A Different of Opinion

The International Grains Council and USDA have conflicting forecasts for global wheat trade, Fortenbery said.

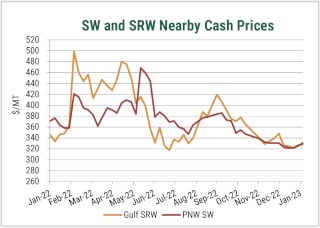

The council expects total world ending wheat stocks to be up 3% compared to last year and a 1.3% reduction in world wheat trade, which suggests a decline in prices. USDA projects world wheat stocks to be down 2.6% and trade to be up 5%, which suggests a price increase. Fortenbery said he leans toward the international council’s projections.

Both agencies agree the combination of Russia and Ukraine wheat exports will be up compared to last year. The flow of grain out of the Black Sea market appears to have stabilized the price impact of the conflict, Fortenbery said.

Commodity prices generally look favorable in the next few months, but input costs are also at historic highs, Fortenbery said. Almost every major expense category was significantly higher last year compared to 2021; some were up to 60% or more.

He’ll be watching general inflation, which affects interest rates and production loans, and natural gas and refined fertilizer shipments from the Black Sea.

Click here to see more...