Underpinned by record production, U.S. pork exports completed a tremendous first quarter with new March records for volume and value, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports also trended higher year-over-year in March, establishing a record first quarter pace.

“March export results were very solid, especially given the COVID-19 related headwinds facing customers in many international markets at that time,” said USMEF President and CEO Dan Halstrom. “Stay-at-home orders created enormous challenges for many countries’ foodservice sectors, several key currencies slumped against the U.S. dollar and logistical obstacles surfaced in some key markets – yet demand for U.S. red meat proved very resilient.”

Some recent events, including temporary closures of several U.S. processing plants, are not reflected in the first quarter export data. Halstrom cautioned that April and May exports could slow as a result, but his outlook for 2020 remains positive.

“These are truly unprecedented circumstances, creating an uncertain global business climate,” Halstrom explained. “The U.S. meat industry has spent decades developing a loyal and well-informed customer base throughout the world, which has embraced the quality and value delivered by U.S. red meat. Their commitment to U.S. products during this crisis is much-appreciated.”

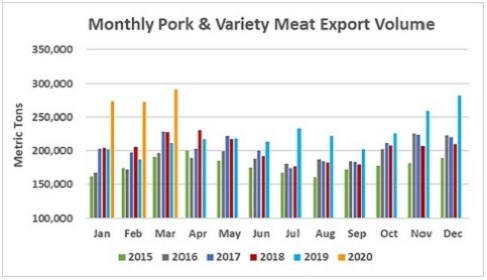

Strong demand from China/Hong Kong continued to drive U.S. pork exports to new heights, but March exports also increased significantly to Mexico, Japan and Canada. Export volume reached 291,459 metric tons (mt), up 38% from a year ago and topping the previous record set in December 2019. Export value increased 47% to $764.2 million. Through the first quarter, pork exports increased 40% from a year ago to 838,118 mt, valued at $2.23 billion (up 52%).

Pork export value per head slaughtered reached $63.99 in March, up 32% from a year ago. The January-March per head average was $64.66, up 40%. March exports accounted for 31.6% of total pork production and 28.4% for pork muscle cuts – each up about six percentage points from a year ago, even as March production increased by 12%. Through the first quarter, exports accounted for 31.4% of total pork production and 28.5% for muscle cuts, up from 24.4% and 21.3%, respectively, in 2019. U.S. pork production was up 9% in the first quarter, with industry expansion fueled by strong international demand, especially in several key Asian markets still battling African swine fever (ASF).

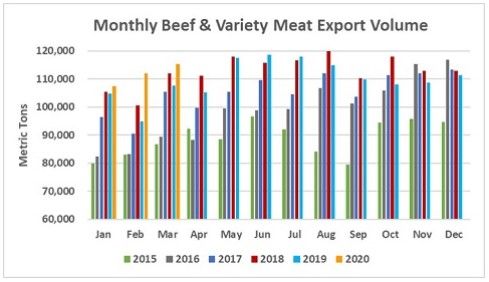

Driven by solid growth in Japan, where U.S. beef is benefiting from reduced tariffs under the U.S.-Japan Trade Agreement, as well as South Korea, Mexico, Canada and Taiwan, March beef exports totaled 115,308 mt, up 7% from a year ago, valued at $702.2 million – up 4% and the highest monthly value since July. First quarter beef exports climbed 9% from a year ago to 334,703 mt, valued at $2.06 billion (up 8%).

Beef export value per head of fed slaughter was $308.21 in March, down 8% from the very high March 2019 average. For the first quarter, per-head export value increased 2% to $317.06. March beef exports accounted for 13.9% of total production and 11.3% for beef muscle cuts, down from 14.8% and 12%, respectively, a year ago. Exports accounted for 14% of first quarter beef production and 11.4% for muscle cuts, each up slightly year-over-year. U.S. beef production increased by 14% in March and 8% in the first quarter as export growth continued to make a critical contribution to carcass value even as the COVID-19 pandemic disrupted the global foodservice sector.

China, Japan, North America drive record first quarter pork exports

Despite lockdowns lasting through the first quarter, China’s ASF-driven pork deficit continued to drive record-large demand for imports, not only from the United States but from all major suppliers. U.S. exports to China/Hong Kong reached 100,676 mt in March, nearly triple the year-ago volume and just short of the December 2019 record (110,876 mt), while March export value climbed 269% to $235.9 million. First quarter exports to China/Hong Kong were up 231% in volume (296,525 mt) and 321% in value ($724.5 million). China reported total first quarter pork and pork variety meat imports of a staggering 1.197 million mt, up 118% from a year ago. U.S. market share was 18% with the EU remaining the primary supplier, holding 61% market share.

Capitalizing on the new U.S.-Japan Trade Agreement, pork exports to Japan are trending significantly higher in 2020. March exports increased 18% from a year ago to 36,675 mt, valued at just under $150 million (up 19% and the highest since 2017). First quarter exports to Japan increased 12% to 103,515 mt, valued at $428.3 million (up 14%). Japan’s first quarter import data showed a 6% increase in U.S. chilled pork (to 52,061 mt) and a 17% increase in ground seasoned pork (to 20,928 mt). Further tariff reductions were implemented on April 1, which is expected to drive additional demand for value-added products such as ground seasoned pork and sausages, which are in high demand with more Japanese consumers cooking at home.

Pork exports to Mexico continue to make a strong recovery from the retaliatory duties that saddled trade in the first half of 2019. March exports were 63,198 mt, up 9% from a year ago, while export value climbed 19% to $108 million. First quarter exports to Mexico increased 10% to 195,351 mt, valued at $350.2 million (up 34%), though devaluation of the peso and the timing of the Easter holiday are expected to slow April export results.

Other first quarter highlights for U.S. pork exports include:

- Demand for U.S. pork remains strong in Canada, with exports increasing 13% to 60,145 mt, valued at $214.4 million (up 14%).

- Soaring demand in New Zealand bolstered exports to Oceania, which increased 4% to 31,325 mt while value jumped 30% to $102.6 million. Exports to Australia were steady with last year in volume at 27,787 mt, but increased 24% in value to $89.3 million. Exports to New Zealand were sharply higher in both volume (3,538 mt, up 58%) and value ($13.3 million, up 95%).

- Led by solid growth in Honduras and Guatemala and a sharp increase in exports to Nicaragua, U.S. pork continues to build momentum in Central America. First quarter exports were 17% ahead of last year’s record pace in volume (24,392 mt) and 31% higher in value ($62.8 million).

- Pork exports to Vietnam, where domestic production has also been heavily impacted by ASF, increased 251% in volume (4,382 mt) and 182% in value ($9.8 million). This included 1,215 mt of pork variety meat (mostly pork feet and tongues), up 242% from a year ago, valued at $1.6 million (up 315%).