By Gary Schnitkey, Jonathan Coppess.et.al

Farmers and landowners can now make the decision between farm programs, receiving commodity title payments from either Agricultural Risk Coverage at the county level (ARC-CO) or Price Loss Coverage (PLC) for each covered commodity with base acres on the farm; the Agricultural Risk Coverage at the individual level (ARC-IC) is also available but must be elected for all covered commodities with base acres on the farm. For the 2019 and 2020 programs, the deadline for the decision for each Farm Service Agency (FSA) farm is March 15th, 2020. This article describes the ARC-CO option contained in 2018 Farm Bill. Future articles will describe PLC, making choices between PLC and ARC-CO, and ARC-IC.

Differences between 2014 and 2018 ARC-CO Programs

The ARC-CO program was in the 2014 Farm Bill, and ARC-CO was selected for the vast majority of corn and soybean acres during the 2014 sign-up. Differences between the ARC-CO in the 2014 and 2018 Farm Bills are:

- The 2018 Farm Bill makes payments on the county where the farm is located. For the 2014 Farm Bill, the administrative county of the farm was used to determine payments (there was a one-time option to change the administrative county in 2014).

- Yields from crop insurance will be given preference in the calculation of county yields in the 2018 Farm Bill. For the 2014 Farm Bill, National Agricultural Statistical Service (NASS) data were given first preference.

- For 2018, 80% of the t-yield is yield as the floor on county yields. For 2014, 70% of the t-yield was the plug yield.

- For 2018, county yields are trend adjusted before calculating benchmark yield. The trend adjustment was not used in 2014 Farm Bill.

- For 2018, there is an effective reference price that can be higher than the reference price if 85% of the five-year Olympic average is above the reference price. The 2014 ARC-CO program did not have this escalator provision.

- For the 2018 Farm Bill, benchmark yields and prices used in calculating benchmark yields, prices, and revenues are lagged one year. The 2014 Farm Bill did not lag data.

- For the 2018 Farm Bill, the choice between commodity title programs is not binding over the life of the 2018 Farm Bill. By March 15th, 2020, farmers and land owners will choose for the 2019 and 2020 program years. A yearly decision then can be made for 2021, 2022, and 2023. For the 2014 Farm Bill, the commodity title choice was made for all program years from 2014 to 2018.

Benchmark Revenue for ARC-CO in the 2018 Farm Bill

ARC-CO is a county revenue program that will make a payment when county revenue is below an ARC-CO guarantee. The ARC-CO guarantee is 86% of benchmark revenue, with benchmark revenue equaling benchmark yield times a benchmark price. The calculation of the guarantee will be illustrated for non-irrigated corn in Champaign County for 2019.

Both the benchmark yield and benchmark price will be based on five-year Olympic averages that drop the highest and lowest years out of the average. For 2019, averages are based on data from 2013 to 2017, and will not include data from 2018. This is a revision to the ARC-CO calculation from the 2014 ARC-CO program; a one-year lag in the Olympic average allows farmers and landowners to know the ARC-CO guarantee at sign-up.

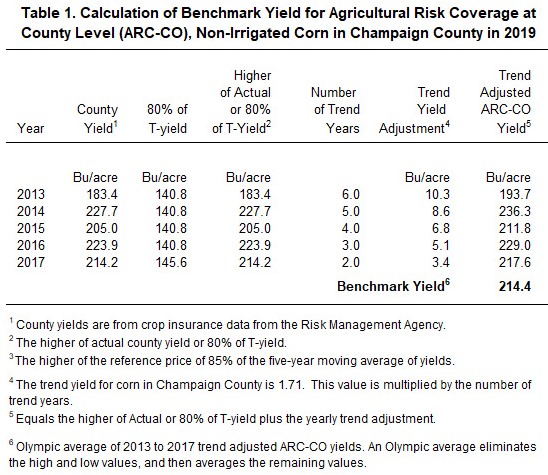

Benchmark yield will be based on a trend-adjusted Olympic average. Table 1 shows the steps required to calculate the benchmark yield. The 2019 benchmark yield calculation begins with county yields for the years from 2013 through 2017. Those yields for corn in Champaign County are 183.4 bushels per acre for 2013, 227.7 for 2014, 205.0 for 2015, 223.9 for 2016, and 214.2 for 2017 (see Table 1). Those yields are based on crop insurance data compiled by RMA. The higher of these yields or 80% of the county T-yield are used in calculations. The t-yields for Champaign County are 140.8 bushels per acre for years up to 2017 and 145.6 bushels per acre in 2017. In all cases, the actual Champaign County yields are higher than the t-yields (see Table 1).

