- Indemnity payments from the area plan will be insufficient to cover farm-level losses when they occur (under compensation or a false-negative error) (see farmdoc daily article from May 5, 2021 for more information).

- Indemnity payments from the area plan will be larger than what is needed to fully cover farm-level losses (over-compensation or a false-positive error).

Today’s article focuses on the likelihood of over-compensation or false-positive errors.

To quantify basis risk, we use simulation analysis to generate farm-level and county-level yields, and harvest insurance prices for corn. Harvest prices are simulated based on the projected insurance price and volatility factor from the Risk Management Agency (RMA) for the 2021 crop year ($4.58/bu projected price and 0.23 volatility factor).

Basis risk is related to the correlation between farm yields and county yields, or how closely farm yields tend to follow the county over time. The stronger the correlation between a farm and the county, the lower the basis risk meaning a county-level product will more closely match coverage from a farm-level product. For the comparisons here, the correlation between farm and county yields is assumed to be 0.8 which is representative of the historical correlation observed between farm yields from Illinois FBFM and USDA-NASS county yields for central Illinois.

Policy Comparison

As in part I of this series, losses triggered by Revenue Protection at an 85% coverage level (RP-85) are used as the measure of true losses experienced at the farm level. Basis risk is then measured by comparing RP-85 to combinations of individual coverage and supplemental area coverage options. Specifically, we compare RP-85 to the following three alternatives:

- RP-80 + SCO

- RP-80 + SCO + ECO-90

- RP-80 + SCO + ECO-95

Scenarios for Champaign (low risk) and Monroe (high risk) Counties in Illinois are examined. Estimated premiums for each policy combination are calculated as the average indemnity across the simulations, and existing subsidy rates are then applied to estimate farmer-paid premiums (see table 1 from May 5, 2021).

Indemnity Payment and Basis Risk

To measure the likelihood of over-compensation, the outcomes from the simulation where indemnity payments are triggered from the alternative policy combinations are compared to payments triggered by RP-85 in the same outcomes.

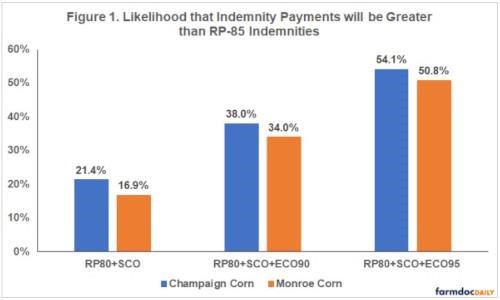

The supplemental area plans increase coverage levels beyond those currently available for individual plans of insurance, leading to indemnity payments being triggered more often based on smaller required losses (see farmdoc daily article from December 10, 2020). For Champaign County, the likelihood of a payment from RP-80+SCO is nearly 40%. The likelihood of a payment increases to 47.5% when ECO-90 is added, and to just over 60% when ECO-95 is used. Figure 1 shows the likelihood these alternative policies will trigger indemnity payments that exceed indemnities from RP-85 (i.e. payments from the alternative policies exceed losses compensated by the RP-85 policy ).

For RP-80+SCO, the indemnity would be greater than RP-85 with a likelihood of 21.4%. The likelihood of a RP-80+SCO indemnity when no farm-level losses occur (RP-85 indemnities are zero) is 6.7%. The likelihood of indemnities being greater than farm-level losses increases when ECO coverage is added (38% with ECO-90 added and 54.1% with ECO-95) . The likelihoods that the alternative policies trigger payments when no farm-level loss occurs also increases when ECO is added (12.8% with ECO-90 and 23.1% with ECO-95).

For Monroe County, the likelihood of the alternative policies triggering payments is larger than for Champaign County (50% for RP-80+SCO, 55% with ECO-90, 63% when ECO-95 is added), reflecting the greater production risk. In contrast, as shown in figure 1, the likelihood of over-compensation from the alternative policies are slightly smaller than in Champaign County for each of the alternative policies examined. The likelihood of indemnity payments being triggered when no farm-level losses occur is 7.9% for RP-80+SCO, 12.7% with ECO-90, and 20% with ECO-95.

