“Prevented Planting Decisions for Corn in the Midwest”, farmdoc daily, May 14, 2019.

“The Advisability of Planting Corn Declines Rapidly with Later Planting”, farmdoc daily, June 4, 2019

Economic Considerations of Prevented Planting

Last year, much planting occurred after the final planting date, with rough estimates being that about half the Illinois corn crop was planted in June. This planting occurred with the expectation of a short crop and higher fall prices as compared to the spring price. As it turned out, corn acres were at expected levels, yields were near trend, and prices were lower in the fall compared to the spring. In many cases, taking prevented plant insurance payments turned out to be the higher return alternative than planting corn (farmdoc daily, December 30, 2019).

This year, the economic situation differs from 2019, with current expectations of much lower prices than projected prices for crop insurance. The 2020 projected price for corn is $3.88 per bushel. Because of the Coronavirus and COVID-19 control measures, expectations are for much lower 2020 corn prices (see farmdoc daily, April 28, 2020). Currently, the December 2020 corn contract on the Chicago Mercantile Exchange (CME) is trading near $3.35 per bushel. This $3.35 CME price is a good estimate of the harvest price for crop insurance. Current fall delivery bids in central Illinois are $0.25 below the December futures contract at $3.10 per bushel.

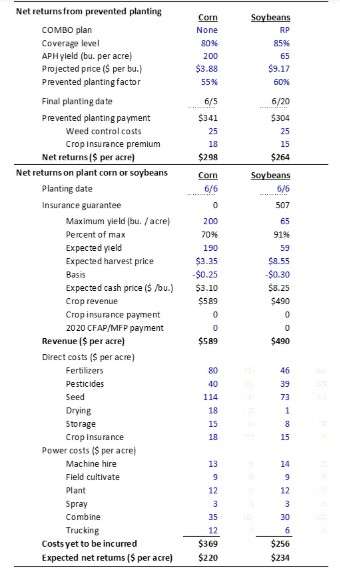

Figure 1 shows estimates of expected returns from taking prevented planting versus planting corn. The analysis is made for planting on June 6, the day after the final plant date for corn in most of Illinois. The Planting Decision Model, a Microsoft Excel spreadsheet downloadable from the FAST section of farmdoc, was used to generate Figure 1. Calculations are for a farm in Champaign County that has chosen a Revenue Protection (RP) policy at an 80% coverage level.

Figure 1. Expected Net Returns from Prevented Planting and Planting Corn, Output from Planting Decision Model

The expected return from the prevented plant payment on corn is $298 per acre. This is based on an APH yield of 200 bushels per acre and a prevented plant payment of $341 per acre. From the $341 prevent plant payment, costs are deducted for weed control ($25 per acre) and the crop insurance premium ($18 per acre). This gives the $298 net return. This assumes no other expenses have been incurred for the intended crop.

The expected net return for planting corn is $220 per acre. Revenue includes an expected yield of 190 bushel per acre and a cash price of $3.10 per bushel. The 190 bushel per acre expected yield is well above agronomic predictions for planting on June 6. Costs yet to be incurred are $369. We assumed that $100 of nitrogen fertilizer and pesticides have been already applied. The net return from planting giving the return of $220 per acre.

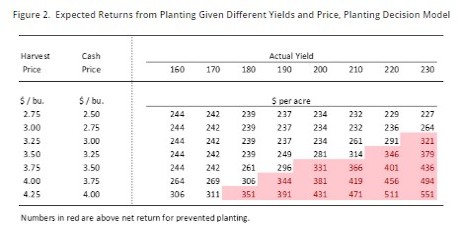

Net return of planting corn of $220 per acre is $78 per acre less than taking the $298 net return of prevented plant. Obviously, different prices and yields will result in different net returns from planting (see Figure 2). At a $3.10 cash price, yields would have to above 215 bushels per acre before planting corn has expected returns that exceed taking prevent plant given this scenario. A combination of higher yields and higher prices could also result in net returns exceeding the $298 net return from prevented plant (combinations highlighted in red in Figure 2). An 85% coverage level would increase the advantage of prevented plant relative to values for the 80% coverage level shown in Figures 1 and 2.

Note that the above analysis does not include any additional federal support payments for the 2020 crop. While unannounced, it seems likely additional aid will be provided. It also remains unclear whether farmers would be eligible for additional aid, if provided, on prevented plant acreage. For example, to receive payments from the MFP in 2019, producers had to plant acres to an eligible crop. Still, it seems unlikely that any additional payments on planted acres would be enough to push expected returns for planting corn above the expected prevent plant return, especially in situations where weed control is the only cost aside from crop insurance premium. As the level of expenses invested in the intended crop increases, the margin gained from prevent plant will diminish.

Summary

The above analysis was conducted for a particular situation with no input costs for the intended crop. We find the analysis shown above to be applicable to a wide range of situations, particularly for farmers who have selected a high coverage level on a COMBO product. Still, we suggest farmers conduct their own analysis given parameters specific to their farm situation. The Planting Decision Model can be downloaded from the farmdoc website at: https://farmdoc.illinois.edu/fast-tools/planting-decision-model.

The dramatically lower prices caused by COVID-19 control measures and correlated outlook for harvest price set 2020 prevent plant return expectations apart from 2019. For higher coverage levels of crop insurance, it is difficult to build situations in which planting corn has higher expected returns than taking prevent plant. However, the advantage will decline for farmers who have non-refundable investments in the intended corn crop. The decision is further complicated for farmers who cash rent and may need to plant to avoid risk of losing the farm in a future year.

Source : illinois.edu