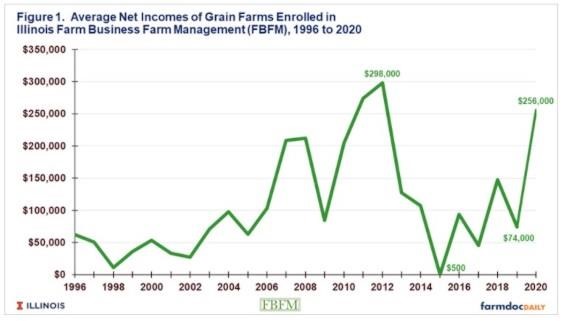

Incomes in this figure will serve as benchmarks for 2021 and 2022 projections. From 2013 to 2019, net farm income averaged $85,000 per farm. During this period, a slight deterioration occurred in average working capital and debt-to-asset positions. For farms of the average size of about 1,400 acres, net farm incomes above $85,000 are needed to see financial improvement for a farm. Conversely, incomes well below $85,000 will result in a deterioration of financial positions.

Income Projections

Income projections are made with a 1,400 acre grain farm located in central Illinois. This farm has 20% of its acres owned, 40% share rented, and 40% cash rented, a tenure position close to the average for central Illinois. The high-productivity budgets for Central Illinois shown in a November 2, 2021, farmdoc Daily article are used to quantify costs. A summary of yields and costs are:

- Yields are 220 bushels per acre for corn and 68 bushels per acre for soybean, and

- Non-land costs equal $708 per acre for corn and $451 per acre for soybeans. These are record levels of costs. The $708 per acre of corn costs are $101 higher than 2021 costs, with 70% of the cost increase coming from fertilizer. The $451 per acre of soybean costs is $57 higher than 2021 costs, with 70% of the cost increase coming from fertilizer.

Projections are made with a 50% corn and 50% soybean rotation, close to the historical average for central Illinois. Cash rent is at $310 per acre.

This farm is a single farm, while historical averages shown above include many farms. Over time, projections of the central Illinois farm of near average size have tracked FBFM averages closely.

In addition to 2022 income, the 2021 income also is projected as the year has not been completed. The same 1,400 acre farm is used in making projections, but estimates of 2021 prices, yields, and costs are used.

Scenarios for 2022

Income projections are made for differing 1) fertilizer and 2) price scenarios.

One fertilizer scenario uses current 2022 fertilizer cost projections of $233 per corn and $102 per acre for soybeans (see farmdoc Daily, November 2, 2022). The other scenario uses 2021 fertilizer costs of $153 per acre for corn and $45 per acre for soybeans. The net income difference in 2022 and 2021 costs quantifies the impacts of higher fertilizer costs on net income.

Net income is evaluated at three price scenarios. The first is current fall delivery bids of $5.00 per bushel for corn and $12.00 for soybeans. These prices represent current market estimates for grain produced in 2022.

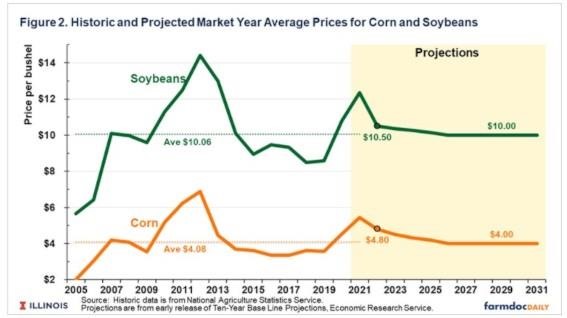

The Economic Research Service (ERS) — an agency of the U.S. Department of Agriculture — recently released the initial USDA Long-run Projections to 2031.These projections include price forecasts for each year from 2022 to 2031, which will be reviewed and perhaps revised before presenting at the 2022 Agricultural Outlook Forum held in February 2022. The 2022 estimates of prices are $4.80 per bushel for corn and $10.50 for soybeans. USDA’s 2022 projected corn price is $.20 below the current fall bids of $5.00 per bushel. USDA’s 2022 projected soybean price is $1.50 per bushel below the fall bid of $12.00 per bushel. Relative to current fall bids, USDA’s projection suggests a sharp fall in soybean prices. The lower corn and soybean prices both contribute to lower projected 2022 net income relative to the baseline scenario using current fall bids.

