Canada: Pulse and Special Crops Outlook

Canadian producers decreased the area seeded to all P&SC for 2011-12, compared to last year. Seeding progress was generally later than normal and as a result crop development is behind normal. Significant areas in Manitoba and Saskatchewan were not seeded because of excessive moisture. The soil moisture problems and seeding delays are expected to result in higher than normal abandonment. Normal precipitation, crop quality, and trend yields have been assumed for both western and eastern Canada.

Total production of P&SC is forecast to decrease by 28% to 4.0 million tonnes (Mt). Total supply is forecast to fall by 26% to 5.0 Mt, as the decrease in carry-in stocks combines with the fall in production. Domestic use is expected to fall below 1.0 Mt. Exports are expected to fall by 28% to 3.5 Mt due to the lower exportable domestic supply and world demand. Total carry-out stocks are expected to tighten by 25% to 0.6 Mt, the lowest since 2007-08. This is expected to provide positive support for prices. Prices, averaged over all types, grades and markets are forecast to rise for most crops, with the exception of chickpeas. Prices are expected to be pressured by the strong Canadian dollar which is forecast to be above par relative to the US dollar.

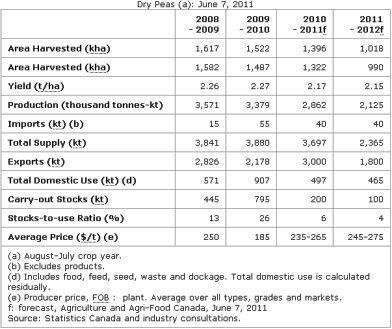

Dry Peas

For 2011-12, seeded area is estimated to fall by 27% from 2010-11. The proportion of area seeded to yellow pea types relative to green types in 2011-12 is expected to be same as 2010-11. Harvested area is forecast to fall 25% compared to 2010-11. Production is forecast to fall by 26% due lower expected yields and high abandonment. Supply is forecast to fall sharply due to lower production and significantly lower carry-in stocks. Exports will be limited in 2011-12 by the lower exportable supply to 1.8 Mt. Carry-out stocks are expected to fall to 0.1 Mt, the lowest since 1993-94. The average price is expected to increase from 2010-11 due to the smaller Canadian supply and tighter carry-out stocks. For 2010-11, Canada’s dry pea exports are expected to reach a record 3.0 Mt. The increase was largely due to record imports by India, which is expected to take over 50% of Canada’s pea exports, mostly the yellow types. Canada increased its export market share in China, the EU-27 and Pakistan for 2010-11.

Dry Peas (a): June 7, 2011

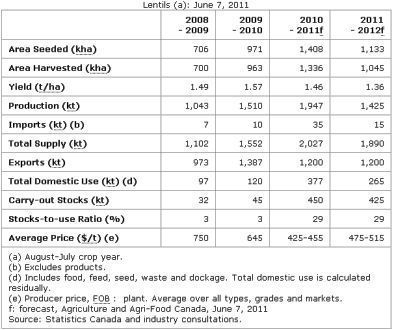

Lentils

For 2011-12, seeded area is estimated to decrease by 20% from 2010-11. The majority of the fall in area is expected to be area that had been intended to be used for red lentil types. Harvested area is forecast to fall by 22% due to high abandonment rates. Production is expected to fall sharply to 1.6 Mt. However, supply is forecast to decrease only marginally as lower production is partly offset by the record carry-in stocks of lower quality lentils. Exports are forecast to remain unchanged from 2010-11 due to a more favourable grade distribution. Carry-out stocks are expected to fall but remain historically high due to the larger supply and lower expected domestic use. The average price is forecast to rise from 2010-11 as lower expected prices are offset by a more normal grade distribution. Canada’s lentil exports are on pace to reach 1.2 Mt for 2010-11, down from 1.4 Mt in 2009-10, although supply increased significantly. This was due to an unfavourable grade distribution, heavily weighted by low grade red lentils. Turkey, India and the EU-27 remain the largest markets for Canadian lentils, with smaller volumes going to various countries in the Middle East and South America.

Lentils (a): June 7, 2011

To view full report, please click here.

Source: Agriculture and Agri-Food Canada