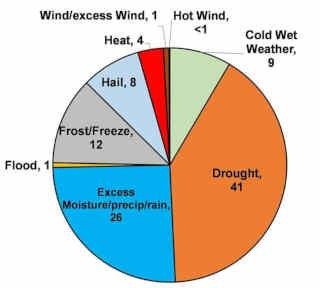

Figures 1 and 2 reflect hay prices for Pennsylvania spanning 2012 through September 2022 averaged either by year or month. The drought years were 2012 and 2016. All three hay quality prices increased after 2012, however, the opposite occurred after 2016. It was interesting that from 2015-2017, hay prices were very similar regardless of quality. In 2018, alfalfa hay prices diverged greatly from the mixed and grass hay prices. It does appear that hay prices in 2022 are trending downward and searching out hay purchases sooner versus later might be prudent. This is confirmed in Figure 2 evaluating hay prices by month. September appears to be consistently the low-price month for all hay qualities. July is also a low-price month for mixed and grass hays.

Figure 1.

Figure 2.

Figures 3 and 4 show the corn grain and 48% soybean meal prices for the past ten years both by year and month. Soybean meal spiked after the 2012 drought where the corn price descended. After 2014, both commodities remained flat and then the pandemic hit causing both to increase in price. Corn and soybean meal appear to be plateauing in 2022. On a monthly basis, the fall appears to be an ideal time to purchase corn and soybean meal at more competitive prices.

Figure 3.

Figure 4.

When trying to outsmart the forage or grain markets, there will always be an unexpected wrinkle to factor into the equation. However, when examining the last ten years' worth of data, there does appear to be some trends. These could help in making smarter decisions on when to purchase hay or grains during the year. The local hay auctions are more reflective of current weather conditions whereas corn and soybean meal are more influenced by nationwide events. If Pennsylvania dairies continue to be land limited, then focus on strategies to purchase hay and grain when it is advantageous to the buyer.

Economic perspective:

Monitoring must include an economic component to determine if a management strategy is working or not. For the lactating cows, income over feed cost is a good way to check that feed costs are in line for the level of milk production. Starting with July 2014's milk price, income over feed cost was calculated using average intake and production for the last six years from the Penn State dairy herd. The ration contained 63% forage consisting of corn silage, haylage and hay. The concentrate portion included corn grain, candy meal, sugar, canola meal, roasted soybeans, Optigen and a mineral vitamin mix. All market prices were used.

Also included are the feed costs for dry cows, springing heifers, pregnant heifers, and growing heifers. The rations reflect what has been fed to these animal groups at the Penn State dairy herd. All market prices were used.

Income over feed cost using standardized rations and production data from the Penn State dairy herd.

Note: August’s Penn State milk price: $25.74/cwt; feed cost/cow: $7.20; average milk production: 79 lbs.

Feed cost/non-lactating animal/day.

Source : psu.edu