By Dr. Kenny Burdine

Following the February 2021 winter storm, James wrote about USDA’s Livestock Indemnity Program (LIP). The LIP program is intended help compensate producers for greater than normal levels of livestock deaths from adverse weather, disease outbreaks, and predator attacks. The program can also partially compensate producers for lost value resulting from injury. As I try to process the disastrous impact of the recent flooding in my home state of Kentucky, and other parts of the region, I felt like a reminder about the program might be worthwhile.

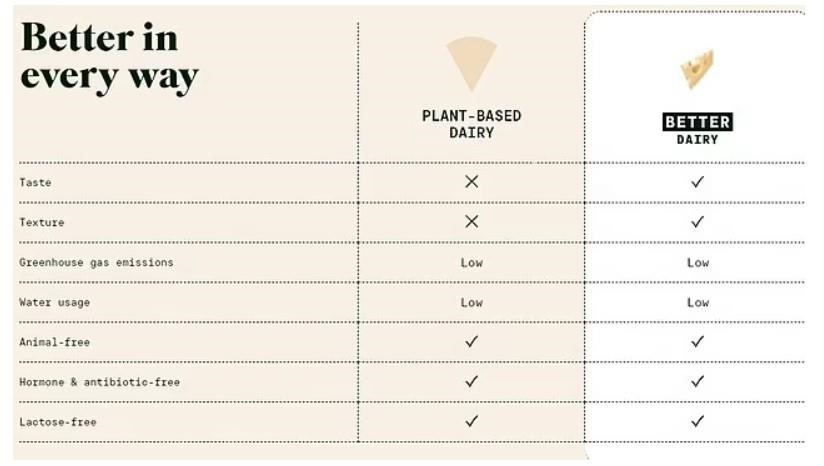

LIP payment rates for losses are set by the Secretary of Agriculture and are done so on a per head basis. The rates are updated regularly and are intended to be about 75% of the average national market value of cattle by type and weight range. The table above shows payment rates per head for all categories of beef cattle, which includes a recent increase in the payment rate on calves under 250 lbs. While this newsletter focuses on beef cattle, most all types of livestock are eligible for payments if losses resulted from a qualifying event.