics Service. Researchers limited the analysis to the 15 main agricultural States for which ARMS provides statistically reliable estimates. In 2019, the aggregate bankruptcy rate for the 15 main agricultural States was 6.7 per 10,000 farms eligible for Chapter 12 bankruptcy protection.

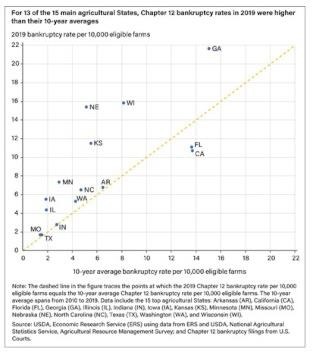

The chart below shows the relationship between the 2019 bankruptcy rate and the average bankruptcy rate since 2010 for each of the main agricultural States. Points above the dashed line indicate that a State’s 2019 bankruptcy rate was higher than its 10-year average; points below the line indicate the 2019 rate was lower than the average.

For 13 of the 15 main agricultural States, 2019 bankruptcy rates were higher than their 10-year averages. Georgia and Wisconsin had the highest 2019 bankruptcy rates among these States. In Georgia, lower chicken prices and weaker farmland prices may have contributed to its bankruptcy rate of 21.6 per 10,000 eligible farms. Broiler chickens were the most important commodity in Georgia, generating half the State’s total farm cash receipts that year. Prices for broilers declined 30 percent from 2014 to 2019 after peaking during the commodity price boom around 2014. Also, agricultural land values in Georgia fell 27 percent from 2009 to 2019 in real (adjusted for inflation) terms. Lower land prices limit farmers’ ability to secure loans from lenders and to refinance debts.

Wisconsin had the second-highest farm bankruptcy rate in 2019 at 15.8 per 10,000 eligible farms. The rate there has trended upward since 2005, when it was 1.9 per 10,000 eligible farms, probably partly because of consolidation in the dairy industry, which accounts for about half of Wisconsin’s farm cash receipts. In the United States, the number of licensed dairy herds fell 47 percent from 2005 to 2019. In Wisconsin, the number of herds fell even more—49 percent—over the same period. Moreover, from 2018 to 2019, Wisconsin lost 9 percent of its herds–more than any other State.

Of the 15 States examined, only California and Florida had bankruptcy rates in 2019 that were below their 10-year averages. In Florida, fruits and vegetables account for most farm income, and these high-value commodities did not experience as sharp a decline in prices in recent years as did many livestock products and row crops such as corn and soybeans. Fruits and vegetables also accounted for a substantial share of California’s farm receipts in 2019. Improvements in non-farm economic conditions also may have contributed to California’s decline in bankruptcy rates in recent years.

Drivers of State Bankruptcy Rates

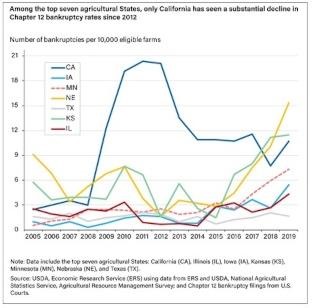

Chapter 12 bankruptcy trends since 2005 for the top seven agricultural States in terms of cash receipts (California, Iowa, Texas, Minnesota, Nebraska, Illinois, and Kansas) illustrate how economic conditions have evolved for farmers in those States.

In States where production is dominated by a few commodities, trends in the bankruptcy rates often reflect the prices of those commodities. For example, in Nebraska and Kansas, cattle accounted for about half of total farm cash receipts, and cattle prices fell steadily in real (adjusted for inflation) terms since 2014, remaining below 2011 levels since 2016. Correspondingly, bankruptcy rates in these States increased more than fivefold between 2015 and 2019.

In Minnesota, Iowa, and Illinois, production was concentrated in corn, soybean, and hog production—which accounted for 60 percent, 75 percent, and 89 percent of those States’ respective cash receipts in 2018. Prices for each of these commodities stagnated between 2016 and 2019, dropping to their lowest levels since at least 2009. In all three States, the lower prices coincided with increasing bankruptcy rates over those 4 years.

California’s bankruptcy trend differs somewhat from the other big agricultural States. California’s farm bankruptcy rate has remained relatively high over the past decade, quadrupling in 2009 and staying high until 2012. Unlike the other States, however, California’s bankruptcy rate has not increased since 2012. Compared with the other big agricultural States, California’s agricultural production is diverse, and the State’s bankruptcy rate does not appear to be driven by the price of one or two commodities. Instead, California’s bankruptcy rate appears to have been influenced by wider macroeconomic conditions, including unemployment and farmland prices during the Great Recession.

The unemployment rate in California rose to 12.2 percent in 2010, higher than the 9.6 percent peak in the U.S. unemployment rate. As a result, a larger share of farm households in California may have lost off-farm income during the recession than in other States.

The Great Recession also had a bigger effect on real estate prices in California. Between 2008 and 2012, farmland values in California increased 6.8 percent in nominal (not adjusted for inflation) terms, less than half the rate of the United States as a whole (16.1 percent). A relatively large share of farmland in California is near urban areas, and the collapse in the residential real estate market may have contributed to the slow farmland appreciation. Between 2008 and 2012, California house prices fell 39.8 percent, more than double the 17.7 percent decline seen nationwide. Most farm operators own their homes and thus would have been directly exposed to this market collapse.

Following the Great Recession, California experienced relatively robust growth in employment and real estate values, which may have contributed to the subsequent decline in State’s farm bankruptcy rate. Residential real estate values in California appreciated 74.5 percent since 2012, compared with 43.5 percent for the entire United States.

Source : usda.gov