A classic example when discussing beef exports is beef livers. Slaughtering 33.7 million head this year means finding a home for 33.7 million beef livers. I can tell you that we do not consume that many beef livers in the U.S. Instead, we export the vast majority of them. It turns out that we send approximately 75% of U.S. beef livers to Egypt. In 2021, the value of beef liver exports to Egypt totaled 67.2 million dollars. That’s 67 million dollars to the U.S. beef industry by exporting one beef product to one country. Combined, the export value of beef variety meats totaled $1.08 billion in 2021.

Beef variety meats are not the only product that the U.S. exports. A beef carcass is fabricated into eight primal cuts. Many different individual muscle cuts are derived from subprimal cuts. Exports help find a home for each muscle cut. For some muscle cuts, the decision to export is obvious. For example, 85% of beef short rib is exported. On the other extreme, only 3% of beef tenderloin is exported. For other beef cuts, there is a tradeoff involved with exporting: export whole muscle cuts or grind domestically as a source of lean trim.

Deciding whether to export or grind a beef muscle cut is a balancing act and dynamic process influenced by several factors. An easy way to illustrate this process is to think about freezer beef operations. The average consumer is unfamiliar with most beef items on a freezer beef cut sheet. Instead, consumers would prefer the steaks they are familiar with and more ground beef. Individual producers do not have access to export markets, so they either have to grind these unfamiliar muscle cuts or risk a consumer throwing them out. I have seen several freezer beef cut sheets that include a box for consumers to check if they prefer a specific cut be used for ground beef. There is an export market where those beef items are valued more as a whole muscle cut.

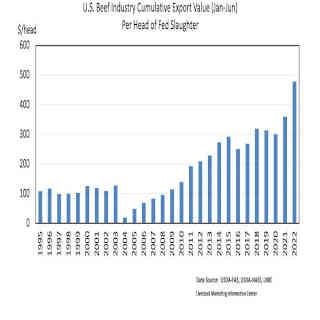

Beef wholesalers have access to export markets, so they can choose whether to grind or export whole muscle cuts. Nothing goes to waste, and more value is created for the entire beef industry. In 2021, beef and veal export value totaled $9.5 billion. This value was created by exporting approximately 11.3% of 2021 U.S. beef production, which totaled 26.973 billion pounds. This year, cumulative year-to-date U.S. beef export value totals $5.6 billion or $477 per head of fed cattle slaughter. This year, approximately 23% of fed steer value is attributed to beef exports.

Note: Export statistics for individual beef cuts are estimated by USMEF.

Source : osu.edu