By Noah Ranells

Written leases are strongly recommended because they provide security to both the landowner and the farmer. A written lease makes the terms of the lease clear and defensible in the event of a land transfer or farm sale.

In addition, a lease will be helpful in the event of a liability situation or property insurance claim. Check with your insurance agent to find out how your current insurance policy can be modified to include the farm lease and whether the lease document will be acceptable within the terms of your policy. You may also request to be added to the farmer’s insurance policy as “additional insured.” This will help cover you if a third party is involved in damage or liability. More info available at Liability and Insurance in a Farm Lease (Land for Good).

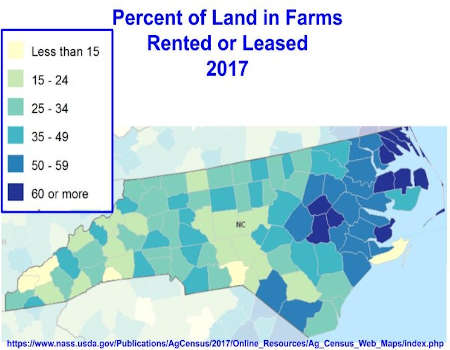

Farmland Rental Rates

Determining a lease or rental rate that is fair to the landowner and the farmer results from transparent and informed communication about the type of land, type of soil, type of operation, and inclusion of buildings and infrastructure. Farm maintenance and operation considerations can also inform a fair lease rate. Farm advisors, area farmers, and Cooperative Extension agents may also be contacted for what current rates are for the soils and farmland demand in your area.

NC farmland rental rates can vary widely from $35 to $240 per acre for cropland, with most pastureland rent from $15 to $45 per acre. In some situations, landowners may offer a no-cost lease to farmers who agree to keep the land in production. Landowners who rent their land to farms may be able to maintain Present Use Value reduced tax rate with documentation that the land produces $3,000 over a three year period.

Consider the following items:

1. Type of land. Pasture land vs crop land. In general, rent for tillable land is usually higher than for hayland and pasture land.

2. Type of soil. Soil texture, soil drainage, and available water holding capacity can greatly affect the productivity of soil and therefore can impact farm activities and resulting profitability or farm enterprises.

3. Type of operation. A farmer engaged in intensive vegetable production may pay a higher cash rent per acre than a row crop farmer growing corn, wheat, and soybeans. Operations with grazing livestock usually pay the least.

4. Buildings and other infrastructure. Buildings present a greater risk and a higher cost of ownership for the landowner and are accordingly often rented for more money. Fencing and water for grazing livestock can also add value to a rental rate.

There are online resources that may be helpful to determine a cash rent. Both resources are objective data and are not to be used as the only information when developing a rental rate.

A. Find cash rents data through pre-defined Quick Stats queries by clicking on USDA Quick Stats page. Select ‘North Carolina’ and another couple selection options will appear, then select the County of interest. Here’s a printable list of available information from 2019 and 2017.

B. Click on the following link to download the County Rental Rates for the USDA Conservation Reserve Program. A link will pop up on the bottom of your computer screen. Click on it to open the spreadsheet. Spreadsheet has two tabs on the bottom one for CRP which if for the Conservation Reserve Program and a send for the Grasslands Reserve Program. Click on either page and click the arrow in the cell on the top of the State column and select “North Carolina,” then click on the County and select to see the County current and previous rental rate.

USDA Conservation Reserve Program Rental Rates

These rates DO NOT include any infrastructure, but rather only relate to cropland and pastureland / grassland.