- Statutory reference price, or

- 85% of the previous five years of MYA prices lagged one year, with a cap of 1.15 of the statutory reference price.

Compared to MYA prices, Congress has set rice, peanuts, and seed cotton statutory reference prices at much higher levels than for corn, soybeans, and wheat. Between 2014 and 2022, peanuts and rice received PLC payments in 89% of the years because MYA prices were frequently below statutory reference prices (see farmdoc daily, November 7, 2023). On the other hand, PLC never paid for soybeans because soybean MYA prices have always been above statutory reference prices.

The level of statutory reference prices also impacts how often effective reference prices are above the statutory reference price (bullet two above). Before 2024, effective reference prices always equaled statutory reference prices for the major program crops. For 2024, the effective reference price for corn is $4.01, 8% higher than $3.70. The effective reference price for soybeans in 2024 is $9.26, 10% higher than the statutory reference price (see Table 1). For 2025, the effective reference prices for corn and soybeans will respectively be $4.26 and $9.66, hitting their 1.15 maximums relative to statutory reference prices. The 2025 effective reference price for wheat will be above the statutory reference. Seed cotton, peanuts, and rice effective reference prices in 2024 and 2025 will be the same as the statutory reference price. The differential experience reflects a difference in the statutory reference prices relative to MYA prices as written by Congress.

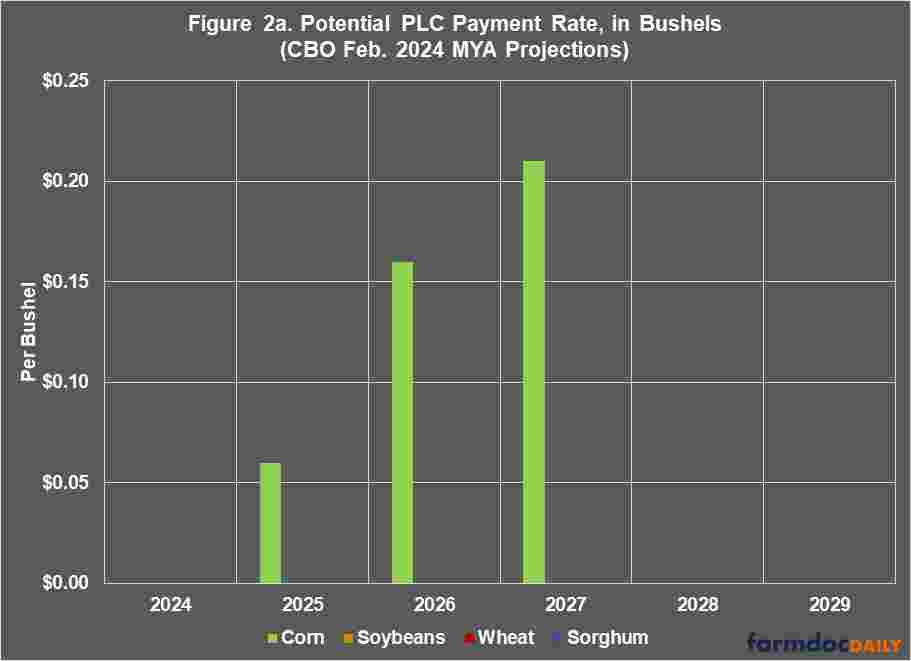

The relatively lower likelihood for triggering payments to corn, soybeans and wheat due to the statutory reference prices will likely continue. The Congressional Budget Office (CBO) projected MYA prices for 2024 to 2033 in its February 2024 release of USDA mandatory spending. In rank order, CBO projected MYA prices to be 15% below statutory reference prices for peanuts, 4% below for seed cotton, 2% below for ric,0% for wheat, 9% above for corn, and 18% above for soybeans (see Table 1). The frequency and size of payments will thus be much larger for peanuts, rice, and seed cotton because prices are projected below statutory reference prices than for corn, soybeans, and wheat. Moreover, corn, soybeans, and wheat will gain more from enhancement to the effective price mechanism, often called the escalator, represented by bullet two above. The Senate version implicitly recognizes this relationship by proposing a change to the escalator for corn, soybeans, and wheat while seed cotton, rice, and peanuts receive a 5% increase in statutory reference prices.

Lower statutory reference prices also cause corn, soybeans, and wheat to have a higher participation in the Agricultural Risk Coverage (ARC) program. Each year, farmers decide between enrolling their base acres in PLC or ARC. The county version of ARC makes payments when county revenue is below 86% of the benchmark price times the benchmark yield. The benchmark price equals the Olympic average of the five previous MYA prices lagged one year, with a minimum value per year of the statutory reference price. The benchmark price has a high chance of being above the statutory reference price for corn, soybeans, and wheat. For rice and peanuts, because the statutory reference price is high relative to MYA prices, ARC’s benchmark price is likely to be equal to the statutory reference price. In these cases, ARC triggers at a much lower MYA price than PLC without a yield loss. As a result, most base acres in rice and peanuts elect PLC. Given a statutory price increase, those crops with MYA below the statutory price increase will gain more because a higher proportion of their acres are in PLC.

