By Jonathan Coppess and Scott Irwin

Department of Agricultural and Consumer Economics

University of Illinois

Since 2017, the Environmental Protection Agency (EPA) has been generously granting exemptions to small refineries from the renewable fuels mandates on the transportation fuel industry established by Congress under the Renewable Fuels Standard (RFS). This has raised a set of concerns with EPA’s implementation of the RFS and the impacts of that implementation on the biofuels industry (farmdoc daily, December 6, 2017; July 12, 2018; and September 19, 2019). A recent decision by the Tenth Circuit Court of Appeals delivered yet another loss to EPA in its interpretation, implementation and operation of the RFS; the issue this time regarding its granting of small refinery exemptions (SREs). This article continues analysis by reviewing this most recent court decision, as well as the implications for RIN prices.

Background

The U.S. Renewable Fuel Standard (RFS) was created under the Energy Policy Act of 2005, and was later modified and expanded under The Energy Independence and Security Act of 2007. The RFS included a provision to exempt small refineries—those processing less than 75,000 barrels of average aggregate daily crude oil throughput—from the RFS mandates for blending biofuels into the transportation fuel supply. Known as the Small Refinery Exemptions (SRE), the exemptions have gone through a series of changes. Initially, all small refineries were granted a blanket exemption through 2010, which was temporarily extended by EPA through 2012 and then beginning with 2013 few exemptions were granted. This policy was reversed in 2017, with the EPA granting a total of 85 SREs for the 2016-2018 compliance years representing 38.31 billion gallons of exempted gasoline and diesel volumes (Based on data as of August 22, 2019 at the EPA webpage for small refinery exemptions, farmdoc daily, September 19, 2019). As discussed below, the Tenth Circuit Court of Appeals noted this change in the granting of SREs and that 19 out of 20 were granted in 2016, 35 out of 37 in 2017 and 31 out of 42 in 2018 (Renewable Fuels Ass’n. v. EPA, 2020 U.S. App. LEXIS 2286 (10th Cir. 2020)).

Congress provided for SRE’s in the RFS statute; the statute provided, in relevant part, that a small refinery that would suffer “disproportionate economic hardship” if the small refinery has to comply with the RFS mandates can receive a two-year extension of the broad exemption that was through 2011 and later extended by Congress (42 U.S. §7545(o)(9)). In addition, the RFS statute provides for an extension of an exemption based on disproportionate economic hardship upon petition to EPA by a small refinery. The Tenth Circuit case reviewed EPA’s determination of SRE’s based upon the arguments of a coalition of biofuels interests, led by the Renewable Fuels Association, that EPA had exceeded its authorities under the statute.

Discussion

In general, there are two key points for discussion of this issue. The first is the legal issues for EPA in its use of the SRE provisions; an issue with specific implications for the SRE’s but also a larger issue with EPA’s continuing failure to properly implement the RFS as Congress intended. The second issue is the impact that EPA’s questionable operations of the RFS statute has had on the biofuels industry; the economics of the delays, the confusion over obligations and the court decisions on the biofuels industry, especially in light of Congressional intent to force the industry to make advances on this front.

(1) Legal Discussion: EPA, SRE and Statutory Construction.

On one level, the Tenth Circuit decision is fairly perfunctory; a routine and straightforward application of basic statutory interpretation precedent. It is probably most notable for that perspective. The Tenth Circuit decision adds yet another loss for EPA’s interpretations of this statute.

First, the Tenth Circuit easily concluded that the text of the statute included a clear intent by Congress that the exemptions would be based on valid reasons for the individual small refinery and that the goal was to “funnel[] small refineries toward compliance over time” (Renewable Fuels Ass’n. v. EPA, 2020 U.S. App. LEXIS 2286 (10th Cir. 2020), at *90-91). Any small refinery seeking an extension of an exemption must first have had an exemption in prior years; seemingly common sense, the court made it clear that EPA couldn’t grant an extension of an exemption that wasn’t already in place. The court understood the provisions to be clear and unambiguous which meant that EPA is required to execute the statute in accordance with the terms; unambiguous language limits EPA’s interpretative flexibility as well as the deference owed to the agency’s interpretation by the courts (e.g., farmdoc daily, August 29, 2019). In addition, the decision to extend a small refinery exemption was found to be an informal decision (or adjudication) and entitled to a lesser standard of deference by the court such as giving some weight to the interpretation based upon the validity of reasoning, consistency with earlier interpretations and the persuasive power of the interpretation (Id., at 86-87).

