By Kenny Burdine

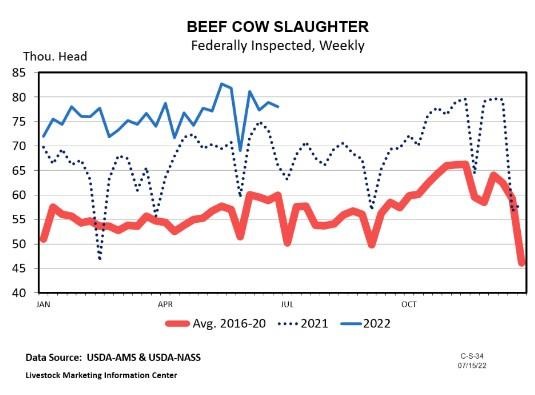

As has been the case all year, there is no shortage of factors to discuss when it comes to this cattle market. Drought has intensified in much of the Southern Plains and has also moved into large portions of the Southeast since early summer. This continues to result in very large beef cow slaughter levels, which have been running 14% above last year (see chart below). There is a little time lag on harvest data, but a lot of signs point to cow culling accelerating again in recent weeks as conditions have worsened.

Had it not been for the widespread drought, beef production would be running below 2021 levels. The cow herd and calf crop have been getting smaller for several years now. But, the onslaught of cows and heifers entering the supply chain is adding to beef production. At the same time, cattle on feed numbers have been higher because cattle have been placed on feed sooner than would normally be expected. For example, calves that were pulled off wheat pasture early this winter (or those that went straight to feed and never saw wheat pasture) are also entering the supply chain.

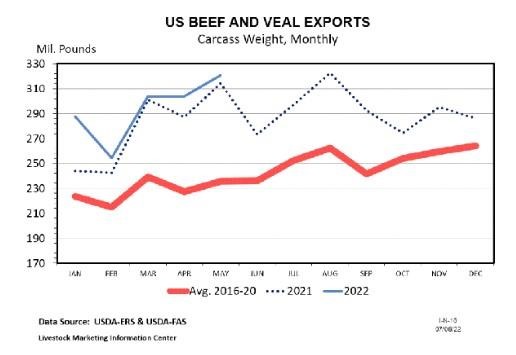

There has also been some “pull” from the demand side. Consumer demand has remained strong at the retail level. And, beef exports are running more than 5% above the high levels seen in 2021 (see chart below). There is simply no way that this supply picture is not going to get much tighter once we work through the effects of this drought. And the longer the drought persists, the tighter that supply picture will be on the other side.

Risk management tools such as futures and options and Livestock Risk Protection (LRP) Insurance provide producers the opportunity to capture price expectations revealed through futures markets. The markets understand the tight supply picture that is being set up and have responded accordingly. Fall CME© Feeder Cattle futures have moved back into the mid-$180, which is more than $10 per cwt higher than they were in late May. As I write this in mid-July, I would remind everyone that this creates pricing opportunities for summer stocker operations, and spring calving cow-calf operations, that will be marketing cattle this fall.

Producers that use Livestock Risk Protection (LRP) insurance, which is heavily subsidized and scalable to smaller quantities, need to remember that the minimum length of coverage is 13 weeks. So, the first available ending dates for LRP policies being purchased right now are in mid-October. For a lot of people, that means it is time to act if they want to manage price risk for this fall. There is no way to know where these markets are headed, but there are opportunities to take advantage of this recent price run up.

Source : osu.edu