Compared to the July projections, while the revised crop estimate was a shock, US 2017 crop year Ending Stocks are only ½ million bales higher than the July projection. This is because also in this month’s report:

- Exports for the just completed 2016 crop year were adjusted up 420K bales—reducing carry-in stocks to the 2017 crop year.

- Projected exports for the 2017 crop year were increased 700K bales—likely reflecting higher available export supply.

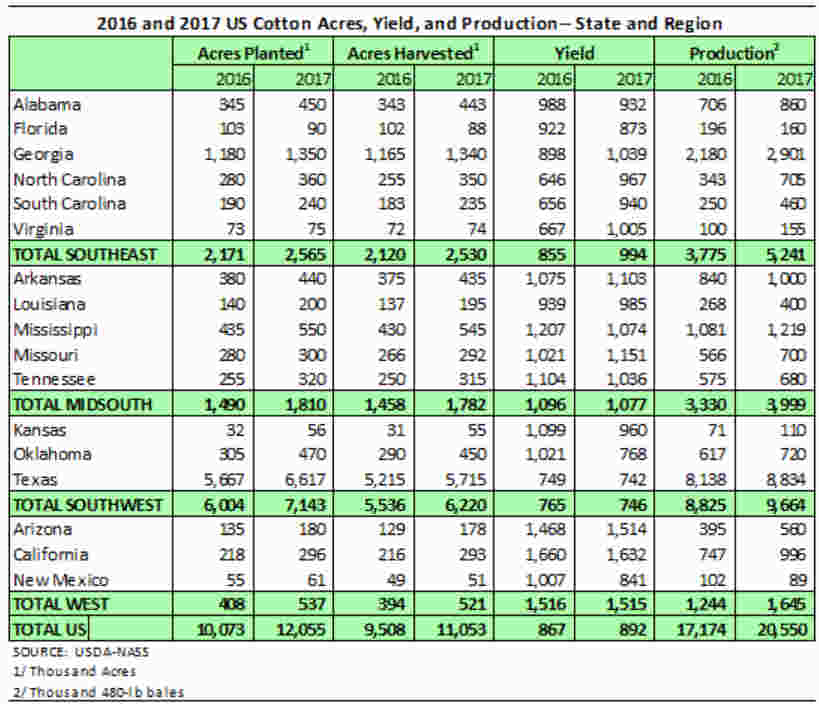

The crop is now estimated at 20.55 million bales on an average yield of 892 lbs per acre. If realized, this would equal the record US average yield achieved in 2012. Eight states are currently projected to have an average yield above last year. Twelve states are expected to have a yield above their 5-year average (Cotton’s Week, National Cotton Council, August 11, 2017).

The August numbers are the first based on farmer survey for 2017. Data collection (farmer responses) occurred from July 29 to August 3. Also (for cotton only), actual plant counts and measurements were taken July 25 to August 1.

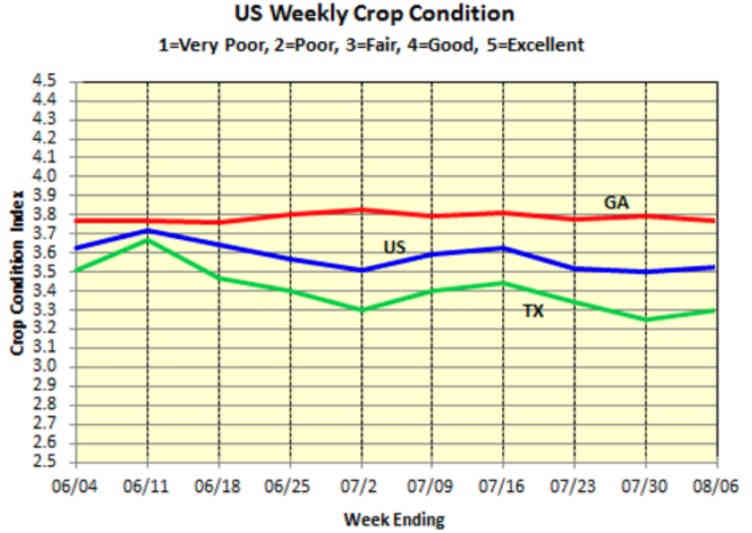

Crop conditions in Texas have declined over the growing season. Texas yield is projected at 742 lbs per acre compared to 749 last year—so essentially the same. As of August 6 (after the yield survey data collection and plant measurements), the Texas crop condition was 3.30 compared to 3.19 last year at the same time. The entire US crop is rated at 3.53 compared to 3.37 last year. The Georgia crop (the second largest state is expected to yield 1,039 lbs per acre compared to 898 last year and 5-year average of 936. If realized this would be 52 lbs below the record in 2012.

There is opinion that the USDA August estimate of 20.55 million bales will be reduced in future reports. I’m not going to second-guess USDA. The number is what it is and regardless of what one thinks about the number, the market will deal with it until something else comes along.

Elsewhere in yesterday’s report, on the foreign and World scene:

- The China crop projection was increased ½ million bales and mill use increased by ½ million bales. Stocks were unchanged.

- World use/demand for the 2017 crop year was increased a net 370K bales—due largely to the increase in China.

- China imports remain and 5 million bales. Imports were revised up for Mexico, Turkey, Indonesia, Bangladesh, and Vietnam—all major markets for US exports.

- The projected India and Australia crops were unchanged from the July estimates.

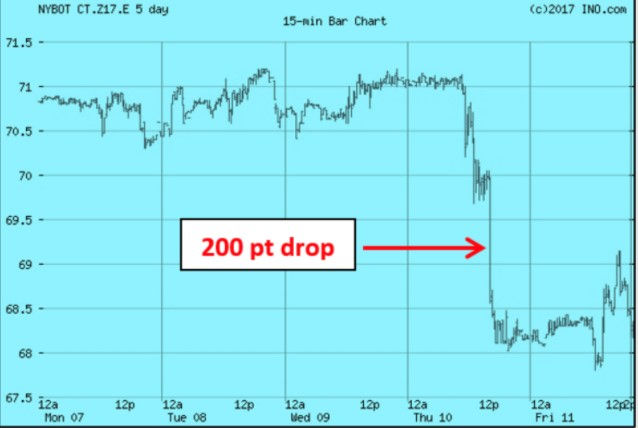

After the report-induced decline, prices (Dec futures) now hover at the 68 cent level—washing out most of the gain since mid-July. Prices could improve if crop conditions and yield outlook worsens—but like I said earlier, the market now has a 1½ million bale cushion it didn’t have before.

Some observers are convinced the US crop will only get smaller. All we really know is that the market has to digest and make what it will of the 20.55 number for now. If the September numbers continue to validate a 20+ million bale crop, then prices could decline further. If the crop does get smaller, the 68 to 70 cent level or better should hold.

Source: ufl.edu