- Farmland returns, often represented as cash rents per acre. Expectations of higher returns increase farmland prices. Typically, farmland price increase during periods of rising cash rents.

- Interest rates. Increasing interest rates generally put downward prices on farmland and vice versa.

2023 Illinois Cash Rents and Farmland Prices

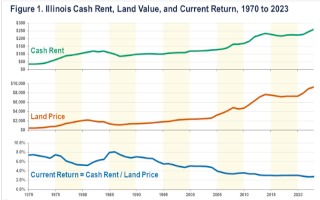

USDA recently released cash rents and farmland prices for major states in the US. The average Illinois cash rent for 2023 was $259 per acre, up 6.6% from the 2022 cash rent of $243 per acre (see Figure 1). After being roughly stable from 2016 through 2020, average cash rents have increased yearly since 2020: $222 per acre in 2020, $227 in 2021, $243 in 2022, and $259 in 2023. Cash rents increased by 16% from 2020 to 2023, primarily driven by strong returns to farmland (see farmdoc daily, May 23, 2023).

Illinois farmland prices were at $9,300 per acre in 2023, up by 4.5% from $8,900 per acre in 2022 (see farmdoc daily, August 7, 2023). Like cash rents, farmland prices have increased since 2020: $7,300 per acre in 2020, $7,900 in 2021, $8,900 in 2022, and $9,300 in 2023 (see Figure 1). Since 2020, farmland prices have increased by 27%, with strong returns contributing to farmland price growth.

The current return to farmland often is presented as the cash rent divided by land value. This return is similar to the interest payment on a debt instrument. Not included in the current return are gains on the value of farmland, which have been an important part of the total return to farmland over time. The current return and interest rates are correlated over time.

Interest Rates and Current Returns to Farmland

The Federal Reserve Bank (FED) has implemented practices that increase interest rates to counter inflation. As a result, most interest rates have risen, including the Ten-year Constant Maturity Treasury (CMT) rate (see farmdoc daily, March 28, 2023). The Ten-year CMT rate averaged .89% during 2020, the year of COVID and many extreme fiscal and monetary policies. Since 2020, the 10-year CMT increased to 1.45% in 2021 and 2.95% in 2022. So far, in 2023, the rate has averaged 3.67% (see Figure 2).

During the late 1970s and early 1980s, the Ten-year CMT rate exceeded the current return (see Figure 2). Ten-year CMT rates reached highs in the early-1980s as the FED increased interest rates to reduce inflation. Farmland prices declined during the mid-1980s, bringing the current return and 10-year CMT rate in close alignment. Since the mid-1980s, the ten-year CMT and current return track each other closely.

Interest rates were on a general downward trend from the mid-1980s to 2020. Those declining interest rates put upward pressure on farmland prices. Arguably, falling interest rates were as important as increasing rents in the upward trajectory of farmland prices since the mid-1980s.

Outlook

The current 2023 average of CMT rates is 3.67% above the 2023 current return of 2.78% ($259 cash rent / $9,300 land price). Still, the difference between the Ten-year CMT and the current return is not large. That difference is comparable to the difference between 1994 to 2000 and 2005 to 2008. As a result, the current return and interest rates do not suggest significant farmland price declines.

Downward pressures likely will be placed on farmland prices in the future for two reasons.

- Farmland returns likely will be lower than in 2021 and 2022, putting downward pressures on cash rents.

- Interest rates seem likely to remain in the 3 to 3.5% range. While the FED could reduce interest rates in the future as inflation eases, very low-interest rates should not be expected.

If the cash rent remains at $259 per acre, a farmland price of $8,633 per acre will result in a 3% current return, a likely range for the ten-year CMT over the next several years. An $8,633 price is below the current level of $9,300, suggesting that current fundamentals would put downward pressure on prices. That downward pressure may not result in lower farmland prices for a year or two.

Summary

Both cash rents and farmland prices have increased over the years. Farming returns likely will decline from 2021 and 2022 levels. Interest rates likely will remain at higher levels than in recent years. Both declining returns and stable interest rates suggest downward pressures on farmland prices. While downward pressures may occur, those price declines may be in the future.

Source : illinois.edu