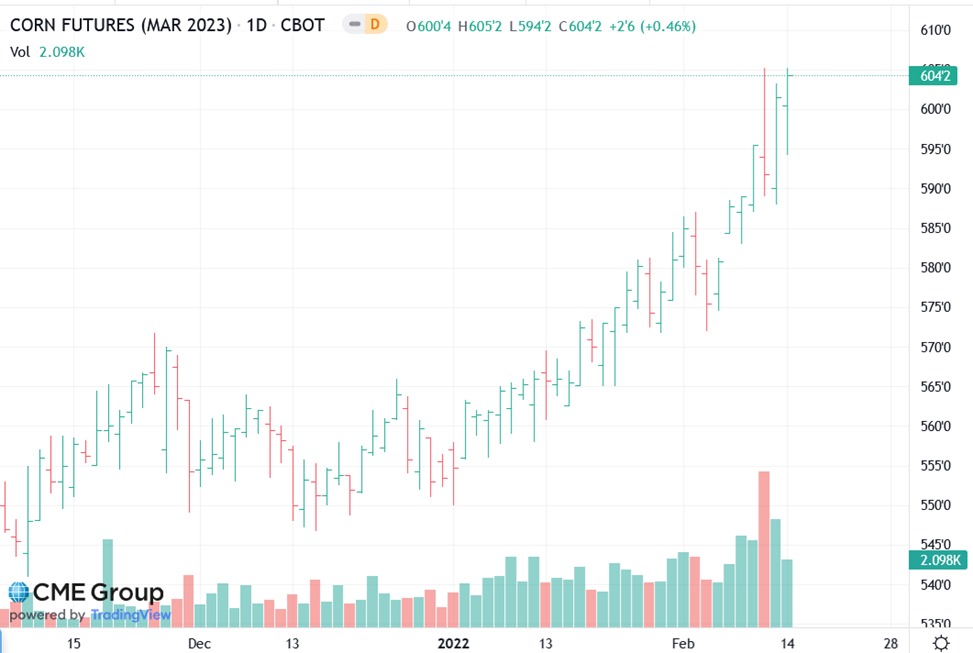

Corn Futures hit contract highs as March 2023 Futures pass the $6.00 mark recently. New crop corn (2022) delivered in January/February/March 2023 could be priced in the mid $6.00 range

Trying to guess the month with the highest price is not possible. Consider forward contracting a portion of your new crop over several months. Historically incremental sales during the first 7 months of the year (January through July) would tend to have a higher probability of high futures prices. Committing bushels to delivery could be complimented using crop insurance products, especially Revenue Protection (RP).

This chart from CME Group shows the November 2022 Soybean Futures in blue and the December 2022 Corn Futures in orange as a percentage change since February 2021. Corn is up over 36% and soybeans over 29% both near their contract highs.

Another marketing tool that could be a big benefit to producers is purchasing put options. Puts provide you the right to sell futures but not the obligation. Think of buying puts as insurance against lower prices, it gives you a price floor but allows you to take advantage of higher prices. I encourage you to have a discussion with a market advisor to determine the number of bushels, strike price (price floor), and cost appropriate for your operation.

Another very common strategy is harvesting the crop, storing it on-farm, and making incremental sales over the first half of the calendar year. Keep in mind this option does not provide any downside protection.

Farmers should have a new crop marketing plan written down and use discipline in order to implement this plan.

Remember, locking in a price for your crop is not any different than locking in your seed or fertilizer price six months before you even plant the crop. There is no marketing tool that will guarantee hitting the top of the market but having a goal of receiving a profitable average price year after year consistently should help you sleep better at night.

Source : psu.edu