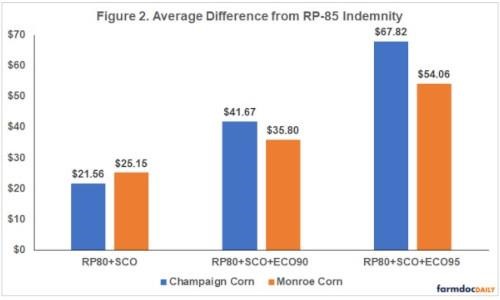

Figure 2 shows the average dollar-amount difference in indemnity payments for outcomes where the alternative policies over-compensate for farm-level losses. On average, the level of over-compensation from RP-80+SCO is about $21 per acre for Champaign County. This increases to $42 and $68 per acre when ECO-90 and ECO-95 are added, respectively. For Monroe County, the average level of over-compensation associated with RP-80+SCO is $25 per acre. It increases to $36 per acre and $54 per acre for ECO-90 and ECO-95, respectively.

Net Indemnities and Basis Risk

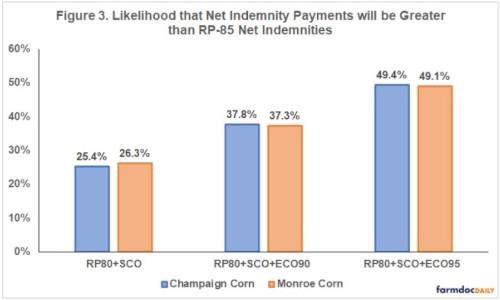

To incorporate the effect of premium costs, the same comparisons were also made using net indemnities (indemnities minus farmer-paid premium). Figure 3 reports the likelihood of over-compensation, or when payments from the alternative plans are triggered and net indemnities from the alternatives exceed those from RP-85.

For Champaign County, net indemnities from RP-80+SCO exceed those from RP-85 in 25.4% of outcomes. This likelihood increases to 37.8% and 49.4% when ECO-90 and ECO-95 added. The overall likelihood of over-compensation of net indemnities is similar to those for indemnities. For Monroe County, likelihoods of overcompensation for net indemnities are similar to those in Champaign for each of the policy alternatives.

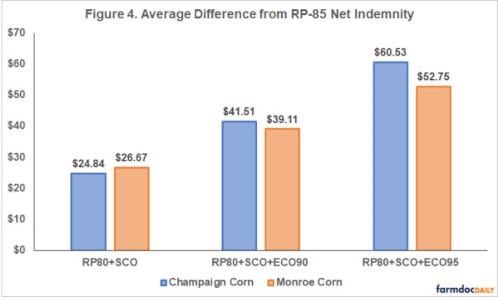

Figure 4 reports the average dollar amount of over-compensation for net indemnities of the alternative policies. For Champaign County, net indemnities average $25 per acre more from RP-80+SCO than from RP-85 when over-compensation occurs. The average level of over-compensation increases to $42 per acre and $61 per acre when ECO-90 and ECO-95 added. For Monroe County, over-compensation averages $26 per acre for RP-80+SCO and increases to $39 per acre and $53 per acre when adding ECO-90 and ECO-95.

Summary

The introduction of supplemental area insurance plans has provided farmers with the ability to add coverage to an underlying individual plan of insurance, and potentially trade-off a portion of their farm-level coverage for county-based coverage. While these supplemental programs allow farmers to increase their overall coverage level, they also introduce basis risk and additional premium costs (see farmdoc daily article from March 2, 2021 for more discussion). Basis risk results in the potential for both under-compensation and over-compensation of losses experienced at the farm-level.

The likelihood of indemnity payments from policy combinations using SCO and ECO over-compensating losses covered by RP-85 are estimated to be between 21% and 54% for a low-risk county scenario (Champaign). Similar estimates, ranging from 17% to 51% are found for a high-risk county scenario (Monroe). Over-compensation becomes more likely as greater levels of supplemental area coverage are added. When over-compensation occurs, indemnity payments from the policy combinations exceed farm-level losses by an average of around $25 per acre for RP-80+SCO, increasing to over $50 per acre when ECO-95 is added.

Based on net indemnities (indemnities less farmer-paid premium costs), the likelihood of over-compensation for both Champaign and Monroe Counties ranges from 25% for RP-80+SCO to 49% when ECO-95 is added. On average, the level of over-compensation of net indemnities is quite similar to indemnities, ranging from around $25 per acre for RP-80+SCO to more than $50 per acre when ECO-95 is added.

In part I of this series, using greater levels of supplemental area coverage were shown to reduce (but not eliminate) the potential for under-compensation of farm-level losses (lower rate of “false-negatives”). Today’s analysis illustrates that the trade-off is an increase in the likelihood of over-compensation as coverage levels of the supplemental area plans increases (higher rate of “false-positives”). Over-compensation implies an inefficient allocation of resources which, in the case of the Federal crop insurance program, are partially provided by taxpayers through premium discounts.

Source : illinois.edu