The court also emphasized that, in addition to having an exemption in place, a small refinery seeking an extension of that exemption “must demonstrate that it will suffer disproportionate economic hardship if required to comply” with the RFS mandates (Id., at *104). And that such a finding requires a direct link of a disproportionate hardship for the small refinery due to having to comply with the RFS mandate; this cannot be a hardship shared widely by refineries or one that is not a result of compliance with the RFS mandates (Id., at *108-109). The “renewable fuels compliance must be the cause of any disproportionate hardship” and that “hardships caused by overall economic conditions are different from hardships caused by compliance with statutory renewable fuel obligations” (Id., at *111-113). EPA was wrong to grant “extensions of exemptions based at least in part on hardships not caused by RFS compliance” because such reasoning “was outside the scope of the EPA’s statutory authority” to grant extensions (Id., at *113-114).

This latest decision is another command by the courts that supports the north star concept for the RFS that is supposed to guide EPA and has been discussed in previous farmdoc daily articles (August 18, 2017; October 5, 2017; March 7, 2018). Specifically, the Tenth Circuit highlighted that the “renewable fuel targets” in the RFS “were essential to promoting biofuel production, energy independence, and environmental protection” and they were “designed to be aggressive and ‘market forcing’” (RFA v. EPA, at *92-93 (quoting Americans for Clean Energy v. EPA, 864 F.3d 691, 710 (D.C. Cir. 2017)). The appellate court added that small refineries were “in a much different position” in 2016 or 2017 than they were back in 2006 because they “had many years to ponder operational issues and compliance costs” all of which factors into whether they should be granted extensions of exemptions, if an exemption were already in place (Id., at *94-95).

It is this that may be the bigger issue. Multiple court decisions have now been clear that EPA’s interpretation of the RFS is to be for the benefit of the biofuels industry; where there are uncertainties or interpretative efforts necessary, EPA is to err on the side of the biofuels industry not the crude oil refining industry. In short, the market-forcing aspect of the RFS is to be EPA’s north star, guiding its interpretations as it implements and administers the statute and its mandates. The courts leave little doubt or uncertainty about this interpretation of what Congress clearly intended. The bigger question here is why EPA continues to make interpretations that fail to follow this guidance. Why can EPA not find or follow the north star? As EPA’s losses in court pile up and the RFS speeds towards 2022, this question grows in importance, adding to concern for the policy.

There is a much bigger issue at work here and one that extends beyond the RFS and the scope of this article. In short, the Supreme Court has been wrestling with the issue of deferring to agency interpretations of statutes for nearly 40 years; grants of deference to executive branch interpretations if the statute is found to be ambiguous because ambiguity is considered a delegation to the agency to fill in gaps but only if the agency interpretation is reasonable (Chevron, U.S.A., Inc. v. NRDC, Inc., 467 U.S. 837 (1984)). This is keeping in line with the general concept of the separation of powers embedded in the Constitution pursuant to which Congress delegates to the Executive for interpretation in the implementation of laws and courts should generally respect both the delegation and the Agency interpretation. The Supreme Court, however, has become increasingly skeptical of deference, delegation and the reasonableness of agency interpretations (see e.g., FDA v. Brown & Williamson Tobacco Corp., 529 U.S. 120 (2000); Util. Air Regulatory Group v. EPA, 573 U.S. 302, 307 (2014); Michigan v. EPA, 135 S. Ct. 2699, 2708 (2015)). EPA’s consistent inability to interpret the RFS in a reasonable, legally-acceptable manner may well have implications that go beyond this particular policy.

(2) Economic Issues: Implications of Losing Court Battles on Economics of Biofuels.

