For both corn and soybeans, the marketing year begins in September and ends in August. The 2021 MYA year — sometimes referred to as the 2021-2022 marketing year — started in September 2021 and will end in August 2022. Therefore, the current 2021 MYA projections are at the beginning of the marketing year for both corn and soybeans. Historical observations suggest that actual MYA prices could vary significantly from current forecasts.

MYA prices serve as useful and important indicators of prices that farmers are receiving in the U.S. Moreover, MYA prices have significance in that they enter into the calculation of Farm Bill commodity title payments from the Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs.

Corn

The Office of the Chief Economist (OCE) releases market information and MYA price projections in its monthly World Agricultural Supply and Demand Estimates (WASDE) report. In the September 2021 report, the 2021 MYA projection was $5.45 per bushel for corn. This September projection is lower than the $5.70 projection made in the May report, the first projection of 2021 MYA by the OCE. OCE’s estimate of MYA corn price has declined by $.35 since May. Still, a $5.45 MYA price would be the third-highest price in history. The 2012 price of $6.89 per bushel was the highest, and the 2011 price of $6.22 per bushel was the second highest. The $5.45 forecast for 2021 is $1.00 per bushel higher than the 2020 forecast of $4.45 per bushel. The 2020 forecast will be final at the end of September and likely will be very close to $4.45.

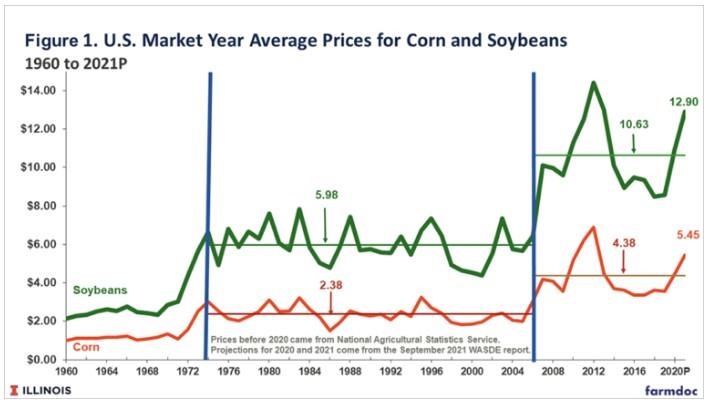

Commodity prices tend to have long periods in which prices do not trend up or down but vary around a long-run average (see farmdoc daily, April 22, 2016, March 29, 2011; and Choices). Both corn and soybeans did not trend up or down from roughly 1974 to 2006, varying around averages of $2.38 per bushel for corn and $5.98 per bushel for soybeans (see Figure 1). Changes in long-run plateaus usually are associated with a change in demand. For example, corn and soybean prices reached a higher level around 1974 because of increased crop export demand. A new plateau again was reached around 2006 because of increasing corn use in ethanol production, along with continuing strong export demand for soybeans.

From 2007 to 2021, MYA prices for corn averaged $4.38 per bushel, ranging from a low of $3.36 in the 2016 and 2017 marketing years to a high of $6.89 per bushel in 2012. From 2007 to 2021, MYA prices were below the average of $4.38 in ten of sixteen years, or 63% of the time. Within that period, a six-year run of prices below the long-run average also occurred from 2014 to 2019.

Without compelling evidence for a structural change leading to increased demand, there is a strong likelihood that the 2021 projection of $5.45 does not signal a new era of prices, and that corn prices likely are in the same regime that has existed since 2006. This would suggest that corn prices will continue to average near $4.38, and that there will be declining prices below $4.38 sometime in the future.

Soybeans

The September 2021 WASDE report contains a 2021 MYA projection of $12.90 per bushel for soybeans. The 2021 soybean projection has declined from the initial projection of $13.85 per bushel in the May report. The2021 forecast of $12.90 is $2.00 per bushel higher than the 2020 forecast of $10.90 per bushel.

Similar to corn, the 2021 soybean projection is the third highest in history. The 2012 price of $14.40 and the 2013 price of $13.00 per bushel exceeded the current $12.90 projection.

Periods of long-run plateaus typically coincide for corn and soybeans. From 1974 to 2006, soybean prices averaged $5.98 per bushel. A new plateau was reached in 2006, and the average price from 2007 to 2021 has been $10.64 per bushel. During the 2007-2021 period, the high was $14.40 per bushel in 2012 and the low was $8.48 in 2021. The MYA price for soybeans was below the $10.64 average in 60% of the years from 2007 to 2021.

Similar to corn, the 2021 soybean projection of $12.90 likely does not signal that prices have reached a new higher plateau. Rather, soybean prices likely will decline in the future.

Commentary

Expectations are for high prices in the 2021 market year. In Illinois and much of the eastern corn-belt, yields are projected to be above-trend levels. Relatively high prices and above-trend yields should lead to relatively high farm incomes in much of the eastern corn-belt. However, incomes will be lower in the western corn-belt as drought has impacted Iowa, Minnesota, North Dakota, and South Dakota yields.

Current high prices likely are not harbingers of continued high prices in future years. Generally, a commodity price regime change occurs when demand conditions change. No long-term changes in demand can be identified at this point. Instead, supply responses and higher yields will likely lead to lower prices, and future prices of these commodities are expected to continue to vary around the 2007-2021 averages of $4.35 per bushel for corn and $10.64 per bushel for soybeans. Moreover, prices in the future will include periods when prices fall below these long-run averages, similar to the period from 2014 to 2019 when MYA prices averaged $3.53 per bushel for corn and $9.15 for soybeans.

Having noted the likely decline in prices, the timing of this decline is unpredictable, depending on the realization of supply and demand factors. As an example, MYA prices were at record levels of $6.22 for corn and $12.50 per bushel for soybeans in 2011, well above average prices. Another record of $6.89 for corn and $14.40 for soybeans was set in 2012, when a large drought in the Midwest caused low supplies. Similarly, a yield shortfall in 2022 could lead to higher prices than exist today. Other demand events also could impact prices.

Still, one should expect lower corn and soybean prices sometime in the future. As a result, prudent farm management should account for this possibility.

Source : illinois.edu