A Black Sea Breakthrough

Flash forward to July 2022, when Russia and Ukraine, with support from the United Nations and Turkey, agreed to the Black Sea grain corridor and created the Joint Coordination Center (JCC) to facilitate exports for the region. The agreement allowed supplies trapped in Russia and Ukraine to re-enter the world market, and in response, wheat futures eased 37% from the spring’s highs.

Return to Pre-War Prices

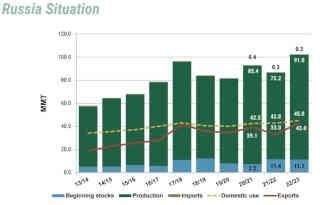

In the months since the corridor was implemented, wheat futures have continued falling to pre-war levels. The downward pressure of steady, low-priced Black Sea wheat exports remains the primary driver. According to JCC data, since the corridor’s inception, 5.1 MMT of wheat have been shipped from Ukraine. As for Russian exports, the January U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates pegged Russian wheat production at 91.0 MMT, though some private sector forecasts are upwards of 104.0 MMT. With record production, Russian exports are expected to reach 43.0 MMT, 17% above the five-year average.

A record crop from Australia has also helped ease some global supply concerns. The Australian wheat crop is rumored to reach nearly 42.0 MMT, though USDA estimates hover at 36.6 MMT.

Click here to see more...