One of livestock’s responses to competition from meatless meat will be to adjust prices, and the first price response would come from the ground meat market. This is because plant-based meat industry’s entry point into the meat market is ground beef, with products like Impossible Burger and Beyond Burger. Because ground beef is jointly produced with other, more valuable cuts of beef, however, plant-based competition with ground beef will prompt a price response from the entire beef market. For this reason, the beef market will be difficult to penetrate, because the supply of ground beef cannot be adjusted without changing the supply of other cuts of meat. Plant-based meat does not yet offer substitutes for more valuable cuts of meat like steak, so ultimately the beef market will be able to undercut the price of plant-based meat as it develops a surplus of ground beef.

Ground Beef Market

The ground beef supply in the U.S. comes from three main sources– the beef industry, the dairy industry, and imports from Australia, Canada, Mexico, New Zealand, and Brazil (Ishmael, 2020). Ground beef is a ‘subprimal’ cut of beef, meaning that it is lower quality meat. Thirty-eight percent of a steer’s carcass is sub-primal meat, which can be processed into ground beef and stew meat (American Angus Association). Ground beef comes in many different blends – 70%, 80%, 90% lean – which are created from fattier trimmings blended with leaner trimmings (Ishmael, 2020). In general, fattier trimmings come from fed cattle, and leaner trimmings come from dairy cows and imports. Table 2 displays the proportionate contributions of these sources to ground beef supply. Trimmings from fed cattle contribute 43% of total supply, domestic cows (mostly dairy cows) contribute 27%, imports contribute 26%, and trimmings from domestic bulls (uncastrated males used for breeding) contribute 4%.

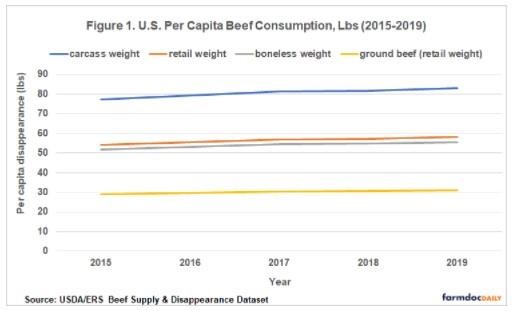

It is estimated that 45% (Ishmael, 2020) to 62% (Rabobank, 2014) of the beef that Americans eat is ground beef. Demand for ground beef has grown over the past forty years, as convenience and leanness attributes became more valuable to American consumers (Rabobank, 2014). As a result of this shift in preferences, the U.S. relies on imports of lean beef trimmings to meet demand for ground beef. U.S. beef animals are optimized for choice and select cut production instead of ground beef production. With the recent increase in ground beef demand, it has been argued that the beef industry no longer produces an optimal ratio of prime to sub-prime cuts for the U.S. market (Rabobank, 2014).

Joint Product Theory

Beef products are joint products – production of a certain cut of beef involves the production of other cuts of beef, because all cuts come from a single allocable factor, a beef carcass (see Beattie and Taylor (2009) for a discussion of joint product theory). More specifically, ground beef is jointly produced with choice and select cuts of beef – approximately 62% of a steer carcass is used for choice and select cuts, and optimally the remaining 38% is used for ground beef or sub-prime cuts (although all of the carcass could be processed into ground beef) (American Angus Association). The production of ground beef cannot be adjusted without adjusting the production of choice and select cuts of beef, and vice versa. Therefore, joint product theory indicates that the supply, prices, and demand for choice and select cuts of beef will respond to changes in supply, prices, and demand for ground beef.

Market Response Estimates Using Beef Price Elasticities

Price elasticities of different cuts of beef can be used to describe how plant-based competition with ground beef would ripple through the entire beef market.

Part 1:

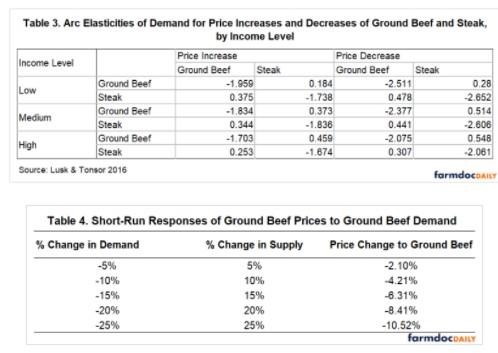

A decrease in demand for ground beef would lead to a surplus of the product, which would lead to a price cut. Table 4 displays the change in price that would result from changes in demand for ground beef. The figures are calculated using an estimate of price elasticity of demand from Lusk and Tonsor (2016) as a substitute for price elasticity of supply.[1] Ground beef has a negative own price elasticity of demand, which means that it is a normal good. As an estimate for price elasticity of supply, -2.377, means that a 2.377% increase in ground beef supply means a price decrease by 1%.

