By Roger Claassen, Daniel Hellerstein.et.al

Under the Agriculture Improvement Act of 2018 (also known as the 2018 Farm Act), agricultural conservation policy retains most of the programs under the previous Farm Act of 2014. Unlike the 2002, 2008, and 2014 Farm Acts—all of which involved some reconfiguration of programs—the 2018 Act continues all major conservation programs and makes only modest changes in program funding. The five largest agricultural conservation programs continue to account for a large majority of mandated conservation spending, while overall spending levels are projected to be slightly higher than they would have been under the 2014 Farm Act.

Embedded within the bill, however, are changes that could have far-reaching effects on the conservation incentives offered to farmers and ranchers. Specifically, the 2018 Farm Act sets funding for the Conservation Stewardship Program (CSP) at $700 million in fiscal year (FY) 2019, lower than in recent years, and gradually increases funding to $1 billion per year by 2023. In contrast, the new Farm Act increases funding for the Environmental Quality Incentives Program (EQIP). Specifically, the 2018 Farm Act shifts funding away from the Conservation Stewardship Program (CSP) and toward the Environmental Quality Incentives Program (EQIP). The new Act is also likely to decrease the average size of annual payments available to producers in the Conservation Reserve Program (CRP), which could reduce incentives for landowners to offer land for CRP enrollment and lessen the program’s role in the land market.

Conservation Funding To Increase Slightly

Under voluntary incentive programs, producers receive financial and technical assistance to take actions that conserve resources or reduce the environmental effects of agricultural production. These five programs are the backbone of agricultural conservation policy:

- The Conservation Reserve Program (CRP) provides annual rental payments to landowners who voluntarily retire environmentally sensitive cropland for 10 to 15 years or who reenroll earlier contracts subject to the availability of signup opportunities.

- The Environmental Quality Incentives Program (EQIP) provides financial assistance to farmers who adopt or install conservation practices on land in agricultural production.

- The Conservation Stewardship Program (CSP) supports ongoing and new conservation. To be eligible, farmers and ranchers must demonstrate a high level of stewardship and agree to further improve conservation over their whole farm or ranch during the life of the CSP contract (5 years).

- The Agricultural Conservation Easement Program (ACEP) provides long-term or permanent easements for preservation of wetlands and the protection of agricultural land (cropland, grazing land, etc.) from commercial or residential development.

- The Regional Conservation Partnership Program (RCPP) engages partners, often environmental or agricultural non-governmental organizations, to address resource conservation or environmental problems on a regional or watershed scale. By pooling together Federal and non-Federal resources, RCPP provides financial and technical assistance.

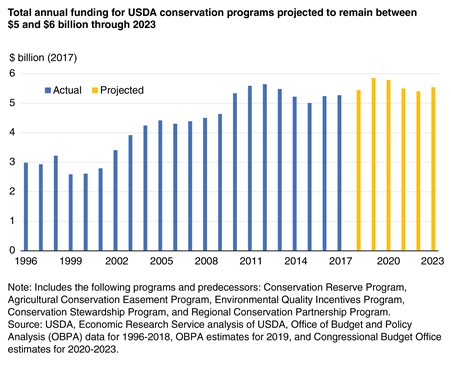

Under the 2002 and 2008 Farm Acts, spending on farm bill conservation programs grew rapidly. Over the course of a single decade, real (inflation-adjusted) spending grew by more than 80 percent—from less than $3 billion in FY 2001 to roughly $5.5 billion in FY 2011. Conservation spending leveled off under the 2014 Farm Act (FY 2014-18), settling at levels that were higher on average than under the 2008 Farm Act (FY 2008-13), but lower than peak spending in fiscal years 2011 and 2012. Under the 2018 Farm Act, which covers FY 2019-23, the Congressional Budget Office (CBO) projects mandatory spending that is slightly higher than spending projected under an extension of previous 2014 Farm Act programs. Although funding for farm bill conservation programs is mandatory (annual appropriations are not required to fund these programs), spending on these programs in future years is subject to congressional review and, under past farm acts, sometimes has been reduced.

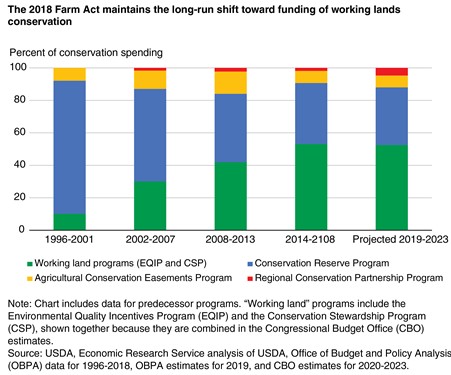

Funding changes over the last decade have resulted in a “rebalancing” of conservation effort from programs largely designed to move land out of production (e.g., CRP) to programs designed to support farmers who use resource-conserving practices on land in crop and livestock production (e.g., EQIP and CSP). The rapid increase in conservation spending between 2001 and 2011 was accomplished largely through increases in such “working land” programs. Programs like EQIP and CSP can and do fund a wide range of conservation practices. Widely supported practices include winter cover crops, brush management, grass waterways, nutrient management, irrigation water management practices, conservation tillage, and terraces (for soil conservation). The practices applied on any given farm or field depend on type of agricultural production, climate, topography, producer preferences, and other factors.

Three programs, CRP, EQIP, and CSP, account for approximately 88 percent of conservation spending mandated by the 2018 Farm Act. While the share of conservation funding for working lands was increased through the 2002, 2008 and 2014 Farm Acts, spending projections suggest that working land programs will receive 53 percent of conservation spending under the 2018 Farm Act (2019-23), nearly identical to the proportion under the 2014 Act.

Within the working land category, however, the new Farm Act shifts funding away from CSP and toward EQIP. CSP supports farms that have already met certain conservation thresholds to maintain and enhance existing conservation practices and expand conservation efforts using a comprehensive, farm-wide approach. EQIP is available more broadly (there are no minimum conservation requirements for program eligibility and no payments provided for continued adoption of existing practices), offering farmers and ranchers a more “a la carte” approach. For example, EQIP may fund anything from a single practice addressing a single resource concern to broader, more comprehensive farm-level plans. The CBO baseline (spending under a continuation of programs in the previous Farm Act) projected average annual spending of roughly $1.75 billion for each program during FY 2019-23. Under the 2018 Act, CSP spending (for new contracts) is limited to $700 million for FY 2019, increasing to $1 billion by FY 2023, both a decline from the $1.32 billion of CSP funding in 2018. In contrast, EQIP funding held steady initially, going from $1.76 billion in FY 2018 to $1.75 billion in FY 2019, and then increases gradually to $2.025 billion in FY 2023.

CRP Participation Incentives To Decline

Conservation Reserve Program (CRP) funding is projected to be roughly $2 billion per year over the course of the new farm bill (according to CBO projections). Under CRP, producers who agree to place marginal or environmentally sensitive cropland in grass or tree cover for 10-15 years can receive benefits, such as annual rental payments, cost-sharing, and other incentives.

The 2018 Farm Act increases CRP’s overall acreage cap from 24 million to 27 million acres, but also includes changes that are likely to reduce the size of annual rental payments to participants. The new limitations are designed, at least in part, to reduce per-acre costs of enrolling land in CRP and to limit the extent to which CRP is competing with farm operators who may be looking to rent the same cropland. Lower payments may also make it more difficult to maintain and expand CRP acreage, excluding some land with high environmental benefits or more beneficial practices that could have been enrolled when annual payments were higher.