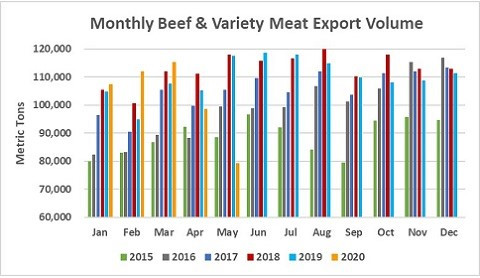

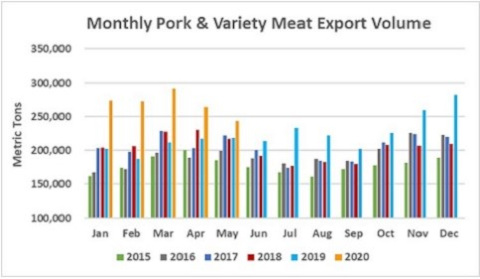

U.S. beef and pork exports trended lower in May, due in part to interruptions in slaughter and processing, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports dropped well below year-ago levels and recorded the lowest monthly volume in 10 years. Pork exports remained higher than a year ago but were the lowest since October 2019.

“As protective measures related to COVID-19 were being implemented, plant disruptions peaked in early May with a corresponding temporary slowdown in exports,” said USMEF President and CEO Dan Halstrom. “Unfortunately the impact was quite severe, especially on the beef side. Exports also faced some significant economic headwinds, especially in our Western Hemisphere markets, as stay-at-home orders were implemented in key destinations and several trading partners dealt with slumping currencies.”

Halstrom noted that the recent rebound in beef and pork production will help exports regain momentum in the second half of 2020. The global economic outlook is challenging, but he looks for export volumes to recover quickly in most markets as U.S. red meat remains an important staple, not only in the United States but for many international consumers as well.

“In what has been a remarkably turbulent year, consumer demand for U.S. red meat has proven very resilient,” he said. “Now that production has substantially recovered, the U.S. industry is better able to meet the needs of both domestic and international customers. While the foodservice and hospitality sectors face enormous challenges, they are on the path to recovery in some markets while retail demand remains strong. Retail sales have also been bolstered by a surge in e-commerce and innovations in home meal replacement, as convenience remains paramount.”

May beef exports were down 33% from a year ago to 79,280 metric tons (mt), with value falling 34% to $480.1 million, as shipments were higher than a year ago to Hong Kong and China but trended lower to most other markets. For January through May, beef exports fell 3% below last year’s pace in volume (512,596 mt) and 5% lower in value ($3.14 billion).

Exports accounted for 12.5% of total beef production in May and 10.5% for muscle cuts only, down from 14.6% and 12.0%, respectively, in May 2019. For January through May, exports still accounted for slightly higher percentage of both total beef production (14.1%, up from 14%) and muscle cut production (11.6%, up from 11.3%) compared to last year. Beef export value per head of fed slaughter averaged $282.48 in May, down 10% from a year ago. The January-May average was $318.87 per head, up 3%.

May pork exports totaled 243,823 mt, 12% above a year ago but down 13% from the monthly average for the first quarter of 2020. Export value was $620.9 million, up 9% year-over-year but 16% below the first quarter monthly average. May exports increased year-over-year to China/Hong Kong, Taiwan and Vietnam, but trended lower to Mexico, Japan, Canada and South Korea. For January through May, exports were 30% ahead of last year’s pace in volume (1.35 million mt) and 37% higher in value ($3.53 billion).

Exports accounted for 36.2% of total pork production in May and one-third of muscle cut production, up substantially from last May’s ratios (27.3% and 23.3%, respectively). For January through May, exports accounted for 33% of total pork production and 30% for muscle cuts, also up significantly from last year (25.4% and 22.1%, respectively). Export value per head slaughtered averaged $72.30 in May, down only slightly from the April record and 32% higher than a year ago. The January-May average was $67.33 per head, up 38% year-over-year.

Few bright spots for May beef exports, but China’s growing demand encouraging

The U.S.-China Phase One Economic and Trade Agreement has provided much-needed momentum for U.S. beef exports to China, which totaled 1,671 mt in May (up 205% from a year ago), valued at $13.2 million (up 187%). The agreement’s red meat trade provisions took effect in late March, and in just a short time helped January-May exports to China reach 4,926 mt (up 66% from a year ago) valued at $38.9 million (up 71%).

“Phase One provided significant market access gains for U.S. beef, finally putting the U.S. industry in position to compete in the world’s fastest growing beef market,” Halstrom said. “These early results are really just a small preview of what we expect to see as China’s foodservice sector regains momentum and U.S. beef production returns to its normal level.”

Beef exports to Hong Kong also trended higher in May, reaching 8,397 mt (up 10% from a year ago) valued at $68 million (up 8%). For the first five months of the year, exports still trailed last year’s pace by 11% in volume (31,610 mt) and 10% in value ($270.6 million).

