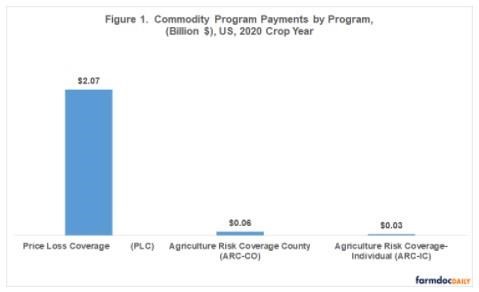

Payments by Program

PLC accounted for 96% of 2020 crop year commodity payments (see Figure 1). PLC made payments to 12 program commodities. ARC-CO made payments to at least some acres for all program commodities except rapeseed and possibly Temperate Japonica rice. Many counties did not receive ARC-CO payments as 2020 crop yields were near to above average for most crops and areas, and prices were generally higher, often much higher, than in recent years. Average ARC-CO payment per ARC-CO base acre was generally small. It exceeded $10/acre for 7 crops, with Southern crops having the largest average ARC-CO payments. Their payments are discussed below.

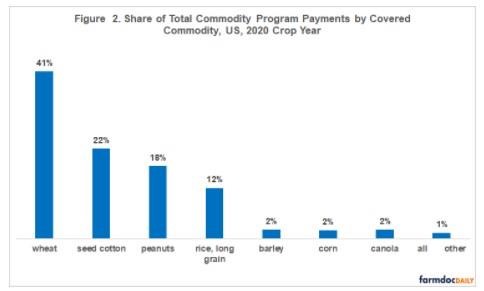

Payment Share by Covered Commodity

Commodity programs payment were concentrated in a few covered commodities. The top 4 (wheat, seed cotton, peanuts, and long-grain rice) accounted for 93% of total commodity program payments (see Figure 2). Wheat had the highest share at 41%.

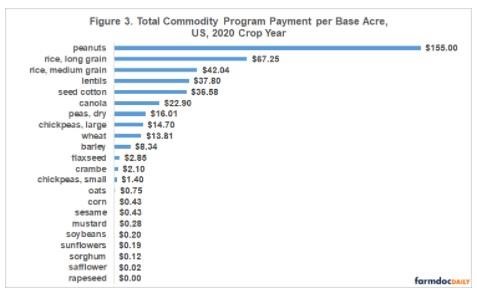

Payment per Base Acre

Peanuts averaged $155 in total commodity program payments per base acre (see Figure 3). Long-grain rice was next at $67 per base acre. Medium-grain rice, lentils, seed cotton, canola, dry peas, large chickpeas, and wheat also had double digit average payments per base acre. For 9 covered commodities, average payment was less than $1 per base acre.

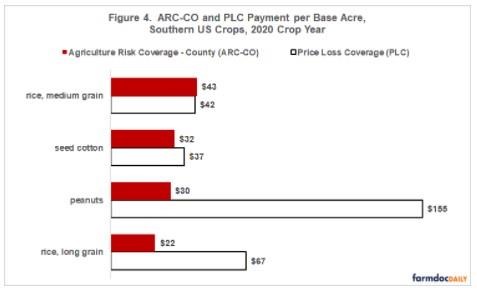

The 4 program commodities traditionally associated with the South (seed cotton, peanuts, long-grain rice, and medium-grain rice) have traditionally favored PLC. Over 99% of their base acres were enrolled in PLC for the 2020 crop year. However, average payment per base acre by ARC-CO and PLC was similar for seed cotton and medium-grain rice (see Figure 4). Once market price approaches or exceeds the reference price, ARC-CO becomes a competitive program even for the Southern crops. See the December 9, 2021 farmdoc daily article for a discussion of the important role of the relationship between the reference price and market price in predicting which program will pay more.

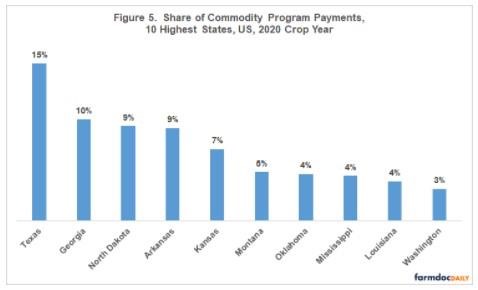

Payment Share by State

The 10 states with the largest share of total commodity program payments accounted for 69% of payments (see Figure 5). Texas had the highest share at 15%. The 10 states were located in the South or west of the Mississippi River. Each is a large producer of wheat, seed cotton, peanuts, and/or long-grain rice, the 4 crops with the largest share of payments.

Outcome of ARC-CO vs. PLC Decision

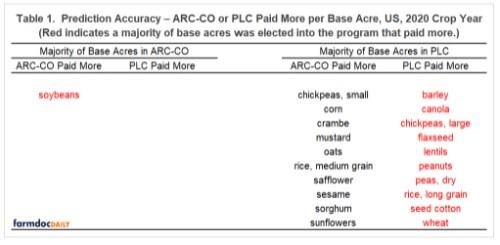

Both research and anecdotal evidence suggest farmers choose the program they expect to pay the most per base acre. An interesting policy question is thus, “Did farmers as a group chose the highest paying program for a covered commodity?” This aggregate question is assessed because individual farm data is not available.

Only soybeans had a majority of its base acres in ARC-CO (see table 1). Excluding rapeseed and Temperate Japonica rice, the program commodities with a majority of base acres in PLC were evenly split on whether ARC-CO or PLC paid more. Including soybeans, only 11 of the 21 program crops in Table 1 had a majority of base acres in the program that paid more. However, foregone payment was relatively small. Total payments would have been 7.7% higher if each crop’s ARC-CO plus PLC base acres were in the program that paid more. Dollar value of foregone payments totaled $163 million.

Concluding Observations

Commodity program payments for the 2020 crop year were concentrated in PLC payments for wheat, seed cotton, peanuts, and long-grain rice. On the other hand, PLC made no payments to approximately half of the program commodities.

Besides the 4 crops mentioned in the previous bullet, medium-grain rice, lintels, canola, dry peas, and large chickpeas also averaged double digit payments per base acre.

ARC-CO made payments to at least some acres of all program commodities except rapeseed and possibly Temperate Japonica rice but average payment was generally small due to higher prices and average to good yields.

Interestingly, given the historical preference of Southern crops for PLC, average payment per base acre by ARC-CO and PLC were similar for seed cotton and medium-grain rice. ARC-CO becomes a competitive program when market price approaches or exceeds a crop’s reference price.

Farmers captured over 90% of the potential payments by ARC-CO and PLC for the 2020 crop year.

Source : illinois.edu