On January 15, USDA announced additional assistance through the Coronavirus Food Assistance Program. This new assistance will include expanded eligibility for certain commodities and producers established in the recently passed relief package, as well as updated payments for producers who were eligible under previous iterations of the program. Producers have from January 19 through February 26 to submit new applications or modify existing applications if they have participated in the program already.

Updated Payment Calculations for CFAP2 and CFAP1

Along with the additional assistance, the Farm Service Agency adjusted the payment calculation to use the 2019 calendar year sales and 2019 crop insurance indemnities, Noninsured Crop Disaster Assistance Program and Wildfire and Hurricane Indemnity-Plus payments, multiplied by the applicable payment rate for sales commodities. In the CFAP2 program, the sales commodities included specialty crops, aquaculture, tobacco, specialty livestock, nursery crops and floriculture.

FSA also adjusted the CFAP2 payment calculation for certain row crops, addressing an issue that existed for producers who had crop insurance coverage but did not have a 2020 Actual Production History-approved yield. Now, when APH is not available, FSA will use 100% of the 2019 Agriculture Risk Coverage-County benchmark yield to calculate payments instead of the 85% the earlier CFAP2 calculations required. This change only covers producers with crop insurance coverage who grow barley, corn, sorghum, soybeans, sunflowers, upland cotton and wheat.

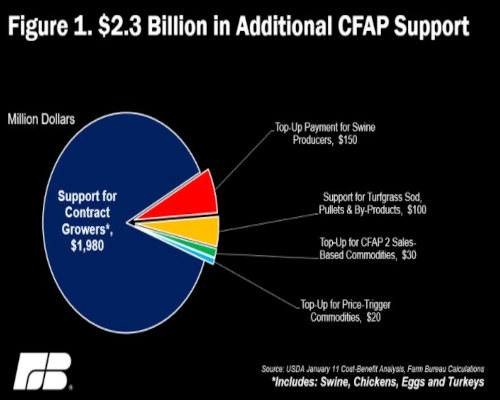

Swine producers who participated in CFAP1 will be receiving an automatic “top-up” payment of $17 per head, increasing the total CFAP1 inventory payment to $34 per head. Payment rates for swine are increasing from 25% to 50%of the estimated total economic loss. This top-up payment aims to rectify large differences between first quarter sales loss rates and inventory payment rates for CFAP1 payments, which were based on expected sales in the second and third quarters. There is no action required by producers to receive these additional payments. Producers who did not submit an approved CFAP1 application are not eligible.

Newly Eligible Commodities and Producers

Many producers were left out of the CARES Act and subsequent CFAP programs because farmers who raise animals under a contract for another entity that owns the animals could not participate. Poultry, in particular, was left out of the CARES Act, largely due to the structure of the industry and how the relationship between the farmer and integrator operates. Typically, a broiler farmer raises and cares for the birds, but the integrator maintains ownership of them. However, these producers saw their income significantly reduced as many of their barns (which they financed the construction of and still were required to service the debt on) remained empty due to supply chain disruptions earlier in the pandemic. The impacts to contract growers could arise from a variety of conditions, including: delayed delivery of young poultry and hogs to contract producers, decreased housing densities, additional costs for keeping animals longer than typical durations, and damage caused by animals too large for housing.

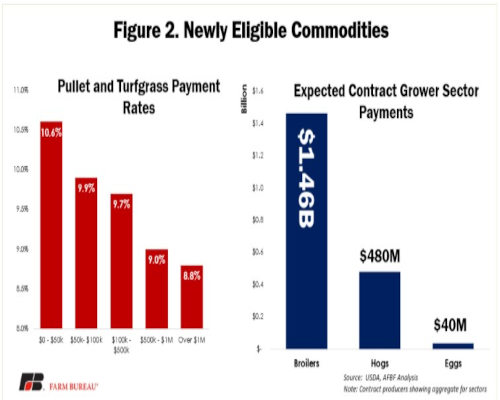

On Friday, USDA clarified that contract producers of broilers, turkeys, chicken eggs, laying hens and hogs who suffered a drop in revenue in 2020 due to the pandemic are now eligible for assistance. Payments are based on eligible revenue for January 1, 2020, through December 27, 2020, minus eligible revenue for January 1, 2019, through December 27, 2019, multiplied by up to 80%, subject to availability of funds. Additionally, producers of pullets and turfgrass sod are also now eligible for CFAP payments. These commodities were not explicitly included in the original CFAP2 rule, but their payment structure will be similar to sales commodities and the payment rate will vary based on their overall sales. For example, if we look at Figure 2, a pullet producer with less than $50,000 in sales would receive a payment rate of 10.6% of those total sales. Figure 2 also shows the expected total payments to each sector of contract growers as calculated in USDA’s cost-benefit analysis of the rule. While the analysis does not show any payments for turkeys, this does not mean that producers are ineligible. In this analysis, USDA is examining the industries in aggregate, and as a result, estimates the aggregate industries’ revenue did not suffer a loss. Individual producers who can show that they suffered a decline in revenue from 2019 to 2020 are certainly eligible and should apply for the program.