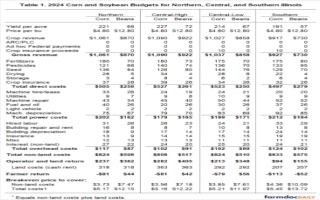

The basis for budgets is farm records from Illinois Farm Business Farm Management (FBFM). FBFM records for each of the four breakdowns are available from 2017 to 2022 in a publication on farmdoc entitled “Revenue and Costs for Illinois Grain Crops.” The projections in Table 1 are updated from historical summaries in the following manner:

- Projected yields are based on historical trends (see farmdoc daily, June 6, 2023, for a discussion of trend yields). Trend yield projections for corn are 221 bushels per acre for northern Illinois, 227 for central-high, 214 for central-low, and 191 for southern Illinois. Trend yields for soybeans are 68 bushels per acre for northern Illinois, 72 bushels per acre for central-high, 67 for central-low, and 57 for southern Illinois.

- Corn and soybean prices are based on current futures prices on Chicago Mercantile Exchange (CME) contracts that will be used to market the 2024 crop. Projected 2024 prices are $4.80 per bushel for corn and $12.80 for soybeans.

- Projected 2024 cost levels are based on 2022 levels, the last year for which FBFM summaries exist. Those 2022 levels are updated based on changes in input prices.

The only revenue included in the 2024 budget is crop revenue. The traditional commodity programs — Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) would not make payments at prices and yields used to construct these budgets. Ad hoc Federal programs could provide an alternative source for payments, but those would require congressional or administrative action.

Total non-land costs include:

- Direct costs — these costs will vary with the crop planted and include fertilizer, pesticides, seed, drying, storage, and crop insurance.

- Power costs relate to machinery and power and include machinery hire, utilities, machine repair, fuel and oil, light vehicle, and machinery deprecation.

- Overhead costs include hired labor, building repair and rent, building depreciation, insurance, miscellaneous., and interest on non-land costs.

Operator and land return equals gross revenue minus non-land costs and represents a return to the farmer and landowner. Subtracting out land costs results in a farmer return.

Projected 2024 farmer returns are negative for corn: -$81 per acre for northern Illinois, -$82 per acre for central-high, -$79 for central-low, and -$113 for southern Illinois. Soybeans are projected to be more profitable than corn. Soybeans in southern Illinois are projected at $44 per acre, $42 per acre in central-high, $56 in central-low, and -$52 in southern Illinois.

Table 1 shows break-even prices to cover non-land costs and total costs. Total costs include non-land and land costs. Break-even prices to cover total costs exceed $5.00 per bushel for corn across all regions. For soybeans, break-even prices exceed $12.00 per bushel in all regions.

Historical Perspective

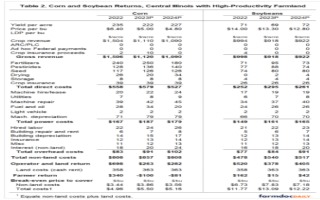

Table 2 provides a perspective of the 2024 budgets relative to 2022 actual results and current expectations for 2023 returns. Two major changes have occurred.

Corn and soybean prices: Corn and soybean prices are projected to decline from 2022 to 2023, and again in 2024. Corn prices averaged $6.40 per bushel in 2022. Projections place the 2023 corn price at $5.00 and the 2024 price at $4.80. Soybean prices declined from $14.00 per bushel in 2022 to $13.30 in 2023 and are projected to decline to $12.80 in 2024. Corn and soybean prices were at relatively high levels in 2020 through 2022. Price levels in 2023 and 2024 are lower, but remain above the average prices for 2014 through 2019: $3.74 per bushel for corn and $9.84 for soybeans.

Non-land costs: For corn, non-land costs increased from $808 per acre in 2022 to $857 per acre in 2023. Soybean non-land costs increased from $478 in 2022 to $540 in 2023. Both corn and soybean non-land costs are at record levels in 2023.

For both corn and soybeans, costs are projected to decrease in 2024. Non-land costs for corn are projected at $808 per acre, back to the 2022 non-land cost level. Soybean non-land costs are projected at $517, down from the $540 level in 2023.

Reductions in fertilizer prices are the main factor in the non-land cost decline. In recent months, fertilizer prices have declined, leading to protected fertilizer cost declines (see farmdoc daily, August 15, 2023). No other costs are projected to decline.

While projected to be down, 2024 projected non-land costs are near historically high levels. For corn, the 2024 level of $808 per acre is $214 higher than the $594 average from 2014 to 2019. For soybeans, the $517 level in 2024 is $154 higher than the 2014 through 2019 average of $363 per acre.

Commentary

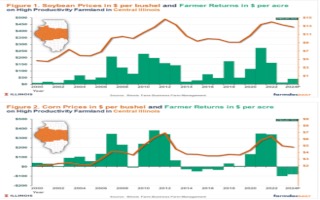

Farmer returns are projected to be much lower in 2023 and 2024 after being relatively high in 2020, 2021, and 2022, as illustrated for soybeans in Figure 1 and corn in Figure 2. Projected returns in 2023 and 2024 are at levels much like those from 2014 to 2019, a period when financial position stayed constant or declined on many Illinois farms. Declines in corn and soybean prices drive the projected revenue declines for 2023 and 2024. While not back at 2014-2019 levels, the price declines in 2023 and 2024 result in low returns because of much higher costs in 2023 and 2024 relative to the 2014-2019 period.

With yields at trend levels, break-even prices are above $5.00 per bushel of corn and above $12.00 for soybeans. Lower prices at trend yields will result in significant losses. Current commodity programs will only provide payments once significant losses occur. An estimated floor on 2024 revenue will become more apparent when projected prices for crop insurance are set in February.

In contrast, higher prices would improve the 2024 return outlook considerably. As always, higher prices are possible. Some possible events that could cause higher prices are 1) a poor finish to the 2022 crop, 2) production problems in South America, and 3) higher demand for U.S. crops from China. Whether these or other events would cause those higher prices are difficult to anticipate at this point.

Acknowledgments

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farms and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide independent, on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Source : illinois.edu