NY/ICE Cotton Futures Since 2020

Source: Cotlook

Uncertain Demand Amidst Inflation and the War in Ukraine

Uncertainty prompted by concern over the war in Ukraine might shift consumer spending away from discretionary items (including clothing) and pull down cotton demand further. Rising prices on essential goods and services, particularly the surge in energy prices and inflated prices for food, may decrease consumers’ discretionary incomes. As a category, clothing falls between need and want, but price increases for more essential items could depress cotton demand. Higher interest rates, which the government uses to combat inflation, could also stifle economic growth and drag down cotton use.

Higher Prices in Other Commodities Might Shift Acreage and Cotton Supply

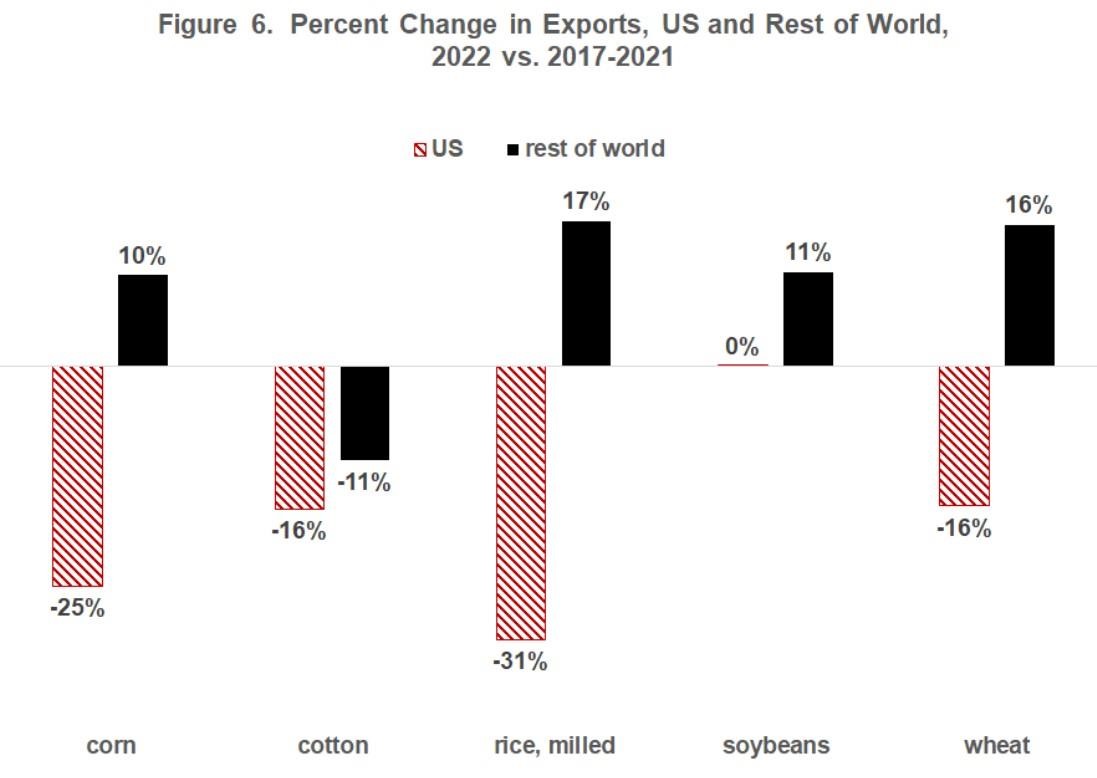

From the supply side, the war in Ukraine has already changed the calculus surrounding planting decisions. While cotton was increasingly attractive in the first two months of the year, the invasion of Ukraine brought on sharp increases in wheat prices and strong gains in prices for corn and soybeans. Growers still have a few months to adjust their planting decisions, but the latest developments in crop prices may shift acreage out of cotton to more profitable commodities.

A survey conducted by the National Cotton Council (NCC) at the end of 2021 suggests that U.S. growers would plant 12 million acres this spring, an increase of 7% over last year. The USDA predicted that U.S. growers would plant 12.7 million acres, a 13% increase. Even in the context of recent global events, more U.S. acreage seems likely, though as these predictions demonstrate, the size of the bump remains in question.

Even after the planting season, questions will remain about acreage harvested and yield. West Texas is home to about one-third of U.S. planted acreage, and the region receives little rainfall. Cotton is drought-tolerant, but if the current drought in West Texas does not lift, it may cause planted acres to be abandoned ahead of harvest. In addition, like consumers, cotton growers are grappling with inflation. Higher prices for inputs may lead to lower applications, and lower applications could impact yield. Assuming average yields and abandonment, the USDA indicated that the U.S. could collect 18.2 million bales in the 2022/23 crop year. Relative crop prices, input costs, and the weather may produce a different volume, but the preliminary forecast suggests an increase of 3%.

Click here to see more...