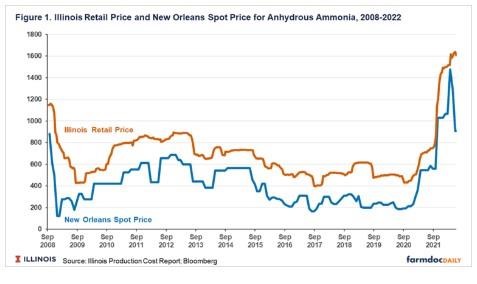

Figure 1 shows the Illinois retail price for anhydrous ammonia and the New Orleans spot price for ammonia from 2008 to 2022. The Illinois retail price for nitrogen fertilizer comes from the Illinois Production Cost Report, a USDA Ag Marketing Service survey for Illinois. The first year of the survey is 2008. The New Orleans spot price is the anhydrous ammonia price at New Orleans from Bloomberg and is often viewed as the price charged by fertilizer manufacturers. The lower Mississippi Delta is the location of several fertilizer manufacturers. The difference between the Illinois retail price and the New Orleans spot price is a marketing margin, covering the costs of transportation, storage, and marketing of anhydrous ammonia. The marketing margin also would include any profit the fertilizer retailers receive from anhydrous ammonia sales.

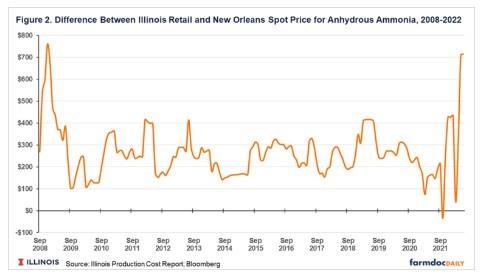

Over time, the margin has averaged $266 per ton. Typically, the margin varies between $200 and $350 per ton. Sometimes the difference in prices is much more significant. For example, the difference reached $760 per ton in December 2008. This difference occurred when the New Orleans price fell, and the Illinois retail price did not fall as quickly. Margins have been much more variable from the second half of 2021 through the first half of 2022, as anhydrous ammonia prices have been very erratic. Given history as a guide, the recent decline in New Orleans spot prices to $907 per ton in June will be associated with a reduction in retail prices if the decrease in the New Orleans price persists.

The two price series are highly correlated, with a correlation of 0.88. Over time, there is little evidence of persistent margin price changes. Adding in a trendline shows the difference between the prices is basically flat for the time period, and even has a slightly negative slope (see Figure 2). Agricultural transporters and retailers have costs to cover from the margin, such as storage costs, labor costs, hauling costs, equipment costs, and risks associated with storing fertilizer. A return for retailers also must be included in the margin. Over time, the total costs and returns have not changed.

Potential Reasons for Stable Price Difference

Looking at the data leads us to consider the reasons why agricultural retailers in Illinois are not increasing the difference between the spot and retail price over time. One reason could be competition in the Illinois agricultural retailer market. In 2021, Illinois had 369 registered custom fertilizer mixers (Illinois Department of Agriculture, 2021). While some may be locations of a larger parent company, and likely not all retailer locations are on this list, there are still quite a few firms selling fertilizer in Illinois. Many farmers in Illinois have more than one firm they can choose from within a nearby geographic radius. Another factor to consider is when and how much the retailers buy fertilizer. The retailers are taking on price risk when purchasing fertilizer. They likely purchase the fertilizer when prices are lower, store it, and then sell it during stronger demand periods, like fall and spring, when prices are generally higher. Another point to consider is that this is not the actual profit margin of the companies, so other costs such as transportation, storage, labor, and marketing would have to be subtracted from this margin. Agricultural retailer margins could have increased over time with the increases hidden by declines in these other factors contributing to the margin.

Conclusion

Often during periods of high nitrogen fertilizer prices, companies face increased scrutiny from the public related to prices. We find this is not the case for Illinois agricultural retailers, as the gap between the spot price and the retail price remains stable from 2008 to 2022. Nitrogen fertilizer is a commodity, and price risks are associated with buying and selling this commodity for all parties involved.

Source : illinois.edu