Option 2: Utilize Risk Management Tools

For producers to secure the opportunity presented by the current futures market in the near-term, they would need to lock in their price using available risk management tools (CME FC Futures, CME FC Options, Livestock Risk Protection-FC, FC forward contracts, etc.) at an acceptable price. This is not an easy decision to make. It requires knowing your cost of production, estimating future animal performance, selecting the appropriate risk management tool, and completing the risk management transactions.

Another factor to consider is that the last time the U.S. Feeder Cattle Index price was above $150 per hundredweight was during the second half of 2018. Therefore, it’s been almost three years since we’ve approached the levels that will be tested during the next few months. Sometimes traders price the market too high and futures will erode the premium and trade back to cash. If that is the case, futures have a long way to fall. Lastly, if the premium does erode then it’s important to understand that the futures market would have provided producers with an opportunity to market feeder cattle at levels that were higher than the cash market ever offered.

Anything is Possible

Risk. Producers should continue to expect markets to be volatile as abrupt changes and big price swings have become the norm over the last decade. Volatility will likely remain high given the continued unknowns of the pandemic as ever-changing supply and demand variables. This is especially true given that in the last 18 months we have seen -$40 per barrel crude oil, extreme civil unrest, government mandates to shut down certain businesses, a massive labor shortage while unemployment remains high, missing products on shelves, and a collapse in processing capacity in meat packing facilities. Risk is at a level that many of us have never seen in our lifetime. No one in the beef cattle supply chain wants to assume more risk right now for the same returns they were receiving prior to the pandemic.

A Look at Marketing Feeder Cattle during Second Half of 2021

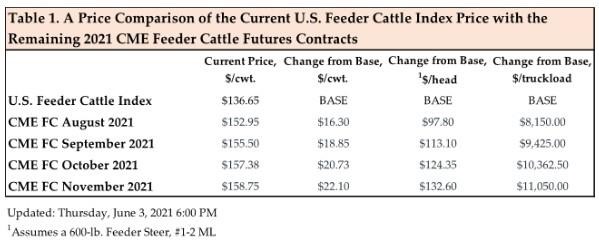

As we start looking at deferred fall feeder cattle futures, prices are even higher than those projected for August 2021. Table 1 compares the U.S. Feeder Cattle Index Price with the remaining 2021 CME Feeder Cattle Futures contract prices to determine the projected premiums that the futures market is offering for feeder cattle during the second half of 2021.

After analyzing the results above, those participating in the feeder cattle futures market today are indicating to the marketplace that they think prices should be a minimum of $16 per hundredweight or $97 per head higher by August 2021 and $22 per hundredweight or $132 per head higher by November 2021, as compared to where the U.S. Feeder Cattle Price Index is today. For an 80-head load of 600-pound feeder steers, that’s an increase of between $8,150 to $11,050 per truckload unit.

Thus, current projections indicate that the fall marketing window should be the best time to sell feeder cattle during 2021. Producers may want to consider preconditioning their feeder calves. This marketing alternative provides producers an excellent opportunity to extend ownership to capture the fall premium, while also adding additional weight to feeder cattle. However, preconditioning can be difficult for many to implement successfully. It’s critical that operations evaluate their available resources, management, expected level of animal performance, and cost of production to determine if a preconditioning program is right for their operation.

Bottom Line

While the future for marketing feeder calves remains bright, there is no telling what may transpire in cattle markets in the near term as commodities remain extremely volatile. As we have seen in the past, short-term prices can fluctuate significantly due to all sorts of things. Recent examples include the COVID-19 pandemic, Tyson beef plant fire, global recessions, trade agreements, and severe weather. Eventually though the fundamentals (corn, live cattle, domestic consumer demand) will likely continue to have the greatest effect on the price paid for Southeastern feeder calves. Currently, CME Feeder Cattle Futures is providing producers with an opportunity to add $100 per head by maintaining ownership and marketing their feeder calves from August through November 2021. Each operation must now evaluate the information available for their individual operation and take the necessary steps to capture the opportunities that are available in 2021.

Source : ufl.edu