So far, 2022 feedlot placements are averaging 0.4% above 2021. However, when you remove February (February 2021 winter storm), 2022 feedlot placements are averaging -1.5% below 2021. In June, placements were 2.5% lower year over year. July 1 cattle on feed totaled 11.3 million head or 0.4% above July 1, 2021. Drought-induced placements in July could hold August 1 cattle on feed numbers close to or slightly above August 2021 feedlot inventories.

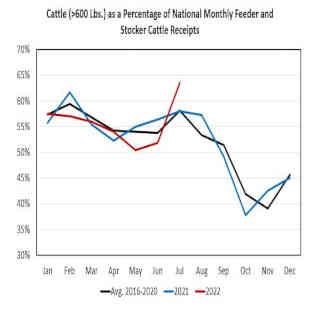

Seasonally, we tend to see larger placements of heavy feeder cattle (greater than 700 lbs.) in August and September. July is a seasonal low in feedlot placements. National feeder and stocker cattle auction receipts totaled 529,700, 1.2% lower than July 2021. While total auction receipts are lower for July, the break-out by weight group suggests that we are seeing cattle come off summer pasture earlier than normal. Last month 63% of feeder cattle auction receipts were for cattle weighing over 600 lbs. Cattle weighing over 600 lbs. accounted for 58% of auction receipts in July 2021. Auction receipt totals and these percentages imply that we sold 25,421 more head of heavy feeder cattle last month than in July 2021.

The longer we delay the decline in feedlot inventories, the more significant it will become. As Josh discussed a few weeks ago, the spread between CME Feeder Cattle futures contracts suggests that traders expect tighter supplies and higher prices. As of this writing, there is a $4.15/cwt spread between the Nov 2022 and Sep 2022 Feeder Cattle futures contracts. The Apr 2023 contract is trading $7.72/cwt above the Sep 2022 contract.

Source : osu.edu