At its base, milk pricing in the U.S. is complicated (How Milk Is Priced in Federal Milk Marketing Orders: A Primer). And the variations in milk checks from farm-to-farm (even neighbors), month-to-month, and cooperative-to-cooperative, and from cooperative to proprietary handler take the pricing complexities to another level. Prices paid to dairy farmers depend upon where the farm is located, where the milk was delivered and pooled, the fat and protein content in the milk and the cooperative- and handler-specific premiums and assessments. Put simply, every dairy farmer in the U.S. likely receives a different price per hundredweight for their milk.

Developing and implementing a farm safety net program outside of crop insurance, i.e., Margin Protection Program and now Dairy Margin Coverage, was complicated by the fact that not only did every dairy farmer have a different price for their milk, but every dairy farmer also likely had different costs of production. Thus, a nationwide approach was taken to deliver targeted income support during times of low milk prices, high livestock feed costs or a combination of the two.

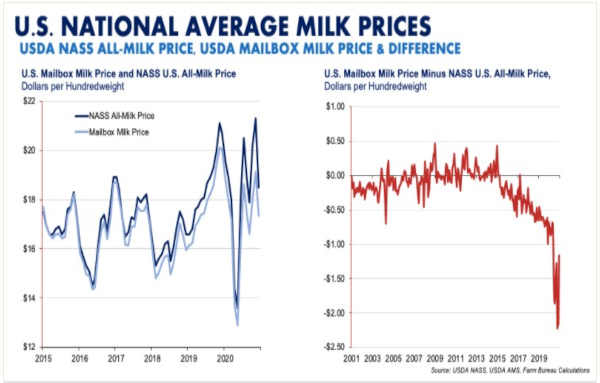

To implement DMC, USDA uses the National Agricultural Statistics Service’s monthly U.S. average all-milk price, i.e., the gross milk price farmers received. The challenge here is USDA publishes another national average milk price called the mailbox milk price, i.e., the net milk price on the check that arrives in the mailbox. The net mailbox milk price includes hauling fees, other authorized deductions and price re-blending due to balancing costs or loads of milk sold at distressed prices, among other items. Historically, these two national average milk prices followed one another very closely.

In recent years, however, these two price series have diverged, and in 2020, a year roiled by COVID-19 demand disruptions, negative producer price differentials and mass depooling (More Negative PPDs and De-Pooling Reignite Federal Milk Marketing Order Debate), the spread between the two milk prices was record-large. For example, in October and November, the USDA all-milk price was more than $2 per hundredweight higher than the national average mailbox milk price. One explanation is the higher-valued milk was not in the pool, and thus was not included in the mailbox milk price calculation.

However, for years now, even before 2020, the U.S. all-milk price has been disconnected from what was happening on the farm, and as a result, the farm safety net is becoming more disconnected from milk prices that farmers are actually receiving (Lack of DMC Payments Does Not Reflect Dairy Farmers’ Difficulties).

Mailbox Milk Price in Dairy Margin Coverage

What if the farm safety net used the mailbox milk price instead of NASS’ all-milk price? To answer this question, DMC milk margins above feed costs, monthly program payments, and total DMC program payments were estimated for 2020 using Farm Service Agency enrollment and price data alongside USDA mailbox milk price data.

During 2020, the DMC margin averaged $9.65 per hundredweight and ranged from a low of $5.37 per hundredweight in May to a high of $12.41 per hundredweight two months later in July. For a farm covering 5 million pounds of milk in DMC, program payments totaled more than $36,000, or 73 cents per hundredweight.

Substituting the mailbox milk price in the DMC margin calculation, the DMC margin would have averaged $8.34 per hundredweight and ranged from a low of $4.67 per hundredweight to a high of $10.55 per hundredweight. More importantly, DMC triggered in five months during 2020. Had DMC used the mailbox milk price, DMC would have triggered in nine months during 2020 and would have delivered nearly $29,000 in additional support to a farm covering 5 million pounds of milk. Total DMC payments for an operation covering 5 million pounds of milk would have been more than $65,000 at $1.31 per hundredweight and 80% higher than the current program design.