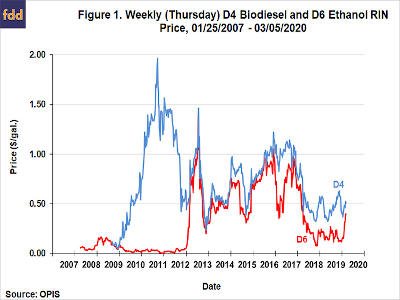

The Tenth Circuit ruling had an immediate impact on the price of RINs, the tradeable credits used by obligated parties to demonstrate compliance with the RFS. Figure 1 shows the weekly price of D4 biodiesel and D6 ethanol RINs available during the sample period running from January 25, 2007 through March 5, 2020. Following the Tenth Circuit ruling on January 24, 2020, the price of D4 RINs increased from $0.44 to $0.56 per gallon, an increase of 27 percent. The price of D6 RINs increased from $0.09 to $0.38 per gallon, an increase of 422 percent. Clearly something very dramatic happened in the RIN market after the court ruling.

.

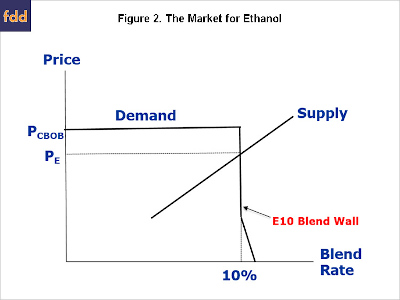

There is actually a straightforward explanation for the increases in RIN prices after the Tenth Circuit ruling. The starting point is a simple conceptual model of the U.S. domestic ethanol market that has been used in a number of previous farmdoc daily articles on RIN pricing and ethanol prices (e.g., February 15, 2018; February 8, 2019) The model in Figure 2 represents the supply of ethanol producers and demand from gasoline blenders at the wholesale level on an annual basis. Quantity is expressed here as a percent of gasoline use in order to focus on the blend rate. The first segment of the demand curve is assumed to be flat (perfectly elastic) up to the blend wall for ethanol prices equal to CBOB gasoline prices. While previous research (farmdoc daily, April 4, 2019) shows that the octane benefit of ethanol in gasoline blends more than offsets the energy penalty for ethanol, we use a conservative assumption that the breakeven price of ethanol is equal to the CBOB price. The second segment of the demand curve is vertical, reflecting the E10 blend wall, which is the physical limit of 10 percent ethanol blends in the gasoline supply. The third segment has a small amount of price sensitivity to reflect the demand for higher ethanol blends, namely E15 and E85. This segment adds at most a few hundred million gallons to ethanol consumption because infrastructure constraints are assumed to restrict the ability to expand consumption of these higher ethanol blends. Note also that imports and exports of ethanol are ignored in the model for simplicity. This does not affect the main conclusions drawn from the model.

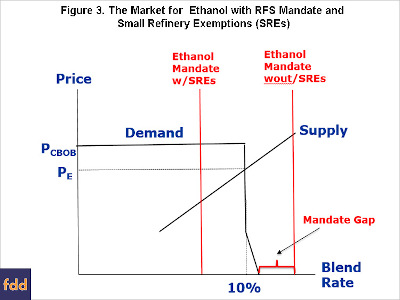

Figure 3 adds an ethanol mandate to the market model in Figure 2. Two mandate scenarios are presented. In the first scenario, small refinery exemptions (SREs) are assumed to waive enough gallons to move the ethanol mandate below the E10 blend wall. When this happens, the mandate is “non-binding” and the equilibrium price and quantity of ethanol are determined by market supply and demand. The non-binding mandate implies an equilibrium price of zero for D6 ethanol RINs. In the second scenario, no SREs are in place and the ethanol mandate is fully enforced and binding. A crucial assumption in this scenario is that the binding ethanol mandate lies to the right of the E10 blend wall and the maximum demand for E85. The implication is that physical blending of ethanol cannot be used to fully comply with the ethanol mandate and a gap opens up between the mandate and the amount of ethanol that can be consumed. The ethanol mandate under the RFS, however, is not infeasible. Rather, the nesting feature of the RFS means that higher-ranked RINs can be used to fill the gap. For example, D4 biodiesel RINs can be used to fill the gap, and by doing so become the “marginal” gallon for filling the ethanol mandate. When D4 biodiesel RINs serve as the marginal gallon for compliance the price of D4 and D6 RINs are the same.