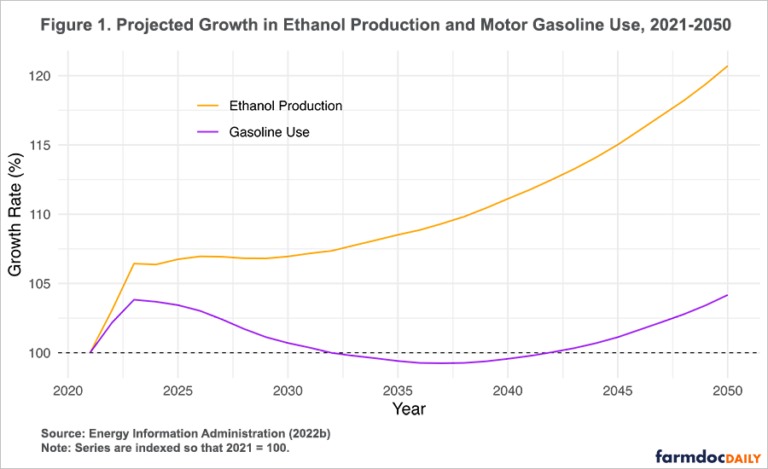

Some portion of future US gasoline use will come in the form of ethanol, which currently makes up roughly one-tenth of US gasoline supply. Current EIA forecasts from its Annual Energy Outlook shown in Figure 1 suggest ethanol production will experience a post-Covid rebound to similar to gasoline use, but that ethanol production will continue to grow slowly between 2023 and 2050. There are reasons to believe future trends in gasoline use and ethanol production may be proportional – that is, ethanol production may follow a time path closer to that of gasoline use as plotted in Figure 1.

Nearly all US ethanol is made from corn and ethanol use is an important component of corn demand. At present, more than one-third of US corn production is used to produce ethanol, the second largest corn use category after feed and residual use (USDA-FAS 2022). This article considers the implications of lower than expected ethanol production (proportional to forecasted gasoline use) for US corn demand and prices. If declining gasoline consumption is accompanied by relatively lower ethanol production, it will shrink corn demand and reduce prices assuming government policy allows. We estimate corn prices would be up to 4% lower if ethanol use is proportional to expected gasoline use relative to the case where ethanol follows current EIA projections.

One caveat to this projection is that it assumes business as usual for the remainder of US corn use. Of course, demand for corn will change over time. Ethanol exports, currently small, may continue to increase. Moreover, recent investments in precision fermentation technologies to make corn dextrose to produce textiles, polymers, pigments, cosmetics, and other goods may change the structure of other domestic uses for corn. Changes in these kinds of corn uses could more than absorb the long-run negative corn demand shock related to lower gasoline use.

The History of Corn Use for Ethanol

Corn is the US’s primary raw material for ethanol production. The US federal government mandated the rapid growth in corn use for ethanol through the Renewable Fuel Standard (RFS), which requires a minimum annual quantity of biofuel, including ethanol, in motor fuel. The RFS was introduced in 2005 and expanded in 2007. The RFS specifies minimum renewable-fuel production each calendar year from 2007 through 2022; While it required increased total biofuel volume every year over this time period, it required use of no more than 15 billion gallons of corn ethanol after 2015 (EPA, 2022). Nearly all US gasoline contains ethanol as an oxygenate, with the typical mixture begin 10% ethanol and 90% gasoline. Most internal combustion engines on the road today cannot use ethanol blends much higher than this. For 2021, EIA estimates US gasoline use at 8.782 million barrels per day and US ethanol production 0.867 million barrels per day, or roughly 10% of gasoline use. Hence, besides the RFS mandate, ethanol use is to a large extent dependent on gasoline usage.

