This lack of consistent data should not be mistaken for a lack of hardship. One part of U.S. agriculture benefits from publicly supported, frequently updated market information; the other does not. That gap makes it significantly harder to quickly and credibly quantify the economic losses specialty crop farmers are absorbing.

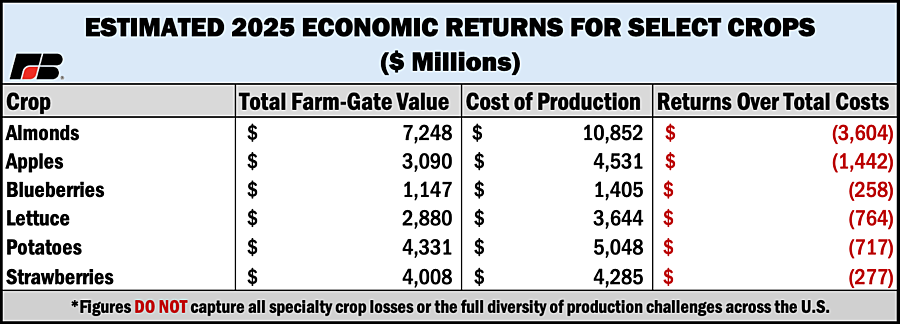

To illustrate the scale of need, this analysis examines six representative crops: almonds, apples, blueberries, lettuce, potatoes and strawberries. These crops were selected because they are among the few specialty commodities with enough available data to conduct analysis, while collectively reflecting the diversity of production systems, regions and marketing channels that define the broader sector. Together, they account for roughly one-quarter of total specialty crop receipts, meaning the true sector-wide losses are significantly larger than what these case studies alone capture. Yet the pressures outlined here (high labor and input costs, tightening margins, weather and disease challenges and ongoing trade instability) are shared across nearly the entire specialty crop sector.

These growers will not benefit from the $11 billion in the Farmer Bridge Assistance Program, leaving substantial unmet need among the commodities examined here and beyond. USDA also announced a welcomed $1 billion specialty crop growers expect to be eligible for, but details and timing remain unknown, and the scale of funding falls well short of the sector’s outstanding economic need.

Any cost-of-production studies used in this report that predate 2020 have been indexed to 2025 dollars. Importantly, this adjustment remains conservative, as many input categories have increased at rates exceeding general inflation.

Click here to see more...