By Michael Langemeier

Center for Commercial Agriculture

Purdue University

This year has exhibited wide swings in commodity prices, drastically changing net return prospects. Earlier papers examined net return prospects in early January (farmdoc daily January 10, 2020) and early May (farmdoc daily May 8, 2020). This article provides updated feeding cost of gain, breakeven prices, and net return estimates for the first nine months of 2020, and projections through the second quarter of 2021. It is important to note that the net return estimates in this article do not include Coronavirus Food Assistance Program (CFAP) payments. Information pertaining to these payments can be found in the fact sheets listed in the citations.

Several data sources were used to compute net returns. Average daily gain, feed conversion, days on feed, in weight, out weight, and feeding cost of gain were obtained from monthly issues of the Focus on Feedlots newsletter (here). Futures prices for corn and seasonal feed conversion rates were used to project feeding cost of gain for the next several months. Net returns were computed using feeding cost of gain from monthly issues of the Focus on Feedlots newsletter, fed cattle prices and feeder cattle prices reported by the Livestock Marketing Information Center (LMIC) (here), and interest rates from the Federal Reserve Bank of Kansas City.

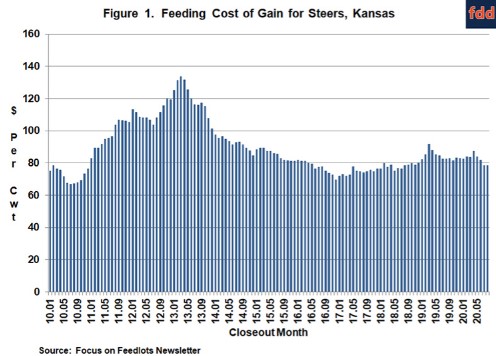

Feeding Cost of Gain

Figure 1 illustrates monthly feeding cost of gain from January 2010 to August 2020. Feeding cost of gain averaged $84.37 per cwt. in 2019 ranging from a low of $81.61 in October to $91.67 in March. Feeding cost of gain per cwt. averaged $83.27 in the first quarter and $84.28 in the second quarter of 2020. Projected feeding cost of gain for the third and fourth quarters of 2020 are $78.75 and $80.75, respectively.

Feeding cost of gain is sensitive to changes in feed conversions, corn prices, and alfalfa prices. Regression analysis was used to examine the relationship between feeding cost of gain, and feed conversion, corn prices, and alfalfa prices. Results are as follows: each 0.10 increase in feed conversion increases feeding cost of gain by $1.24 per cwt., each $0.10 per bushel increase in corn prices increases feeding cost of gain by $0.88 per cwt., and each $5 per ton increase in alfalfa prices increases feeding cost of gain by $0.50 per cwt.

Feeder to Fed Cattle Price Ratio