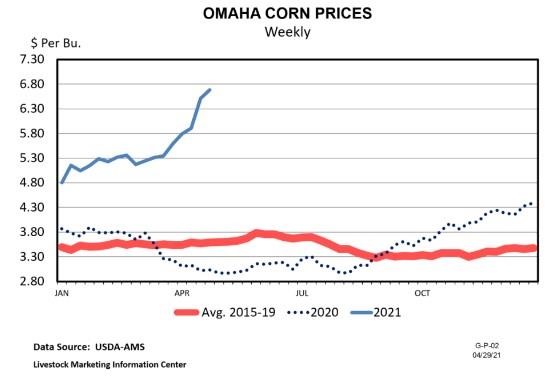

Feeder cattle markets are expectation markets that are primarily driven by two things: (1) the expected value of fed cattle in the future and (2) the cost of getting those feeder cattle to that point. While there are reasons for optimism about the expectation of fed cattle prices, it’s hard not to be very concerned about the level of feed prices in the current market. Nothing rains on a feeder cattle parade like expensive corn and that is exactly what we are seeing this spring. James actually wrote about this right after the Prospective Plantings report came out and corn prices have continued to rise since that time.

The price chart for Omaha corn above is just used to illustrate the trend that we are currently seeing. It is always important to distinguish between old crop and new crop when discussing grain prices and clearly the current market is reflective of old crop. But, even new crop prices are very high by historical standards as December 2021 CME© corn futures settled just under $5 per bushel to end last week. At this point, we don’t know how many acres of corn will actually be planted in 2021 and we don’t know what conditions will be like during the growing season. But, it is sobering to know that the current expectation is that we still have corn around $5 come winter.

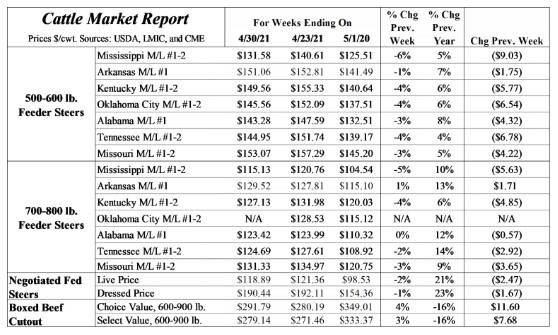

The impact of this on feeder cattle markets is very clear and is having the largest impact on heavy feeder cattle. May CME© feeder cattle futures have dropped by about $15 per cwt since early April. The chart is not pretty and it is keeping us from building any momentum this spring. We are seeing a divergence between fed and feeder cattle prices as slaughter cattle prices improve and feeder cattle prices weaken. This is the market’s way of pricing in expensive corn – that margin has to widen.

Calf prices are a bit more isolated from feed price impacts as calves can be placed into grazing programs or grown on feeding programs that are less corn-dependent. But, all feed prices will tend to move together as they are typically priced on a substitute basis with one another. So, producers backgrounding cattle on commodity feeds are still feeling the impact on their feed bill. Additionally, calf values are really driven by the expected value of heavy feeders and this can be best illustrated by looking at fall feeder cattle futures. The November CME© feeder cattle futures price has fallen by about $10 per cwt since early April. This probably equates to something like a $15 per cwt lower value on calves moving through markets this spring.

There is never a shortage of risk factors in cattle markets. The year 2020 was a lesson on black swan events like COVID-19 and 2021 appears to be reminding us that grain prices are always capable of impacting the values of the calves and feeders that we sell. The April 12th issue of Cattle Market Notes Weekly discussed price risk management strategies in a general sense. This week, we are also sharing the video from a webinar that Josh and I did on April 20th that was largely focused on Livestock Risk Protection Insurance and covers that tool in much more detail. This price insurance product has been made a lot more attractive over the last couple of years and I would encourage all feeder cattle producers to give it a serious look.

Source : osu.edu