Of the 12 covered crops that have base acres in Alabama, only nine of them have national enrollment in the PLC program above 90% of the acres. Corn (75%), oats (61%), and soybeans (14%) had less than 90% of the base acres enrolled in PLC nationally. The majority of the remainder of those acres are enrolled in ARC-CO. However, the decision to enroll in PLC or ARC is an individual farm decision. The discussion of projected payments continues for both PLC and ARC-CO.

Table 2 presents the projected PLC payment rate and ARC-CO yield ratio for each of the covered commodities where base acres are enrolled in Alabama. Projections are based on MYA prices as of July 12, 2021 and compared to the effective reference price for each commodity. When the MYA price falls below the effective reference price, then a PLC payment is triggered. With the rising market prices, crops like corn and soybeans have a projected PLC payment rate of zero. The highest absolute PLC payment rate is for wheat, at 45 cents per bushel. Peanuts are projected at a PLC payment rate of 5.75 cents per pound, or $115 per ton. Meanwhile, seed cotton is projected to have a PLC payment rate just under 3 cents per pound.

Table 2: Projected PLC Payment Rate and ARC-CO Yield Ratio

While ARC-CO enrollment is minimal, table 2 also presents the yield ratio for each crop. To trigger an ARC-CO payment, the county yield must fall below the benchmark yield multiplied by the projected yield ratio. The ARC-CO payment is a county specific determination for a covered crop and production type, either irrigated or dryland. The benchmark yield is computed as the Olympic average of the 2014 to 2018 trend adjusted county yield or 80% of the transitional yield if that is higher. Benchmark yields by county are available at the USDA FSA website for each covered crop and production type.

With the benchmark yield and yield ratio, one can determine the county yield for the 2020 marketing year that would trigger an ARC-CO payment. As an example, non-irrigated seed cotton in Henry County, Alabama has a benchmark yield of 1,558.53 pounds. To trigger a non-irrigated seed cotton ARC-CO payment, the Henry County actual yield must be below 1,558.53 x 0.9349 = 1,457.07 pounds. The seed cotton yield is then converted to an upland cotton equivalent by dividing by 2.4. Therefore, 1,457.07 ÷ 2.4 = 607.11 pounds of upland cotton.

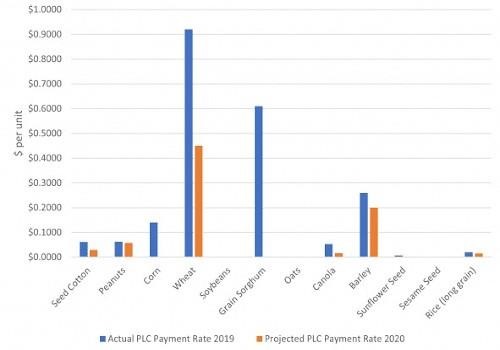

Figure 1. Comparison of 2019 actual and 2020 projected PLC payment rates.

2019 Comparison

Payments to agricultural producers in Alabama from the PLC and ARC programs totaled $91.7 million for the 2019 crop year. As shown in figure 1, nine out of 12 covered commodities triggered a PLC payment. Compared to the projected 2020 rates, the payment rate for wheat and seed cotton were over twice the dollar per unit in 2019. The payment rate for peanuts is expected to decline only 8%, while grain sorghum is expected to have a 100 % decline in the 2020 payment rate compared to 2019.

A Look Forward

Looking forward to the 2021 crop year, market prices have remained strong for most covered crops. People should expect the trend of decreasing government payments for these programs to continue. Based on early projections, base acre holders of peanuts and rice may be the only producers that receive a payment for the 2021-2022 crop year, but it is too early to tell. As producers know, markets can be quite volatile. The PLC and ARC commodity programs provide the safety net producers depend on should situations change.

Source : aces.edu