In the next ten years, USDA is projecting corn prices to reach $4.00 per bushel for corn and $10.00 per bushel for soybeans (see Figure 2). These prices are very close to the average prices from 2005 to 2020 of $4.08 for corn and $10.06 for soybeans (see Figure 2). Essentially, USDA is projecting that the long-run average prices have not changed, and commodity prices will eventually fall and reach these long-run averages.

2021 Net Income Projection

Net incomes for 2021 will be well above average, likely exceeding $300,000 per farm, setting a record income level. Above-average commodity prices, along with above-trend yields, lead to relatively high net incomes. Moreover, costs did not increase as much in 2021 as they are projected to increase in 2022.

2022 Net Income Projections

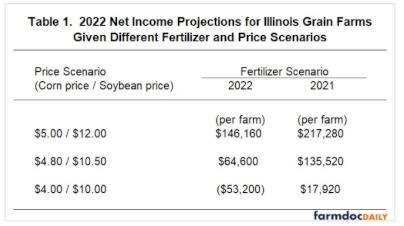

Table 1 shows income forecasts for the alternative fertilizer and price scenarios. Income is projected at $147,160 per farm, given current fall delivery bids and 2022 projections of fertilizer costs. This income projection is considerably below incomes in 2020 and 2021, but it is still above the 2013-2019 average of $85,000 per farm.

Under current fall delivery prices, projected net income using 2021 fertilizer costs is $217,280 per farm, $71,120 higher than the net income of $146,160 with the expected higher 2022 fertilizer costs. Compared to 2021 fertilizer costs, higher 2022 fertilizer costs reduce net income by 34%, a substantial drop. Overall, higher fertilizer prices are having a significant negative impact on net incomes, driving 2022 net incomes closer to 2013-2019 averages, even given relatively high prices.

Using USDA’s price projections of $4.80 for corn and $10.50 for soybeans causes projected net income to be $64,600, a fall of $81,760 per from the $146,160 per farm forecast using current fall delivery bids. The $64,600 net income would be below the average of $85,000 and would lead to slight deteriorations in financial position.

Long-run prices of $4.00 per bushel for corn and $10.00 per bushel for soybeans give a projected net income of -$53,200 per farm, a catastrophically low average income, well below any yearly average experienced over the past 20 years. Higher costs, led by fertilizer, are the reason for the very low incomes. A return to lower 2021 fertilizer costs would raise income to $17,920 per farm, still substantially below the average income of $85,000 per from 2013 to 2019. Although these scenarios are specifically focused on fertilizer costs and corn and soybean prices, low incomes occur because of increases in costs other than fertilizer and increases in cash rents.

Summary

Net incomes in 2022 likely will be below 2020 and 2021 levels because of rising costs. Income could still be above recent averages so long as prices remain relatively high: $5.00 for corn and $12.00 for soybeans. Even small price declines could lead to incomes below the 2013-2019 averages.

Negative income projections resulting with long-run prices of $4.00 for corn and $10.00 for soybeans suggest caution. History suggests that a return to lower prices should be expected. A return to lower prices paired with 2022 projected cost levels would lead to significant financial deterioration and the need to adjust the cost structure on farms. Cash rents would likely need to decline. Calls for another round of ad hoc Federal payments likely would occur as well.

Whether price declines will occur is not a foregone conclusion. Perhaps we have reached a new higher price plateau, although few are projecting that this is the case. Typically, a new price plateau requires a new and growing demand for grain, such as the growth in the use of corn in producing ethanol during the mid-2000s. Identifying a new and growing demand source is difficult at this point. If a new price plateau has not been reached, serious financial adjustments will need to occur in the future when long-run prices occur.

Source : illinois.edu