On Friday, May 10, the US Department of Agriculture released its latest World Agricultural Supply and Demand Estimates (WASDE). The May WASDE includes the first complete projections of corn and soybean production and use for the upcoming 2024/25 marketing year, updating the preliminary new-crop commodity market outlook released by USDA in February at its Agricultural Outlook Forum (AOF). Table 1 compares the February AOF and May WASDE projections.

The May WASDE new-crop balance sheets contained little news on the production side. Corn and soybean production forecasts were revised lower to reflect acreage numbers previously released in the March Prospective Plantings report. Yield estimates reflect long-run trendline expectations. Wet weather, planting delays, and other current crop conditions have yet to be incorporated into USDA production forecasts. In general, USDA’s corn and soybean production numbers were right in line with pre-report expectations.

The May WASDE increased new-crop corn use forecasts by 50 million bushels for both ethanol use and exports relative to AOF numbers. The new-crop ethanol use projection for corn is 5.45 billion bushels, exactly equal to the current 2023/24 marketing year figure. For soybeans, domestic use was increased 25 million bushels, but exports were dropped 50 million bushels. This change continues an ongoing shift in the composition of US soybean demand caused by growing domestic production of renewable diesel.

The US corn market remains adequately supplied, as indicated by ending stocks projections and stocks-to-use ratios. Forecasted 2024/25 ending stocks for corn in the May report were just above 2.1 billion bushels, below pre-report expectations which averaged 2.28 billion. Much of the discrepancy is explained by the higher projections for ethanol use and exports discussed above. Corn stocks-to-use around 14% is more supportive for new-crop prices than previous official numbers but remains burdensome in historical terms. Corn prices did react positively to the report but given the state of corn inventories, the reaction was muted; new-crop December futures were up about 11 cents per bushel on May 10.

US soybean stocks are expected to increase substantially in 2024/25 compared to the previous year. Current 2024/25 ending stocks are projected at 445 million bushels, pushing stocks-to-use over 10% for the first time in five years. Inventories are expected to increase despite the steady growth in domestic soybean crushing. The current forecast for US domestic crush of 2.425 billion bushels would be 125 million more than in 2023/24 and more than 200 million above 2022/23. Prices reflected the flat overall outlook for US soybean use with new-crop November futures up just about three cents per bushel.

Downside Risk in New-Crop Use Projections

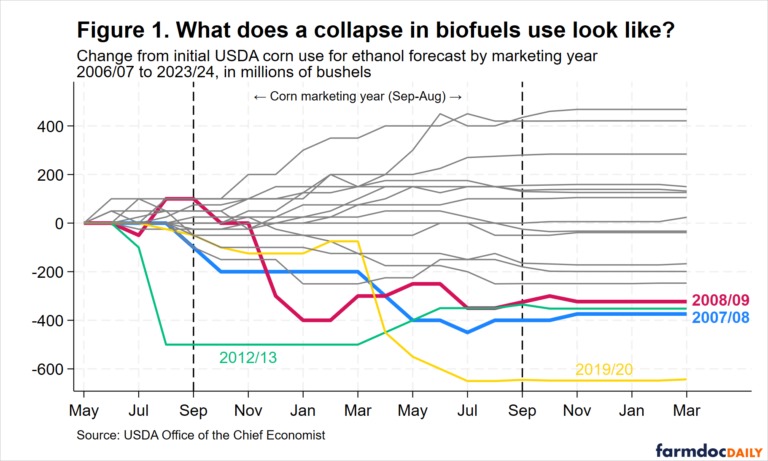

To assess the possible magnitude of a negative biofuel usage surprise on the 2024/25 corn and soybean balance sheets, consider past within-marketing-year changes in ethanol use projections. Figure 1 presents the history of USDA corn ethanol use forecasts relative to initial estimates like those released in the latest WASDE. The implicit thought exercise here is to consider how much corn ethanol use or soybean domestic crush use might change relative to the current projections given in Table 1.

Figure 1 highlights the four marketing years with the largest decline in corn use for ethanol relative to initial forecasts: 2007/08, 2008/09, 2012/13, and 2019/20. Ethanol use changes in 2012/13 and 2019/20 can be explained by the large drought-related corn production decline in 2012 and the collapse in transportation fuel demand following the outbreak of Covid-19 in March 2020. The other two marketing years, 2007/08 and 2008/09, occurred during the post-Renewable Fuels Standard biofuels boom. During this period, rosy projections for ethanol led to overinvestment in processing capacity and many ethanol production plants were announced but never built (e.g. Huffstutter, 2008).

Initial USDA projections for corn ethanol use in 2007/08 and 2008/09 were also higher than final estimates. In both years, initial forecasts were about 350 million bushels higher than actual corn ethanol use. However, the timing of the change in usage expectations differed. In 2007/08, ethanol use expectations steadily declined through the year. In 2008/09, ethanol use forecasts fell dramatically between November 2008 and January 2009, concurrent with a collapse in petroleum prices and the fallout from the global financial crisis. More generally, Figure 1 shows changes in biofuels use projections typically occur in the middle of the marketing year.

The changes observed in Figure 1 are suggestive of the type of corn and soybean demand reduction that may be observed if the US biofuels market becomes “oversupplied” as some market analysts suggest (e.g. Successful Farming, February 23, 2024 and Reuters, May 13, 2024). These oversupply concerns appear particularly acute in the case of renewable diesel for which soybean oil is the major feedstock. In the case of the early ethanol demand decline of 2007 to 2009, the decrease in marketing year corn use for ethanol of about 350 million bushels was roughly 10% of total corn ethanol use at the time.

Final considerations

The May 2024 WASDE report sets expectations for market fundamentals for the remainder of the corn and soybean marketing year. The most recent report displayed continued optimism regarding domestic corn and soybean demand for biofuel use. There is no immediate signal that USDA’s forecast is overly optimistic, but lower corn and soybean use related to concerns about a biofuel supply glut does pose downside price risk. The possible scale of a large change in biofuels use– estimated here at about 10% of total marketing year biofuels use – is considerably smaller than weather-related production risk that will be a consistent topic of market chatter between now and the end of the summer. The historic evidence points to the idea that commodity use quantities are typically small: commodity demand is inelastic. Though commodity price changes are typically larger than changes in quantity in percentage terms, the price impact of such quantity changes in the marketing year ahead would also be mitigated by the presence of ample existing inventories.

Source : illinois.edu