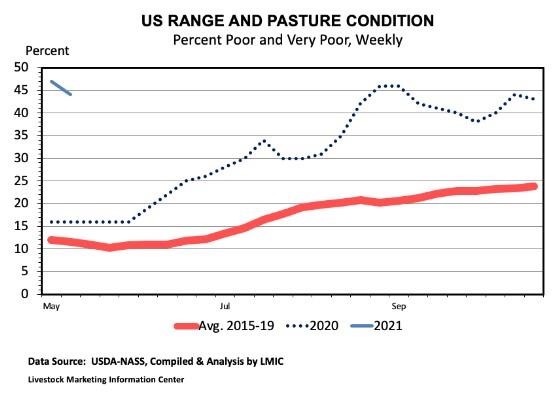

Drought conditions do not appear to be improving. Last month, Josh discussed drought concerns and market implications. Nationally, 44 percent of pasture is in poor or very poor condition. The western U.S. and Northern Plains are being impacted especially hard. In the southeast, 9 percent of pasture is in poor or very poor condition. Cattle inventories peaked in 2019, and persistent drought could accelerate herd liquidation. This would suggest elevated cow slaughter and perhaps selling feeder cattle earlier than anticipated. In general, cull cow markets are a more regional market, and it is unlikely that cow markets in the southeast would be impacted by culling decisions in the western U.S. However, if drought conditions do not improve, we could see impacts in southeast feeder cattle markets.

The feedlot inventory situation largely reflects COVID-19 dynamics from last year. Following the April-June disruptions, June-September 2020 feedlot placements averaged 10.7 percent above the 2015-2019 average. These high placements have resulted in April feedlot inventories that are 5.3 percent above year-ago levels. We still have a lot of cattle to move through the system. In fact, April 2021 was the second largest feedlot inventory in the data that goes back to 1996. This month’s Cattle on Feed report will provide an important update on the feedlot situation. Look for Kenny’s analysis of the May COF report next week in CMN.

Large fed cattle supplies have impacted cattle slaughter. This year cattle slaughter has been averaging 9.8 percent higher than the 2015-2019 historical average. Saturday slaughter has played an important role in raising weekly slaughter totals. As Josh described in last week’s article, Saturday slaughter accounts for 59 percent of the weekly increase over the 2015-2019 average. On the demand side, strong boxed beef cutout values support increased processing. Ultimately, it will take time to move these large supplies through the system. Tightening of fed cattle supplies will support fed cattle prices (all else constant).

Feed costs, drought, and fed cattle supplies all present challenges for cattle markets in 2021. However, it is important to remember that it takes supply and demand to determine price. The export situation has improved from last year, which is a positive for beef demand. Domestic beef demand remains strong as an important time of year for beef approaches. Grilling season!

Source : osu.edu