By Carl Zulauf Ben Brown.et.al

ARC-IC (Agriculture Risk Coverage – Individual) has received less attention than ARC-CO (ARC – County) and PLC (Price Loss Coverage). ARC-IC is operationally more complex, thus harder to explain and understand. It pays on only 65% of program base acres while ARC-CO and PLC pay on 85% of base acres. Nevertheless, ARC-IC is worth considering if an FSA farm has one or more of the appropriate production attributes. These attributes include (1) 100% prevent plant acres on a FSA farm, (2) high year-to-year production variability, (3) much higher farm than ARC-CO and PLC yields, and/or (4) acres planted to fruits and vegetables. The prevent plant attribute is more relevant than normal in 2019.

ARC-IC Overview

- ARC-IC is a whole farm program option based on the average experience of all covered program commodities planted on the ARC-IC farm.

- ARC-IC applies to all base acres of all covered commodities on an ARC-IC farm. It is not elected on a commodity-by-commodity basis.

- An ARC-IC farm is the sum of a producer’s share in all FSA farms he/she enrolls in ARC-IC in a state.

- All payment entities on an FSA farm must elect to enroll in ARC-IC.

- ARC-IC makes a payment if average actual revenue/acre of all covered commodities planted on the ARC-IC farm is less than 86% of the ARC-IC farm’s average benchmark revenue/acre.

- Revenue/acre for a covered commodity and year is (ARC-IC farm yield times US market year price).

- ARC-IC farm benchmark revenue/acre equals the sum of the 5-year Olympic average revenue/acre for each covered commodity weighted by current year acres planted to a covered commodity.

- ARC-IC actual revenue/acre equals the sum of actual revenue/acre for each covered commodity that was planted weighted by current year acres planted to a covered commodity.

- Payment is made on 65% of total base acres on an ARC-IC farm times ARC-IC payment/acre.

- Payment/acre is capped at 10% of the ARC-IC farm benchmark revenue/acre.

- NOTE: Payment depends on program commodities that are planted.

- NOTE: Prevent plant acres are included in ARC-IC revenue calculations ONLY IF 100% of an ARC-IC farm’s initially reported covered commodities are approved as prevent plant.

- NOTE: Only initially planted covered commodity and approved double crop acres are included in the revenue calculations. Any subsequently planted crops are not included in the calculations.

When ARC-IC should be considered: A farm production attribute must compensate for ARC-IC’s fewer payment acres (65% vs. 85% of base acres for ARC-CO and PLC). Such attributes include:

- All of an ARC-IC farm’s initially planted covered commodities are approved as prevent plant. Current year revenue is zero since production is zero, resulting in a payment/acre equal to the payment cap of 10% of ARC-IC benchmark revenue/acre. In contrast, if any acre is planted to any covered commodity, payment is based on revenue/acre for the planted acre(s). Given the prevalence of prevent plant acres in 2019, examples are provided below. To underscore the key point, payment in this situation requires the ARC-IC farm has prevent plant for all covered program commodities on all base acres.

- Production is highly variable from year to year on the ARC-IC farm. High variability increases the likelihood of ARC-IC payment. High variability is most likely when 1 crop is grown and 1 FSA farm makes up the ARC-IC farm. ARC-IC averages across crops and FSA farms. Variability declines as more than 1 crop is grown and/or more than 1 FSA farm makes up the ARC-IC farm.

- ARC-IC benchmark yield is (much) higher than ARC-CO benchmark yield and PLC farm payment yield. Assuming 1 covered commodity and same percent payment rate for both ARC programs, ARC-IC benchmark yield needs to be more than 30% higher than the county benchmark yield for ARC-IC to pay more than ARC-CO. Other situations result in different breakeven yields.

- Fruits and vegetables (other than mung beans and pulse crops) or wild rice are planted on a FSA farm. Payment base acres are 65% for ARC-IC vs. 85% for ARC-CO and PLC. Non-payment acres are the remaining base acres: 35% for ARC-IC vs. 15% for ARC-CO and PLC. Payment is reduced if fruits and vegetables (other than mung beans and pulse crops) or wild rice are planted on more than the non-payment acres. ARC-IC has more acres that can be planted to fruits and vegetables (other than mung beans and pulse crops) or wild rice without losing program payments. Note, base acres on the FSA farm are not altered in this situation.