Led by growth in South Africa, Gabon, Angola and Cote d’Ivoire, Africa continues to emerge as a key destination for beef variety meat in 2020. May variety meat exports nearly doubled in both volume (2,692 mt, up 99%) and value ($2 million, up 94%) from a year ago and for January through May, exports totaled 12,783 mt (up 123%) valued at $9.6 million (up 115%).

Other January-May results for U.S. beef exports include:

- May exports to leading market Japan dipped 33% from a year ago in volume (19,986 mt) and 36% in value ($121.9 million). But exports through May remained ahead of last year’s pace, increasing 5% in volume (134,138 mt) and 2% in value ($841.7 million).

- Exports to South Korea were also hit hard in May at 18,319 mt, down 20% from a year ago, with value dropping 27% to $120.4 million. Through the first five months of the year, export volume to Korea was steady with last year’s record pace at 101,664 mt but value declined 3% to $719.2 million.

- U.S. beef is also coming off a record year in Taiwan. Despite lower results in May, exports to Taiwan remained 2% ahead of last year’s pace at 24,889 mt, with value slightly lower at $215.8 million (down 1%).

- The combination of lower U.S. production, COVID-19 related restrictions and a slumping peso hammered May exports to Mexico, with volume plunging 65% to just 6,989 mt, valued at $25.5 million (down 72%). For January through May, exports to Mexico were down 21% to 77,037 mt, valued at $356.9 million (down 23%).

- Despite trending lower in May, beef exports to Canada remained substantially ahead of last year’s pace at 46,762 mt, up 15% from a year ago, while value increased 16% to $307.3 million. Demand for beef variety meat has been especially strong in Canada, with exports jumping 33% to 4,332 mt, valued at $8.6 million (up 44%).

African swine fever still fueling pork demand in China/Hong Kong, Vietnam

China/Hong Kong continued to drive pork export growth in May, though January-May exports also remained higher year-over-year to several other key markets. May exports to China/Hong Kong pulled back from recent record highs but still reached 112,820 mt, up 148% from a year ago, valued at $259 million (up 188%). Through May, exports to China/Hong Kong tripled last year’s pace at 526,273 mt (up 203%), valued at $1.25 billion (up $284%).

Pork exports to Japan trended lower in May but January-May shipments remained 7% ahead of last year’s pace at 169,912 mt, valued at $704 million (up 10%). Chilled pork accounts for more than half of U.S. exports to Japan, much of which is high-value product destined for retail. Japan’s import data (also through May) showed a 4% increase in U.S. chilled pork at 88,217 mt. Japan’s imports of U.S. ground seasoned pork increased 43% to nearly 50,000 mt, while value soared 69% to $150 million. U.S. share of Japan’s ground seasoned pork imports climbed to 79%, up from 57% last year.

“Having U.S. pork back on a level tariff playing field in Japan has been especially important in these challenging times,” Halstrom said. “Without the U.S.-Japan Trade Agreement, which took effect Jan. 1, U.S. pork would still be at significant disadvantage compared to European and Canadian pork – something we absolutely could not afford in what has traditionally been our leading value market.”

Other January-May results for U.S. pork exports include:

- Although May pork exports to Mexico did not slump as badly as beef, volume was still down 28% from a year ago to 37,715 mt, with value dropping 25% to $111.5 million. This pushed January-May exports 35% below last year’s pace at 275,823 mt, though value was still up 4% to $472.4 million. Mexico’s pork production has been increasing and domestic pork prices moved lower this spring. This has increased price-driven competition in the market, especially with a historically weak peso and reduced consumer spending. With this in mind, July 1 implementation of the U.S.-Mexico-Canada Agreement is especially important for reassuring customers in Mexico and Canada that duty-free trade guided by science-based regulations will continue.

- Demand for U.S. pork in Chile has soared in 2020, with exports climbing 26% from a year ago to 21,643 mt, valued at $605 million (up 30%). For muscle cuts only, exports accelerated at an even faster pace, surging 35% to 19,207 mt valued at $53.4 million (up 51%).

- Led by outstanding growth in Nicaragua and El Salvador, exports to Central America increased 2% to 38,283 mt, with value up 8% to $95.4 million. Exports also trended higher to Honduras, the region’s leading destination for U.S. pork.

- As Vietnam continues to struggle with African swine fever, its demand for U.S. pork has increased dramatically. Exports increased 129% to 7,050 mt, valued at $15.5 million (up 141%). On July 10, Vietnam will reduce its most-favored-nation tariff rate on frozen pork muscle cuts from 15% to 10%, which will further boost the competitiveness of U.S. pork.

- Exports to New Zealand, a key destination for U.S. hams used for further processing, increased 25% from a year ago to 5,509 mt while value soared 46% to $19.4 million.