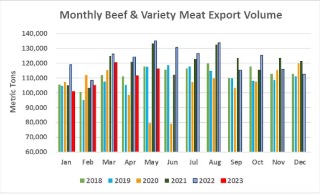

Beef exports totaled 116,159 mt, down 14% from the May 2022 record but up 4% from the previous month. Export value was $874.7 million, down 19% year-over-year but 2% above April. For January through May, beef exports were down 10% to 554,069 mt, valued at $4.09 billion (down 21%).

“U.S. beef exports face considerable headwinds in 2023, on both the supply and demand side, especially when compared to last year’s massive totals,” Halstrom said. “To address tighter beef supplies, USMEF has heightened efforts to showcase underutilized cuts, even in our well-established markets. It’s also encouraging to see beef variety meat exports maintain a strong pace, as this is essential for maximizing carcass value.”

Other January-May export results for U.S. pork include:

Demand for U.S. pork has rebounded strongly in Australia, where May exports more than doubled from a year ago to 9,520 mt (up 103%), while export value increased 91% to $32.7 million. Through May, exports to Australia increased 69% year-over-year in volume (25,666 mt) and 62% in value ($89.3 million). Due to import restrictions, all fresh pork shipments to Australia must go directly into further processing. But Australia also accepts value-added processed U.S. pork products, which are popular in the retail and foodservice sectors.

May pork exports to Taiwan were the largest in 12 years at 3,289 mt, up more than sixfold from the low volume posted a year ago. Export value was $11.2 million, up from just $1.8 million in May 2022. Through the first five months of the year, exports to Taiwan increased more than 400% from a year ago in both volume (6,513 mt) and value ($21.2 million). Faced with tightening domestic supplies, due in part to incidents of porcine epidemic diarrhea virus, and a slowdown in imports due to higher EU prices, Taiwan recently implemented a small (about 9 cents per pound) subsidy to incentivize pork imports.

Led by strong growth in Honduras, Guatemala and Nicaragua, May pork exports to Central America increased 16% from a year ago to 10,514 mt, while value climbed 21% to $29.9 million. Through May, exports to the region were up 2% in volume (51,520 mt) and 8% in value ($145.7 million).

Robust growth in the Philippines and a huge spike in demand from Malaysia pushed January-May pork exports to the ASEAN region to 27,202 mt, up 52% from a year ago, while value climbed 33% to $65.1 million. In both countries, domestic pork production has been hampered significantly by outbreaks of African swine fever. The EU has been the dominant supplier to these countries in the past but smaller EU production and higher prices are limiting exports this year.

Pork exports to Japan continued to trend below last year in May, falling 4% to just under 31,000 mt, while export value was down 7% to $123.4 million. Through May, shipments to Japan were 2% below last year’s pace at 154,849 mt, valued at $617.7 million (down 7%). Japan is the primary overseas destination for U.S. chilled pork, but exports faced an uncertain shipping environment until a tentative West Coast port labor contract was reached in mid-June. The U.S. industry’s primary competitor in Japan’s chilled pork market is Canada, where West Coast longshoremen are currently on strike.

Pork export value equated to $69.08 per head slaughtered in May, up 6% from a year ago. The January-May average was $63.39 per head, up 10%. Exports accounted for 32% of total May pork production, up substantially from a year ago (28.6%). For muscle cuts only, exports accounted for 27.6% of production, up from 25.2%. The January-May ratios were 29.6% of total production and 25.4% for muscle cuts, up from 26.3% and 23.4%, respectively.

Lamb exports trend lower in May

May exports of U.S. lamb muscle cuts totaled 141 mt, down 32% from a year ago and the lowest volume of 2023. Export value was $772,409, down 17%. May exports declined to most major destinations, but increased to the Bahamas.

For January through May, exports remained 9% above last year’s pace at 958 mt, valued at $5.5 million (up 5%).

Complete January-May export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

Click here to see more...