A trend adjustment then is added to each yearly yield. This trend adjustment accounts for the fact that corn yields have been increasing over time. The trend adjustment factor for Champaign County is 1.71 bushels per acre, the same factor that the Risk Management Agency (RMA) uses in calculating trend adjustment yields for crop insurance purposes. The 2013 year is six years from 2019. Therefore 1.71 times 6 results in a trend yield adjustment of 10.3 bushels per acre for 2013 (see Table 1). The 2014 yield is five years from 2019, resulting in an 8.6 bushel per acre adjustment (5 x 1.71). Trend adjustments for 2015 through 2017 are calculated in a similar manner.

The yearly trend yield adjustments then are added to the “Higher of Actual or 80% of T-Yield” to give “Trend Adjusted ARC-CO yield”. For corn in Champaign County, trend adjusted yields range from 193.7 bushels per acre for 2013 up to 236.3 bushels per acre in 2014 (see Table 1).

The benchmark yield is the Olympic average of the yearly adjusted ARC-CO yields. In the Champaign county case, the 193.7 yield in 2013 and the 236.3 yields in 2014 are eliminated because they are the lowest and highest yields. The 214.4 benchmark yield then is the average of the middle three yields (214.4 = (211.8 + 229.0 + 217.6) / 3).

The benchmark price calculation begins with the national average Market Year Average (MYA) prices for corn. For both corn and soybeans, MYA prices are calculated from September to August. The MYA prices were $4.46 per bushel in 2013, $3.70 for 2014, $3.61 for 2015, $3.36 for 2014, and $3.36 for 2017. The higher of these MYA prices or the effective reference price will enter into the calculation of the benchmark price.

The effective reference price is the higher of the reference price or 85% of the five-year Olympic moving average of MYA prices. For corn, the statutory reference price is $3.70 per bushel. The moving average of Olympic prices must average $4.35 per bushel before 85% of that Olympic average will increase the effective reference above the $3.70 statutory reference price. An Olympic average above $4.35 for corn will not likely happen for the foreseeable future.

For benchmark price calculations, a $4.46 price is used for 2013, and $3.70 prices are used for 2014 through 2017 (see Table 2). The $3.70 price is used because the MYA prices for 2014 to 2017 are below the $3.70 reference price. The benchmark price is $3.70 (see Table 2). Note that the benchmark price cannot go below the $3.70 reference price.

Benchmark revenue equals the benchmark yield times the benchmark price. For corn in Champaign County, benchmark revenue is $793.28 per acre (214.4 yield x $3.70 benchmark price). The ARC-CO guarantee is 86% of the benchmark revenue or $682.22 per acre (see Table 3).

ARC-CO Payments

ARC-CO will make payments whenever county revenue is below the ARC-CO guarantee. County revenue equals county yield times MYA price. Take the corn example given above with a $682.22 per acre ARC-CO guarantee. Table 4 shows the calculations of the ARC-CO payments.

A 190 bushel per acre county yield and a $3.50 MYA price will equal $665 per acre in county revenue. Under that scenario, ARC-CO will make a payment because county revenue is below the ARC-CO guarantee. When a payment occurs, the payment rate is calculated as the ARC-CO guarantee minus county revenue, not to exceed 10% of the benchmark revenue. In this example, the payment rate is $17.22 ($682.22 guarantee minus $665.00 county revenue) as $17.22 is less than the maximum ARC-CO rate of $79.33 (0.10 x $793.28 benchmark).

ARC-CO will be paid on 85% of base acres. The 85% payment rate is the same as for PLC. In the example, the $17.22 payment rate translates into a $14.64 payment per base acre. These commodity title programs may be reduced further due to sequester.

Summary

We provide a summary of ARC-CO in this article. Future articles will provide summaries of PLC, making choices between ARC-CO and PLC, and ARC-IC. Farmers can run payment calculation scenarios for their farms using the Gardner-farmdoc too, available here:

https://fd-tools.ncsa.illinois.edu.