Crop machinery costs are computed by summing depreciation, interest, property taxes, insurance, leasing, repairs, fuel and lubricants, and custom hire and rental expense; and dividing the resulting figure by crop acres. Machinery ownership costs are represented by machinery and building depreciation, and interest expense on machinery and buildings. Only the building charges associated with storing machinery are included in machinery ownership costs. On average, machinery ownership costs are approximately 41 percent of total crop machinery costs. This percentage varies considerably among farms, and it is not uncommon for this percentage to be 50 to 60 percent to total crop machinery costs.

Annual Capital Investment Charge

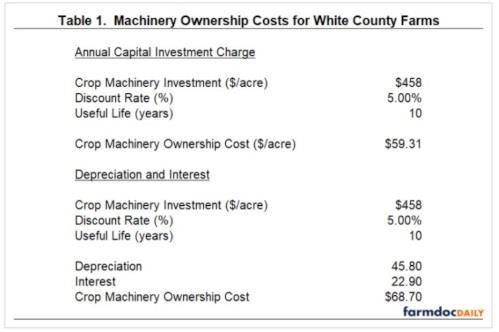

Annual capital investment charges use net present value concepts along with information pertaining to purchase prices, salvage values, average useful life for machinery and buildings, and a discount rate to compute machinery ownership cost per acre. Table 1 illustrates a computation of the annual capital investment charge for a case farm located in west central Indiana. The case farm had a capital investment per acre of $458, an average useful life for machinery and buildings of 10 years, and a 5% discount rate. For the case farm, crop machinery ownership cost computed using net present value concepts is $59.31 per acre. More information pertaining to this computation is available in the Purdue Crop Cost and Return spreadsheet, which can be downloaded on the Center for Commercial Agriculture web site.

Fixed Costs of Machinery Ownership

As noted above, machinery ownership costs include machinery and building depreciation, and interest expense on machinery and buildings. Machinery ownership costs are often computed using machinery investment, average useful life, discount rate, and depreciation and interest expense. Depreciation is computed by dividing crop machinery investment by the average useful life of machinery and buildings. Interest is computed by multiplying crop machinery investment by the discount rate. Information for the case farm is illustrated in Table 1. For the case farm, using the depreciation and interest method, crop machinery ownership cost is equal to $68.70 per acre ($45.80 per acre from deprecation and $22.90 per acre from interest expense). The advantage of using this method to compute machinery ownership costs is its simplicity. The disadvantage of using this approach is that it not does not account for the time value of money.

Sensitivity of Machinery Ownership Costs

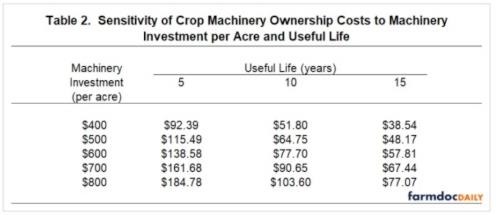

The example illustrated in Table 1 uses a capital investment per acre of $458, an average useful life for machinery and buildings of 10 years, and a 5% discount rate. Machinery ownership costs are sensitive to changes in machinery investment per acre, average useful life, and discount rate. Table 2 illustrates machinery ownership cost per acre for machinery investment ranging from $400 to $800 per acre, and an average useful life of 5, 10, and 15 years. The capital investment charge method was used to create Table 2. Obviously, machinery ownership costs are extremely sensitive to changes in machinery investment per acre and an average useful life. A farm with $400 in machinery investment per acre and average useful life of 15 years would have a machinery cost of $38.54 per acre. On the other extreme, a farm with $800 in machinery investment per acre and average useful life of 5 years would have a machinery ownership cost of $184.78. As noted in a recent article (Langemeier, 2021), the average crop machinery cost per acre for corn and soybeans in 2020 was $115 per acre. A farm with $800 in machinery investment and average useful life for their machinery and buildings of 10 years would have machinery ownership cost of $103.60, and would obviously have a machinery cost per acre that is substantially above the $115 per acre average.

Machinery ownership costs are also sensitive to changes in the discount rate. A 5% discount rate was used for computations in Tables 1 and 2. If the discount rate for the case farm was 4%, machinery ownership cost using net present value concepts would drop to $56.47. Machinery ownership cost would be $62.23 with a discount rate of 6%.

Concluding Comments

This article discussed a couple of different methods that can be used to compute machinery ownership costs. Estimates derived from the two methods were similar, but not exactly the same. Using a range of possible machinery investment per acre values and a useful life for machinery and buildings of 10 years, the machinery ownership charge ranged from $51.80 per acre for a machinery investment per acre of $400 and to $103.60 per acre for a machinery investment per acre of $800. The large range in machinery ownership costs emphasizes the importance of benchmarking crop machinery ownership costs as well as crop machinery cost and investment per acre with similar farms.

Source : illinois.edu