How Livestock Risk Protection Works

Figure 1. Price Components with Livestock Risk Protection Coverage.

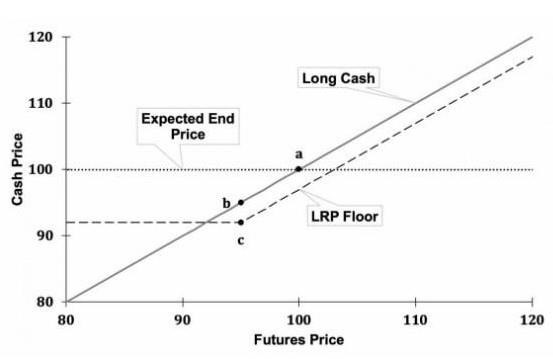

To assess the coverage available, a producer should decide the livestock marketing date (or how long the coverage is needed). Then, examine LRP quotes to determine if an end date within 60 days of the marketing date is available. For a given end date, there is an expected end value with LRP that tracks or is close to a futures price. For example, consider an expected end value of $100 per hundredweight (cwt) (the dotted line in Figure 1). Without LRP, the producer faces a price that could increase or decrease before the end date (the solid line in Figure 1). Each end date may have multiple coverage levels available, corresponding to different deductible levels. The coverage level ranges from 70 to 100 percent of the expected end value, but not all coverage levels are available at all times. Continuing with the example, using the 95 percent coverage level implies a five percent deductible, resulting in a coverage price of $95 per cwt (Figure 1). The deductible is the vertical difference between point a and point b, or $5 per cwt.

The coverage comes at a cost. LRP premiums track, or are similar to, option prices before the subsidy. Unlike when buying options, LRP premiums are not paid until the end of the coverage period. However, the cost of LRP is incurred regardless of what happens to cattle prices by the end date. The premium is the vertical difference between point b and point c in Figure 1, assumed to be $3 per cwt after any subsidy. The result of combining the coverage level and the premium is the LPR floor of $92 per cwt that increases as the futures prices increase (the dashed line in Figure 1). The LRP floor is the minimum price a producer can expect, and it is the minimum of the coverage level price, less the premium or the futures price, less the premium.

LRP indemnity payments are figured relative to the coverage price. If prices fall by the end date, then LRP pays any difference if the actual end value is below the coverage price. The end value is based on a cash price observed on the end date. In the example, if the actual end value falls to $85 per cwt, then the indemnity would be $10 per cwt, and the producer would receive the net amount of $7 per cwt from LRP. When added to the cash price of $85 per cwt, the producer has a price equal to the LRP floor of $92 per cwt.

Note that the coverage prices, end values and premiums are based on national prices. The selling price for livestock the producer receives is unlikely to affect the insurance. A producer’s basis may affect the floor price, but only because of local quality or market conditions. The shortest duration (13 weeks) may limit the time during the year that producers would find useful coverage available. The 60-day window to make cash sales may not fit if adverse conditions move up marketing dates. Technically, LRP coverage can be sold to an eligible buyer of the livestock and be valued like an option at that time.

An Application to Calves

In the LRP Feeder Cattle policy, the endorsement is broken out by cattle type and weight. There are price adjustment factors that act like price slides, price spreads or basis adjustments. Prices and premiums for beef steer calves expected to weigh less than 600 pounds (Weight 1) by the end date are adjusted to 110% of the feeder steer prices and premiums (Weight 2). The actual ending value is the feeder steer price, the CME Feeder Cattle IndexTM, adjusted by 110%. Beef heifer calves have an expected ending value and premiums on par with the feeder steer price. Non-beef (e.g., dairy) type calves have other adjustment factors.

Consider an example with steer calves with a coverage period of 21 weeks. If the feeder cattle futures price is $150 per cwt, the steer calf expected ending value is $165 per cwt. At an assumed implied volatility level of 20% (the volatility is the uncertainty in the futures market that drives the cost for the coverage), the base weight premiums are multiplied by the price adjustment factor and the subsidy factor. For example, the premium for the 100% coverage level would be: $7.56 × 1.10 × (1 - 0.35) = $5.41 per cwt, which results in a floor price of $159.59 per cwt (Table 1). As the coverage levels decline, the premium falls quickly, but the floor price also declines. The floor price is calculated as the product of the ending value, and the coverage level less the premium. For example, at the 95% coverage level, the floor price is: ($165.00 × 0.95) - $3.02 = $153.73 per cwt.

Changing parameters from the base case affects premiums. Consider the following parameter changes and their corresponding impacts on the premium at the 100% coverage level. Lowering the coverage period to 17 weeks would reduce the premium by $0.55 per cwt. Raising the ending value by $10 per cwt. increases the premium by $0.36 per cwt. Lowering the volatility to 17% would decrease the premium by $0.81 per cwt. In practice, producers can work with their insurance agent to choose an effective length and level of coverage.

TABLE 1. ESTIMATED LIVESTOCK RISK PROTECTION PREMIUMS FOR STEER CALVES

| Coverage Level (%) | Premium ($/cwt) | Floor Price ($/cwt) |

|---|

| 100 | 5.41 | 159.59 |

| 95 | 3.02 | 153.76 |

| 90 | 1.35 | 147.15 |

| 85 | 0.50 | 139.75 |

| 80 | 0.15 | 131.85 |

| 75 | 0.03 | 123.72 |

| 70 | 0.01 | 115.49 |

Notes: Assumes an ending value of $165, coverage for 21 weeks and implied volatility of 20%.

Premiums reflect the producer premium after the subsidy.

Source : sdstate.edu