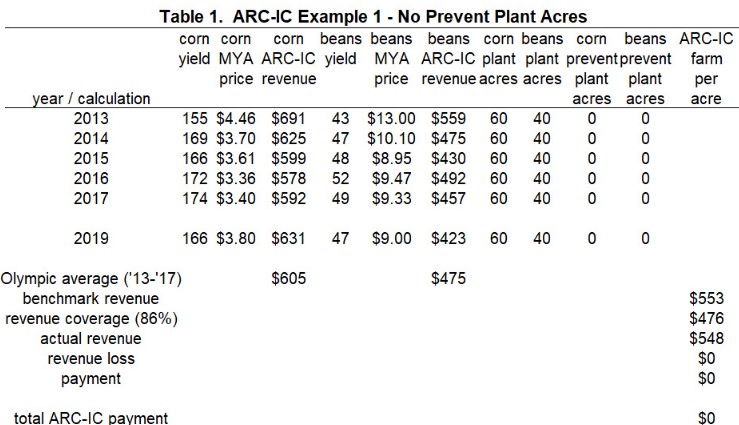

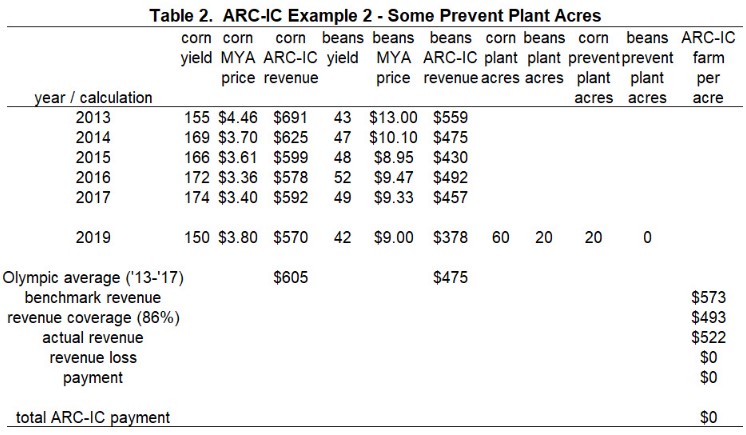

ARC-IC Examples – role of prevent plant – Overview: An ARC-IC farm with all yield information needed to calculate the ARC-IC benchmark revenue is assumed. This information plus the US market year average price for crop years 2013-2017 and 2019 are in the top half of each table of values for each example. The farm has 100 acres of cropland and program base, both composed of 60 acres of corn and 40 acres of soybeans.

Calculation of the ARC-IC benchmark revenue is a 3-step process. In step 1, per acre revenue is calculated for each covered commodity (corn and soybeans in this case) for each of the 5 years in the benchmark calculation window. In step 2, the Olympic average revenue per acre is calculated. An Olympic average removes the high and low value before calculating the average of the remaining values. For the example ARC-IC farm, the Olympic average revenue is $605 for corn and $475 for soybeans. In step 3, the Olympic average revenues are weighted by the acres planted in the current year (2019 in this case) to covered commodities to determine an ARC-IC farm average revenue per acre. This calculation for the example ARC-IC farm is: (($605*60) + ($475*40)) / (60+40), or an ARC-IC benchmark revenue of $553 / acre.

ARC-IC Example 1 – no prevent plant acres: Actual revenue / acre is $631 (166 bushels / acre times $3.80 / bushel) for corn and $423 (47 bushels / acre times $9.00 / bushel) for soybeans (see Table 1). These individual crop values are weighted by acres planted to each covered commodity, resulting in an actual revenue / acre for the ARC-IC farm of $548 (($631*60) + ($423*40)) / (60+40). Since actual revenue of $548 / acre exceeds the ARC-IC coverage revenue of $476 / acre (86% ARC-IC coverage level times benchmark revenue of $553 / acre), ARC-IC makes no payment.

ARC-IC Example 2 – some prevent plant acres: This example has 20 acres of corn prevent plant acres and lower 2019 yields (see Table 2). Actual revenue / acre is $570 (150 bushels / acre times $3.80 / bushel) for corn and $378 (42 bushels / acre times $9.00 / bushel) for soybeans. These individual crop values are weighted by acres planted to each program commodity, resulting in an actual revenue / acre for the ARC-IC farm of $522 (($570*60) + ($378*20)) / (60+20). Only 80 acres is used in calculating actual ARC-IC revenue. The 20 prevent plant acres are not included in calculating ARC-IC actual revenue. Since actual revenue of $522 / acre exceeds ARC-IC coverage revenue of $493 / acre (86% ARC-IC coverage level times benchmark revenue of $573 / acre), ARC-IC makes no payment. ARC-IC benchmark revenue and coverage revenue is higher in Example 2 than Example 1. The reason is the combined impact on the weighted averages of (a) higher revenue per acre for corn than soybeans and (b) fewer acres planted to soybeans (20, not 40).

ARC-IC Example 3 – all prevent plant acres: This example has no planted acres, with all initial planted covered commodity acres approved for prevent plant (see Table 3). Actual revenue / acre is $0 since no initial covered commodity is planted. Because no acres are planted to covered program commodities and all acres of initial planted covered commodities are approved as prevent plant, a benchmark revenue exists. It equals the benchmark revenue in example 1 ($553 / acre). ARC-IC makes a payment since actual revenue of $0 / acre is less than the ARC-IC coverage revenue of $476 / acre (86% ARC-IC coverage level times benchmark revenue of $553 / acre). Payment is however capped at 10% of the benchmark revenue, or $55 per base acre ($553 times 10%). Total ARC-IC payment is $5,500 ($55 per base acre times 100 base acres).

Summary Observations

- Crop program choice rests on the production attributes of an FSA farm.

- ARC-IC may be worth considering more often than commonly thought.

- Farm production attributes which make ARC-IC potentially attractive include:

- 100% of program base acres on a FSA farm are prevent plant acres,

- high production variability from year to year on a FSA farm,

- much higher farm than county or PLC yields on a FSA farm, and

- fruits and vegetables are planted on a FSA farm.

- If prevent plant is the production attribute of interest, all covered commodity acres on the ARC-IC farm must be prevent plant for ARC-IC to make a payment.

- If high production variability is the production attribute of interest, ARC-IC is more attractive if only 1 FSA farm in a state with only 1 program commodity is elected into ARC-IC. ARC-IC pays on the average experience across all program crops on all FSA farms in the ARC-IC farm. Averaging across multiple crops and FSA farms usually reduces variability and thus payment probability.

- Program sign up is for 2019 and 2020. Expected payments in both years need to be considered for ARC-IC, ARC-CO, and PLC. It is highly possible that the program with the highest expected payment will differ for 2019 and 2020, especially if ARC-IC has the highest expected payment for one year.

- This article is not an argument for electing ARC-IC. It is an argument for not dismissing ARC-IC without thinking about the individual FSA farm production attributes.

Source : illinois.edu