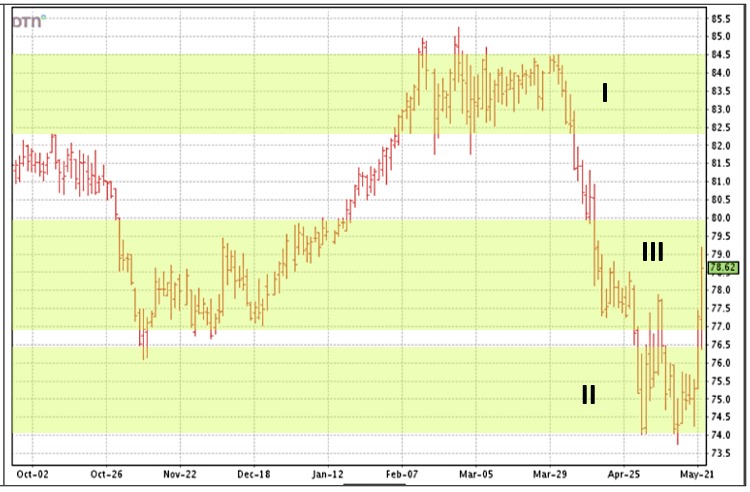

Corn

For the 2024/25 marketing year, USDA projects U.S. corn ending stocks at 2.102 billion bushels, up 4% (80 million bushels) from 2023/24. The current new crop corn projection came in below industry expectations and almost 17% below estimations from the USDA Agricultural Outlook Forum in February. With the loosening domestic market, USDA projects the average market price to fall to $4.40/bushel, down 5.4% from 2023/24. Globally, we can expect corn ending stocks to hold steady in 2024/25 – falling only 0.3% due to lower production.

Overall, the corn market in 2024/25 is looking less bearish than it did when farmers were making planting decisions a few months ago. USDA raised both old crop and new crop corn demand (total use) by 100 million bushels each. Projections for total use in the 2024/25 marketing year of 14.8 billion bushels represent a 1.1 billion bushel increase over 2022/23, bouncing back to near-record levels set in 2021/22 at 14.9 billion bushels. December corn futures responded by moving 11 cents higher with positive follow through on Monday.

Soybeans

While the 2024/25 corn market is looking less bearish, the opposite is true for soybeans. In the upcoming marketing year, U.S. soybean ending stocks are projected at 445 million bushels, higher than both trade expectations and the USDA Agricultural Outlook Forum estimates in February. As compared to the current 2023/24 marketing year, this represents a whopping 30.8% increase. Due to this large projected increase, USDA projects prices to fall to $11.20 per bushel, a year-over-year decrease of 10.8%.

Globally, there is a similar but more muted situation for soybean ending stocks, with a year-over-year projected increase of 15%, rising up to 128.5 million metric tons (MMT). Brazilian production is projected to increase 15 MMT (9.7%) to 169 MMT in 2024/25, and Brazilian exports are projected to increase 3 MMT (2.9%) to 105 MMT.

The estimations for soybeans are heavily reliant on continued growth in soybean use, with an estimated 125-million-bushel increase in both crushings and exports, representing increases of 5.4% and 7.4%, respectively. If demand does not hold firm for soybeans, it could turn more bearish very quickly.

Click here to see more...