By Rob Ziegler

The October USDA Cattle on Feed Report estimated heifers make up nearly 40% of all cattle on feed inventories; a signal of producer’s intentions (or lack thereof) to retain heifers as replacements. Consensus is that the heifer mix needs to be somewhere in the 36-37% range to signal signs of herd rebuild, a level we haven’t seen since 2018. That said, the bred female market has received less attention recently, but moving forward will likely be a primary focus for when cattle producers consider increasing their cow herds.

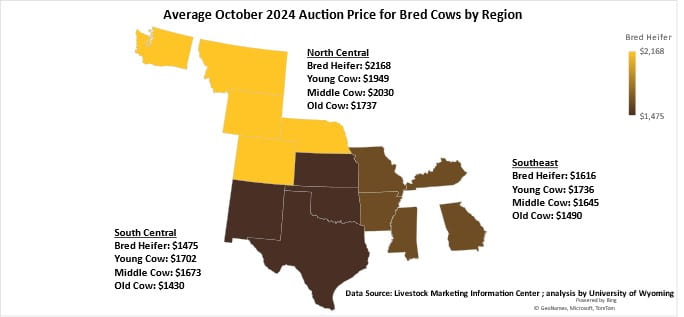

The University of Wyoming compiled replacement female prices available through the Livestock Marketing Information Center and aggregated them into the following categories: bred heifers, cows 2-4 years (Young), 5-8 years (Middle), and cows >8 years (Old). The entire data set includes prices from 2013 to current. Here we focus on prices in October of 2023 and 2024. A simple average was calculated as reference for bred female price in their respective age category regardless of pregnancy trimester. Prices from October 2023 and 2024 were then evaluated for change in price and volume. Furthermore, data from the available 14 states were grouped by region; North Central (CO, MT, NE, WA, WY), South Central (KS, NM, OK, TX), and Southeast (AR, GA, KY, MO, MS).