The Act also contained nearly $31 billion in ad hoc disaster aid to farmers divided into two portions:

- $20.78 billion will aid farmers who have suffered natural disasters in 2023 and 2024, including droughts, wildfires, hurricanes, floods, searches, excessive heat, tornados, winter storms, freeze events, and excessive moisture. The U.S. Department of Agriculture has not announced the mechanisms by which this aid will be distributed. These funds could be similar to recent disaster assistance programs that have been delivered using crop insurance as the design foundation such as the Wildfire and Hurricane Indemnity (WHIP+) and Economic Relief (ERP) Programs (see farmdoc daily from June 6, 2022).

- $10 billion in economic assistance payments. The Farm Service Agency will distribute this aid, likely in the first part of 2025. More detail and payment estimates are provided below.

Economic Assistance Payments

The legislation contained considerable detail on how the $10 billion in economic assistance will be distributed, thus allowing estimates of payments to be calculated. The economic assistance payments are intended to partially offset estimated economic losses for eligible crops associated with the 2024 production year.

Economic losses are defined as the difference between expected production costs and expected gross returns for 2024. Expected production costs are taken from projections provided by the Economic Research Service of the USDA. Expected gross returns are defined as the product of the most recent price forecast for the 2024 marketing year available at the time of enactment of the bill (for most major field crops this would come from the December 2024 WASDE report) and a national average yield over the most recent 10-years (presumably the 2015 through 2024 crop years). For eligible commodities for which the cost, price, or yield information outlined above is not available, the Secretary of Agriculture and USDA have discretion in computing comparable estimates.

Per acre payment rates are defined as the greater of a) 26% of a commodity’s estimated economic loss or b) a minimum payment rate. Minimum payment rates are defined as 8% of the product of a commodity’s statutory reference price as outlined in the 2014 Farm Bill and it’s national average PLC payment yield.

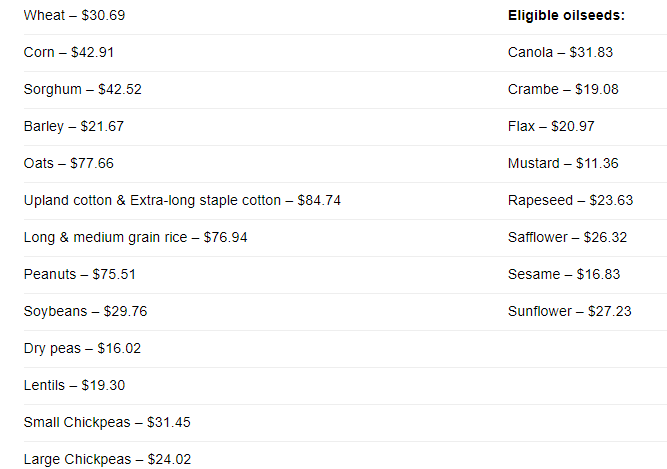

Estimates of the per acre payment rates for major field crops are provided below in Table 1. Estimated per acre payment rates range from $21.76 for barley to $87.26 for cotton. The minimum payment rate applies to barley, peanuts ($76.48), and rice ($69.61). The estimated payments for corn, soybeans and wheat are $42.51, $29.50, and $30.69 per acre, respectively.

Note that the estimates provided in table 1 are based on our interpretation of the legislative text. The USDA will be tasked with calculating and finalizing payment rates as part of the implementation process. Payment rate estimates from other sources (examples here and here) may vary from those above based on how (and when) the various components of the payment rate formulas outlined in the Act were calculated. For example, one area of potential discrepancy could be how the national average PLC payment yield, which is used to determine a commodity’s minimum payment, is computed. We calculated the national average payment yields using county-level averages weighted by total enrolled based acres provided in a data file for 2024 from the Farm Service Agency.

Payments will be made on payment acres which are defined as planted acres and 50% of prevent plant acres for 2024. For example, a farm with 1,100 payment acres, 600 of which are corn and 500 of which are soybeans, will receive $40,253 in economic assistance payments. $25,504 will come from corn ($42.51 per acre x 600 acres) and $14,749 from soybeans ($29.50 per acre x 500 acres).

Payment limits, independent of payment limits associated with other programs, will be applied per person or legal entity based on the amount of income coming from farming. If less than 75% of Adjusted Gross Income (AGI) for the 2020-2022 tax years comes from agriculture, the payment limit will be $125,000. If more than 75% of AGI comes from farming, the payment limit is $250,000.

The maximum number of payment acres of corn, soybeans, and wheat to reach the $125,000 limit using our per acre payment estimates above are:

- Corn — 2,941 aces ($125,000 / $42.51),

- Soybeans — 4,236 acres ($125,000 / $29.50), and

- Wheat — 4,073 acres ($125,000 / $30.69).

The payment limits for farms with more than 75% of income from farming will be $250,000, which would double the payment acres needed to reach the limit outlined above.

Impacts of Economic Assistance

The most recent Revenue and Costs for Illinois Grain Crops publication provides estimates of returns to corn, soybean, and wheat production across regions of Illinois. As an example, average net farmer returns on high-productivity land in central Illinois, after paying an average cash rent of $339 per acre, are negative for both corn and soybeans: -$161 per acre for corn and -$53 per acre for soybeans (see Schnitkey and Paulson, 2024). Adding the economic assistance payments for corn and soybean improves returns but they remain negative: -$118 per acre farmer return for corn and -$23 per acre return for soybeans. A farm with 50% of its acres in corn and 50% in soybeans would have a negative $71 per acre farmer return averaged across the two crops.

Economic assistance significantly reduces projected losses for 2024. Still, a negative $71 per acre farmer return is historically low. From 2000 to 2023, the average net farmer return for cash rented, high-productivity farmland in central Illinois is $103 per acre. Small average negative returns were realized in 2014 (-$3) and 2015 (-$10). Lower prices and high production costs led to a negative $93 per acre average farmer return to cash rented acres in 2023, with large negative returns being projected for 2024 and 2025 (see Figure 1).

In terms of impacts on farm financial accounting, recognizing an accounts receivable for the 2024 economic assistance payments is advisable when preparing the beginning-of-year 2025 balance sheets. The payments are associated with 2024 production; therefore, recognizing the economic assistance payment on 2024 accrual income statements and balance sheets is appropriate. The economic assistance programs will increase income, current assets, and net worth. By increasing current assets, the inclusion of the support payments will increase/improve farms’ working capital positions.

Commentary

Ad hoc Federal aid contained in the American Relief Act of 2025 will help farmers by partially offsetting losses and reducing the erosion of their financial positions resulting from lower commodity prices and continuing high costs. As such, many farmers and lenders will welcome it. The economic aid will make financial planning and loan renewal easier for the 2025 production year.

As always, Federal responses have unintended consequences. This economic aid will likely slow the cost adjustments that need to occur given current commodity price levels. For example, the economic assistance could make landowners less inclined to lower cash rents. Similarly, input suppliers may see reduced pressures to lower input prices.

Our projections for 2025 show continuing low returns (see Figure 1). If commodity prices do not increase in 2025, we are likely to see calls for further ad hoc disaster assistance at the end of the year.

Source : illinois.edu