By Dr. Kenny Burdine

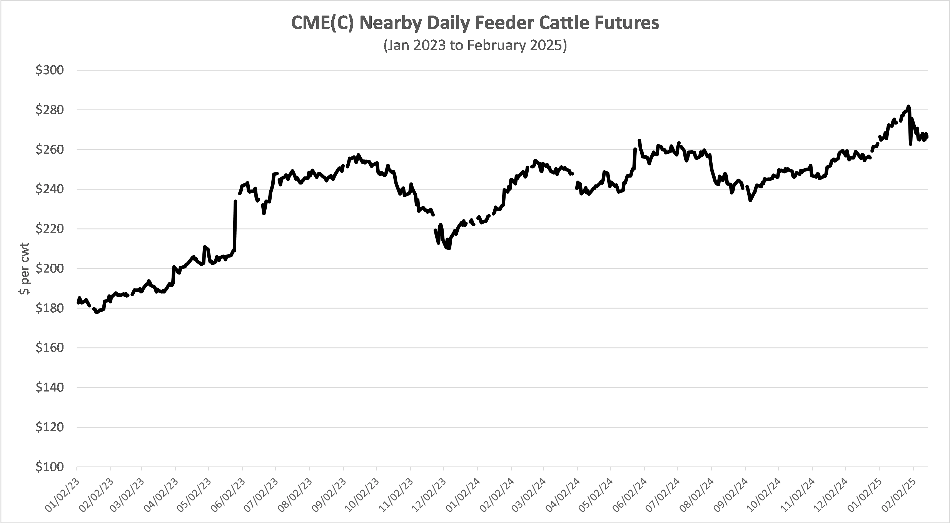

I doubt many would take issue with me calling the last couple of years a “bull market” for cattle. The combination of tight supplies and strong demand has resulted in cattle markets tracing an upward trajectory over the last couple of years. As an illustration, the chart below tracks the daily nearby CME© feeder cattle futures price over the last 26 months. In January of 2023, the nearby feeder cattle futures price was in the $180’s. As I write this article in February of 2025, the nearby futures price is in the $260’s.

While it is hard to dispute the overall strength of the recent cattle market, it is also important to note that during the last 26 months there have been multiple times when markets saw significant downward swings. The most recent of these occurred since the end of January and was likely sparked by the resumption of live cattle imports from Mexico, continued talk of trade disruptions, Avian Influenza, and any number of other factors. The market also fell by more than $40 per cwt from September to December of 2023 and more than $30 per cwt from late May to early September of 2024. For producers who sold cattle during those pullbacks, the impact on returns was significant.

There are a lot of potential strategies to manage price risk and the simplest may be a forward contract. By forward contracting cattle, price risk is largely eliminated as the seller and buyer agree on a purchase price prior to delivery of the cattle. A similar strategy would be selling cattle through an internet auction and specifying delivery at a later time. In both cases, the seller entering the forward contract still has production risk as they must meet the specifications of the contract (weight, quality, etc.), but market swings are no longer a concern.

Futures and options markets are also common tools for price risk management. Short futures positions allow producers to capitalize on the expectation of cattle prices in the future through CME© futures prices. When utilizing a short futures position to offset potential decreases in cattle prices, farmers are essentially exchanging price risk for basis risk. Producers utilizing short futures positions also need to plan for potential margin calls if markets move substantially higher. Put options give producers the right to sell a future contract if they choose and they pay a premium for this flexibility. This effectively sets a price floor for cattle as the strike price on the put option and the premium paid sets a minimum price for the cattle being sold.

Finally, I have talked more about Livestock Risk Protection (LRP) insurance than any other risk management strategy recently. It works almost exactly like a put option but has the advantage of flexibility on scale. Unlike several of the other price risk management tools, LRP insurance can be purchased on any number of head, which is much easier for smaller operations to utilize. LRP has been made more attractive over the last several years through increased premium subsidies and allowing producers to pay premiums after the ending date of the policy.

The specific tool or strategy that cattle producers utilize to manage price risk is less important than their overall risk management plan. I encourage producers to know what risk management tools are available to them, understand how changes in sale price impact their profits, and plan to cover themselves from downside price risk. I still feel good about the fundamentals of the cattle market, but I think the first couple weeks of February have been a good reminder that price risk always exists, even in a bull market!

Source : osu.edu