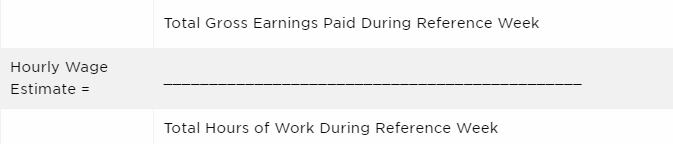

The FLS gathers data from farms in April and October and collects information about reference weeks that include the 12th day of the month in January, April, July and October. The FLS provides an estimate of the average gross hourly earnings for each survey region. In practice, survey respondents report total gross earnings paid to employees for the reference period and the total number of hours worked. The average gross hourly earnings of a single employer is calculated by taking the gross earnings paid and dividing by the total number of hours as follows:

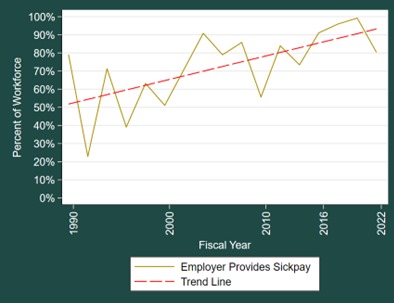

Industry groups have argued that the estimated AEWRs exceed the actual local market wages. This has sparked new interest in the H-2A program rules and the methodology used to calculate them. Some factors that could potentially cause the gross hourly earnings estimate to overstate an hourly wage value include bonuses, health coverage, and paid sick leave, which are payments that enter into the gross earnings with no corresponding increase in hours worked. For example, according to the National Agricultural Workers Survey, an increasing share of employees in the Lake States Region have received sick pay benefits over the past couple of decades (See Figure 2). In the FLS, farmers are instructed to report insurance in the gross hourly earnings and the usual hours worked for individuals on paid leave, but industry sources claim that farmers often fail to understand these kinds of details when they fill out the survey. Failing to adhere to the instructions could cause farmers to overstate the gross hourly earnings.

Figure 2. Percent of Farmworkers Paid Sick Leave in Lake States Region

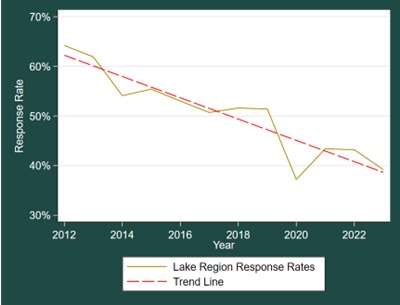

The Farm Labor Survey is a voluntary survey, and a significant number of farmers who receive the survey do not complete it. In the Lake States Region, the response rates have dropped from about 65% in 2012 to about 40% in 2023 (see Figure 3).

Figure 3. Farm Labor Survey Response Rates in the Lake States Region

The wage estimates are calculated using a weighted average of the data values that survey respondents provide as a method to correct for bias that could result from non-response. For example, suppose there are 1,000 farms in a region and the FLS intends to receive a completed survey from 200 of them. If all 200 of those farms complete the survey, each response would represent 5 farms (200 x 5 = 1,000). However, if only 100 farms answer the survey, then each farm that responds would get a weight of 10 in the sample (100 x 10 = 1,000). Thus, when the response rate is only 50%, the farmers who respond to the survey get twice the initial weight they would have otherwise received before other adjustments are made. Survey responses are also subject to a second “calibration” weighting algorithm to adjust to control metrics, which are supposed to account for farm type and economic class.

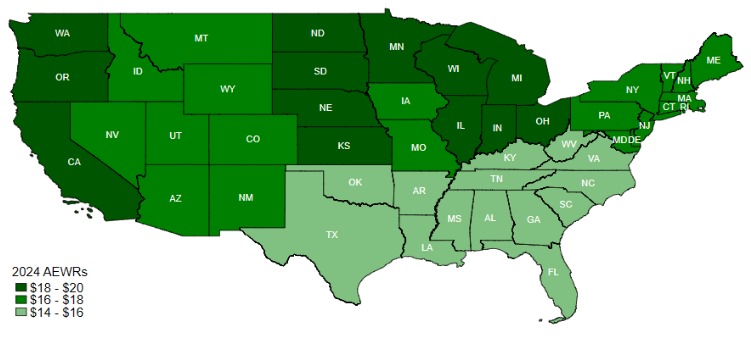

In 2024, the AEWRs ranged from a low of $14.53 in the Southeastern Region to a high of $19.75 in California (see Figure 4). In 2023, Michigan’s AEWR increased by $1.97 to $17.34, and it increased by $1.16 to $18.50 in 2024.

Figure 4. 2024 Adverse Effect Wage Rates

Recently, Congressman John Moolenaar (R-Michigan) introduced the “Supporting Farm Operations Act” (HR 7046), which would freeze the AEWRs until the end of 2025. Similar provisions for freezing the AEWR have been included in the “Farm Workforce Modernization Act,” which also has a number of other provisions that would change conditions in farm labor markets.

The Farm Workforce Modernization Act failed to pass through the U.S. Congress in 2022 but was reintroduced in 2023. For more information about the Farm Workforce Modernization Act, refer to The Farm Workforce Modernization Act and the H-2A Visa Program.

The AEWR is a measure of average gross hourly earnings that serves as the minimum wage for H-2A visa employees and the U.S.-based workers who are employed by H-2A employers in similar jobs. Michigan’s AEWR has risen more than $3.00 over the past two years. There are a number of factors that may have caused the AEWR to rise, including labor supply and demand pressures, low response rates, and the possibility of farmers not filling out the survey correctly. When filling out the survey, it is important to pay close attention to the instructions so that the gross hourly earnings and number of hours are reported correctly. Failing to do so may inadvertently cause the AEWRs to rise above local market wages.

Source : msu.edu