Corn is the U.S.’s primary raw material for ethanol production, and 94% of ethanol production uses corn grain (EIA 2022). Figure 2 shows the historical change in corn production, corn use for ethanol production, and ethanol consumption from 1986 to 2020. Panel A in Figure 2 shows corn production and corn use for ethanol in billions of bushels. After 2000, the ethanol market expanded rapidly, going from 6% of corn use in 2000 to 40% in 2010. The most rapid growth occurred when the RFS mandates were passed in 2005 and 2007. Since 2011, corn use for ethanol has been almost constant at 5.2 billion bushels. As corn production has grown over this period, the share of corn use for ethanol has fallen slightly. Figure 2, Panel B shows annual US ethanol production and consumption in billions of gallons. Before 2010, nearly all US production was consumed domestically. After 2010, the U.S. began exporting ethanol. Finally, in 2020 and 2021, we see ethanol production declined sharply in part due to the Covid-19 pandemic which reduced driving demand.

Price Impacts of Lower Future Corn Ethanol Use

We consider the impact of lower than anticipated growth in corn ethanol production. Specifically, we estimate the effect on corn price and use if corn use for ethanol grows at the same rate as EIA-forecast gasoline use between 2021 and 2050 rather than the ethanol production projection shown in Figure 1. The demand shock we specify is given by the percentage difference between the upper and lower growth paths. We estimate that ethanol production will be 0.9% lower in 2022 than would have otherwise been the case. This ethanol production shortfall grows to 13.7% by 2050. Assuming corn production continues to grow over time as production technology and yield improve, the impact of the ethanol production shortfall on total corn demand diminishes over time. In our model, the initial 0.9% ethanol use shock translates in a 0.3% corn demand shock in 2022. By 2050, the impact of 13.7% lower ethanol production is a 3.9% corn demand shock.

Lower demand for corn for ethanol use does not decrease overall corn use bushel for bushel since other users respond to lower prices by increasing their own use. To estimate the overall effect, we employ a single market equilibrium displacement model to estimate the change in corn price due to the projected shift in demand caused by lower gasoline use. This model estimates price and quantity changes in the US corn market using assumptions about demand and supply elasticities, or how responsive producers and consumers are to changes in market conditions. For this analysis, we follow the Gouel (2020) analysis of US agricultural markets and assume the demand elasticity is -0.2 and the supply elasticity is 0.4. This implies that corn users are relatively less responsive to changes in the price of corn than corn producers.

Figure 3 plots our results: the estimated percentage changes in the price and quantity of US corn use each year if ethanol use growth follows EIA projections for gasoline use. Result show that the corn prices impacts are larger in percentage terms than the quantity impacts since both demand and supply are assumed to be relatively inelastic, unresponsive to changes in market conditions. Because the gap between EIA’s projected ethanol production and gasoline use projection grows over time, our estimated price impacts get larger over time as well. Declining ethanol use related to lower gasoline use results in corn prices that are 2% lower by 2026 and 4% lower by 2050. Quantity produced and consumed falls by up 1.5% by 2050. The quantity decline is smaller because demand and supply are assumed to be relatively unresponsive to changes in price.

Alternative Uses for Corn

As mentioned above, this analysis assumes no structural changes in other corn use between now and 2050. While predicting the future of non-ethanol US domestic corn use and US corn exports is beyond the scope of this article, zero change is unlikely. In the past, high-fructose corn syrup (HFCS) has been a major form of domestic use. However, data in Figure 4 show that HFCS use has trended down in the last two decades. At the same time, corn use for glucose and dextrose production has increased substantially, especially around 2015. The expansion of precision fermentation technologies for dextrose production in recent years shows a pathway to offset potential declines in the relative importance of future corn ethanol use. Using precision fermentation, corn dextrose can be produced for use in food manufacturing, textiles, polymers, pigments, and cosmetics. According to ReportLinker.com (2022), the global precision fermentation market will reach $11.8 billion by 2028, increasing at a compound annual growth rate of 41.5% during the period 2017-2027. However, there is still a long way for precision fermentation to replace ethanol use in US corn demand. Technological innovation to reduce production costs remains a challenge.

Conclusion

US ethanol production faces uncertainty related to adoption of electric vehicles and a resulting decrease in gasoline use. We quantify the impact on corn markets between now and 2050, assuming ethanol use remains proportional to EIA’s projections for gasoline use over time. We find relative declines in ethanol production would decrease corn prices by about 4%, but this price forecast assumes corn production and other uses continue current trends. The development of new uses for corn may substantially alter future corn prices.

Source : illinois.edu