The calendar says July; but for the cotton grower it’s Christmas. This week’s USDA monthly supply and demand numbers were an unexpected gift. The market reacted positively and let’s hope prices can sustain the new-found optimism.

Even if prices eventually slip back a bit, and I’m not saying they will, today’s move at minimum gives growers the first real bona fide opportunity to make a marketing risk management decision for the 2016 crop.

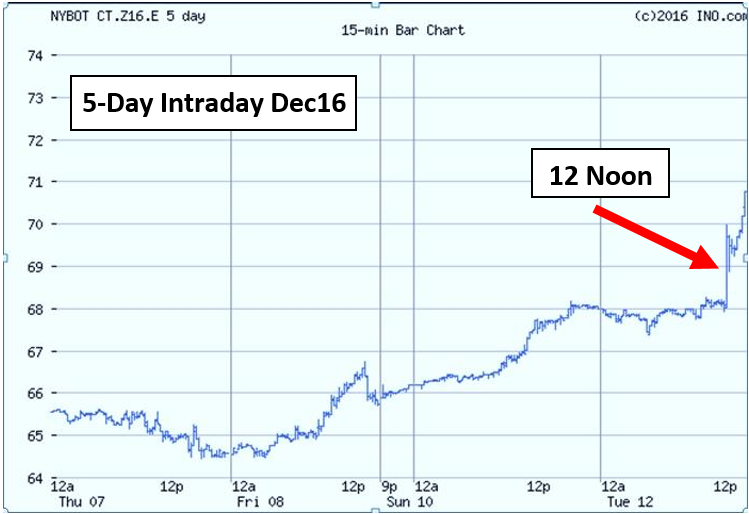

December 2016 futures closed today at 70.78 cents per lb—up the daily limit of 300 points. Prices have not been this high in almost 2 years. Prices showed improvement last Friday closing out of the 64-66 cent rut and moved even higher yesterday before today’s report. Prices rocketed immediately after the report at noon and continued to move higher and closed up-limit for the day.

Today’s move was all about the numbers in the report. When prices move the daily limit up or down, it means the market was surprised. One role of the futures market is to form expectations—to anticipate supply/demand data and information and to reflect those expectations in the prices we see. The market was up-limit today—the market was surprised.

Here’s a summary of USDA’s July 12th report:

- US exports for the 2015 crop year were raised 200K bales. This lowers beginning stocks for the 2016 crop year by that same amount.

- The 2016 US crop is now projected at 15.8 million bales—up 1 million bales from the June estimate. This is based on the higher June acreage number of 10.02 million acres planted. This is still based on an historical yield. The first estimate of actual yield will be reflected in the August report. The US crop could get bigger if conditions cooperate.

- Typically a larger crop might lead to lower prices, but US exports for the ’16 crop year were also raised 1 million bales. This should be no surprise as often exports are raised simply due to the fact that there is more available supply—but, the magnitude of this increase was a surprise.