Part 2:

Ground beef is a joint product, which means that the steer carcass is optimally divided into different cuts of beef, and only 38% of a steer carcass can be made into ground beef. This means that beef butchers cannot use more of the steer for choice or select cuts as ground beef demand declines, so if the market requires that they cut ground beef supply by 10%, these calculations assume that they will have to cut steer supply – and other cuts of beef – by 10% as well.[2]

Part 3:

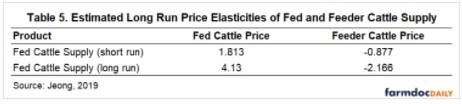

The next step is to calculate how feeder cattle prices would respond to a cut in supply.

Fed cattle have a positive price elasticity of supply (Jeong 2019), which means that supply increases as price increases and contracts as price decreases. The elasticity is greater in the long run than in the short run, which means that supply would contract more in response to a 1% decrease in price over the long term than it can in the short term. This makes sense for cattle supply, since supply in the industry is bound to annual growth cycles of the animals and the age at which the farmer chooses to slaughter the animal.

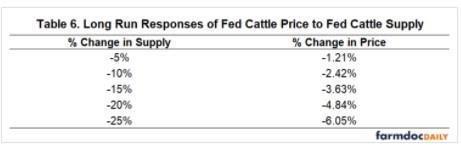

Table 6 displays the long run change in fed cattle prices that would result from different cuts in fed cattle supply.

Part 4:

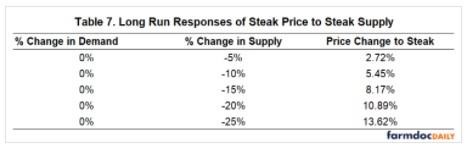

Finally, how would the price of choice and select cuts of meat respond to a drop in steer supply? Since the plant-based meat industry has not yet developed products which could be substitutes for choice and select cuts of beef, the assumption is that the demand for these cuts would remain the same while the demand for ground beef drops. In the face of a supply cut, choice and select cuts of beef would increase in price. This change is calculated using the price elasticities again from Lusk and Tonsor (2016) in Table 3. In this case, the own-price elasticity of demand for steak (in response to a price increase) is used to estimate how the price of choice cuts will react to a shortage. See Table 7.

Evaluation

Because ground beef is a joint product, changes in its market would affect the fed steer and choice/select cut markets as well. The price elasticities for each product, as estimated by recent studies about U.S. beef markets, can be used to quantify price changes across all three markets, under the assumption that the entire beef market was in equilibrium prior to plant-based meat entry. These calculations indicate that the decrease in fed steer price would be less than the decrease in the price of ground beef, and the increase in choice/select prices would be greater than the decrease in both the fed steer and ground beef prices. This suggests that in the long term, the fed steer price could actually increase as a result of plant-based meat competition with ground beef.

For plant-based meat, competition with the U.S. beef market, and especially the ground beef market, will be difficult for a number of reasons. For one, it is the largest in the world, and for another, demand for ground beef is higher than for any other beef product. The supply side of the market poses additional challenges to competitors. As a joint product, the supply for ground beef cannot be adjusted without adjusting supply of other cuts of beef. Cattle life cycles also make it difficult for the industry to adjust supply quickly, which means that it would first undercut plant-based meat prices for years before reducing supply of ground beef. And the fact that ground beef supply comes from multiple sources complicates supply adjustments even further. Dairy cows contribute nearly 10% to total U.S. ground beef supply. However, sales of dairy cattle likely have little impact on the dairy industry. Beef imports pose a similar challenge, since they do not affect U.S. beef farmers’ revenue. So a fixed supply of ground beef will be on the market regardless of beef prices or customer demand, which will give the beef industry an advantage in a pricing competition with plant-based meat.

Tune in next week for estimates of the beef market price response to competition from plant-based meat.

Notes

[1] The reason for this is that the beef market literature has many estimates of price elasticity of demand for different cuts of beef, but not price elasticities of supply. In the short term with a surplus of ground beef, it is fair to assume that the prices of ground beef would adjust according to price elasticity of demand, because the price changes would prompt consumers to respond proportionately and return the market to equilibrium.

[2] Another assumption is that the dairy industry will not react to the drop in the demand for ground beef. The dairy industry contributes to the ground beef supply, but ground beef is a side product of dairy production and does not contribute significantly to dairy farms’ revenue. For this reason, dairy farms will not adjust the size of their herd in the way that beef farms are expected to do. Instead, it is possible that the U.S. would reduce beef imports, since dairy beef and imported beef are leaner and used to cut fattier steer beef into leaner blends preferred by consumers.

Source : illinois.edu