Two “good seasons” of crops in the Americas are needed to get back to a comfortable situation on supplies, Chief Executive Officer Juan Luciano said on a conference call Tuesday.

“Looking forward, we expect reduced crop supplies — caused by the weak Canadian canola crop, the short South American crops, and now the disruptions in the Black Sea region — to drive continued tightness in global grain markets for the next few years,” Luciano said in a statement.

The Chicago-based company reported adjusted earnings of $1.90 per share for the first quarter of 2022, compared with $1.39 a year ago. That beat the average estimate of analysts compiled by Bloomberg calling for $1.41. Revenue of $23.7 billion was almost 14% higher than the consensus of $20.8 billion.

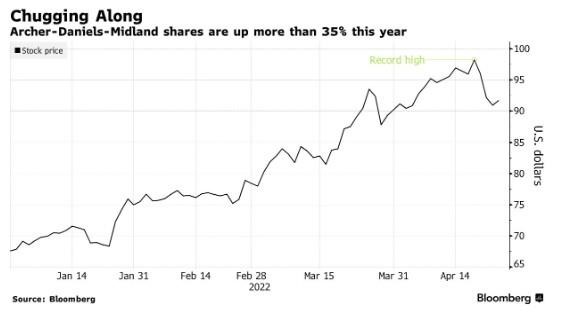

Crop traders like ADM are taking advantage of strong margins, Stephens Inc.analyst Ben Bienvenu said in a note after earnings were released. “We expect ADM to continue chugging along in this constructive fundamental backdrop,” said Bienvenu.

Click here to see more...