Projected Spending Increase from 10% Statutory Price Increase

To illustrate the impacts on Federal outlays, we estimated the impacts of a 10% increase in statutory reference prices on commodity title spending from 2024 to 2033. The House proposal suggests that all program crops will have statutory reference prices increase from 10% to 20%. Hence, the increases in this spending are conservative. Table 2 shows results with no other changes to PLC and ARC. The results assume a 10% increase in each case with no other changes made to PLC or ARC. The impacts of changing ARC will be shown later.

Table 2 shows the results with CBO estimates in the first column. The impacts of 10% increase are shown in the middle three, and the change in commodity title spending is shown in the last. CBO projected total PLC/ARC spending on the six major crops at $41.1 billion over the 11 years in the budget baseline, or $4.1 billion per year (see Table 2). For each major program crop, a 10% increase in statutory reference price would result in the following:

Corn: The reference price for corn would increase from $3.70 to $4.07. CBO projects PLC payments to average $29 per base acre (see Table 2) over the baseline period. We estimate that the statutory price increase would increase payments to $38 per base acre (see Table 2) over those 10 years. The statutory price increase would have increase ARC payments slightly from $25 to $26 per base acre as effective reference prices could be higher with a statutory reference price increase. Total PLC/ARC spending would increase from $21.9 billion to $27.3 billion, a 42% increase.

Soybeans: The soybean reference price would increase from $8.40 to $9.24, thereby allowing the maximum effective price to increase to $10.63. The higher maximum effective reference price would be the major factor contributing to PLC payment increases ranging from $6 per base acre to $11 per base acre. Still, ARC is projected to have higher payments of $13 per base acre. Most acres would be in ARC. Total PLC/ARC spending would increase from $5.0 billion to $5.4 billion, an 8% increase.

Wheat: The reference price for wheat would increase from $5.50 to $6.05. Wheat’s projected PLC payments would increase from $10 to $14 per base acre. Total spending would increase from $5.1 billion to $7.1 billion, a 40% increase.

Seed cotton: The reference price for seed cotton would increase from $.3670 to $.4037 per pound, resulting in PLC payments increasing from $30 to $66 per base acre. Total spending would increase from $3.6 billion to $7.6 billion, representing a 112% increase.

Peanuts: The reference price for peanuts would increase from $.2675 to $.2948 per pound, resulting in PLC payments to go from $120 to $204 per base acres. Total spending would increase from $2.8 billion to $4.6 billion, representing a 69% increase.

Rice: The reference price for rice would increase from $.1400 to $.1540 per pound, resulting in PLC payments going from $58 to $140 per base acre. Total spending would increase from $2,6 billion to $6.4 million, a 140% increase.

Commentary

Increasing statutory reference prices will have a large impact on PLC/ARC spending. A 10% across-the-board increase in statutory reference prices could increase spending will by 42%, or $17.4 billion from 2024-33. Given current budgetary rules, that spending increase will have to be offset by reductions in some other farm bill programs, such as crop insurance, conservation, or nutrition. Finding and justifying offsets in those other programs will be difficult.

A crop’s total PLC/ARC spending is highly related to the total number of base acres in the program that can be enrolled for payments, while the level of payments the farmer receives is relative to the levels of statutory reference prices. Peanuts, rice, and seed cotton will gain relatively more in per acre payments than corn, soybeans, and wheat, but the costs of those gains will not be as large in the scoring estimates because there are far fewer base acres. Seed cotton, peanuts, and rice all have below 8 million enrolled base acres in 2023 (see farmdoc daily, May 7, 2024) compared to 93 million for corn, 52 million for soybeans, and 62 million for wheat.

ARC Changes

Changes to ARC also are being proposed. We evaluated the changes suggested by the House:

- ARC’s guarantee would increase from 86% to 90%.

- Increases ARC’s payment range from 10% to 12.5%. Payments on ARC at the county-level currently are limited to 10% of benchmark revenue. This change would allow payments the maximum to 12.5% of benchmark revenue.

Total PLC/ARC sending would increase to $64.3 billion (see Table 3). ARC add $5.8 billion ($64.3 – $58.5) compared to $17 billion for the 10% increase in statutory reference price ($58.5 billion – $41.1 billion)

ARC changes would have its largest total impacts on corn and soybeans. ARC per base acre payment from $26 per base acre to $37 per base acre, resulting in total spending of $29.9 billion. Soybeans payments would increase from $13 per base acre to $20 per acre. Total soybean spending would increase to $7.5 billion.

Even with the inclusion of ARC changes, the highest percentage change in projected spending goes to southern crops: 128% for seed cotton, 69% for peanuts, and 140% for rice compared to 36% for corn, 49% for soybeans, and 50% for wheat (see Table 3).

Source : illinois.edu